Zero and the Fed

Submitted by DeDora Capital on December 18th, 2015

by Will Becker, AWMA/AIF

After nine long years, this week the Federal Reserve finally mustered the gumption to raise interest rates. News channels went on overdrive to report this momentous moment nearly a decade in the making. The Dow Jones went up 200 points, then down 250 points the next day. What changed on Wednesday? The Effective Federal funds rate will go up one quarter of one percent. So basically, this means that the overnight interest rate that banks charge other banks will go from “effectively free” to “really, really cheap.” It is ok to feel under-whelmed. For a little perspective, interest rates were last raised on June 29th, 2006. At the time, George W. Bush was President, Barry Bonds was still playing with the San Francisco Giants, and Twitter was three months old.

For the past nine years, Interest rates have basically been like this cartoon. If you are paying interest, it is great to have low rates. If you were trying to earn interest income, it is really frustrating.

But with this week’s rate increase, we are technically in a “rising interest rate environment.” In general, how do rising (even slightly rising) interest rates affect folks? Loan rates should go up (a little bit) as well as Money Market rates (a little bit). That is good if you rely on interest income, and bad if you are paying interest. Here is an article that goes into some more depth on the impact. That being said, the whole point is for rates to slowly change, as Nancy Marshall-Genzer from the Marketplace radio program reports.

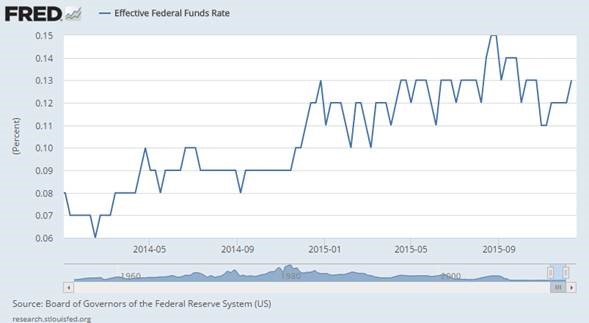

By the way, one reason this week’s Federal Reserve announcement caused a collective yawn in our office is that we know the Federal Reserve has quietly let the Federal Funds rate increase over 50% since 2014 (see chart below). So this week’s announcement is a recognition that rates have already started to creep up and we should expect them to continue to slowly inch their way up.

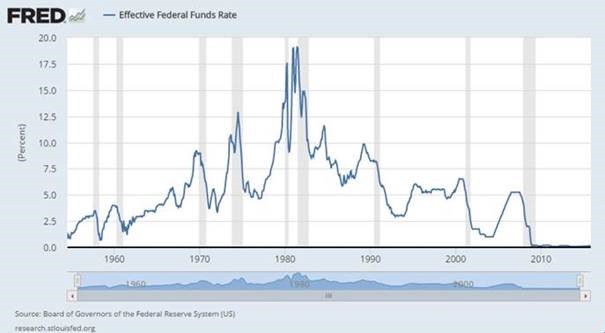

To put this all in perspective, remember that interest rates were over 15% during the 1980’s. If you had a loan during that time, as this rancher did, then you know what really high interest rates mean in daily life. If you are young enough to have not experienced that, then you can make some light conversation around the Holidays by asking about it.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.