Who has a bigger GDP - Greece or Boston?

Submitted by DeDora Capital on July 9th, 2015

by Will Becker, AWMA/AIF

Happy Friday!

Here is a quick update and market commentary. As always, let us know if you have any questions!

The Markets

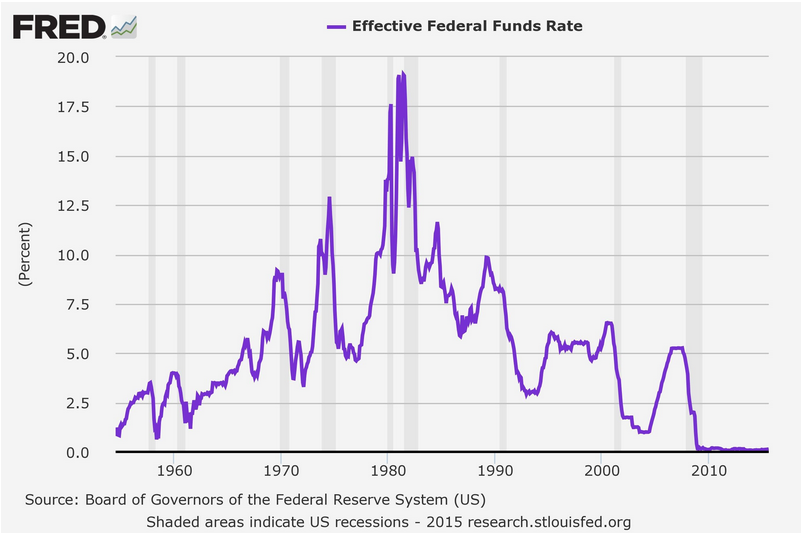

Greece and China picked this moment in history to have their economic existential crises. Just bear in mind that Greece's Gross Domestic Product is the size of Boston's, and it has been in Default for 90 of the past 192 years... so it is helpful to keep Greece's size and track record in perspective as events unfold. China's market has tumbled over 20% from its high mark this year, and the fall seems to have the same cause as the rapid rise: margin-gone-wild. In the Tactical Growth model, we rode the growth in the China market during the past year and exited profitably before the switch to TDAmeritrade. Volatility picked up as capital tried to figure out what to do with the Greece/China situation, as evidenced by bigger swings in the markets. For some perspective, below is a chart from the St. Louis Federal Reserve showing the probability of recession in the U.S. This isn't to say that a recession - or a correction - can't happen. But at the moment we are still in the Expansion phase of the Business Cycle and experiencing a bit of economic turbulence thanks to the aforementioned countries. And Puerto Rico, but I'll save that drama for another time. You may see trading activity as we either rebalance or adapt to economic conditions.

Without further ado, I hope you have a great weekend!

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.