When $77k = Top 10%, Paraplanner, and Payrolls

Submitted by DeDora Capital on June 3rd, 2016

by Will Becker, AWMA/AIF

I am pleased to report that our very own Terri Cavagnaro earned the Registered Paraplanner™ designation! Congratulations! As many of you know from working with her, Terri already had a lot of experience working with Estates and she frequently is in touch with Estate Attorneys to keep Estates settling smoothly. She also coordinates the monthly flow of funds for clients on regular distributions. And let me tell you, that’s not as simple as it may seem… especially when there may be a handful of accounts and annuities involved. There’s a lot more that Terri does, but those two activities highlight her long term experience in what are really planning roles. The Registered Paraplanner™ program validated the work that she has already done, and also deepened her knowledge in the overall financial planning process. Well Done, Terri!

Planning Perspective

Do you have financial regrets? If so, you are among 75% of Americans according to a new study from Bankrate. The most common regrets were 1) not saving enough for retirement, 2) not saving enough for emergencies, and 3) taking on too much credit card debt. And yet, in the words of an actual professional planner that was quoted in the article: "I don't think anybody bats a thousand on financial planning and financial decisions."

So let’s do something about these regrets! If you are not sure how much to save for retirement, then let Janie know that you would like to schedule a retirement roadmap review meeting with one of us. If you do not have an emergency fund, then contact Terri and she can set up a Money Market account that can be part of your “Cash Comfort Level”, as we like to call it. If you have a lot of credit card debt, let Janie know that you would like to schedule some time with us to look at strategies for paying it down efficiently.

But don’t get too hard on yourself. Only 17 percent of the survey respondents reported having no financial regrets. Besides, page 15 of the April Readers Digest reminds us that “$77,000 in assets puts you in the world’s wealthiest 10 percent”. On a ten step ladder, $77,000 puts you on the top step globally.

Investment Perspective

With headlines like “U.S. a dim brightspot in the global economy,” it seems like surely the economic news must be dour. And yet, “Planned layoffs down to a five-month low in the U.S.,” the “S&P 500 topped 2,100 for the first time in the close since April 20 to end at its highest since Nov. 3, 2015,” and the Fed’s Beige Book shows “Modest growth across much of the country.” So what’s going on?

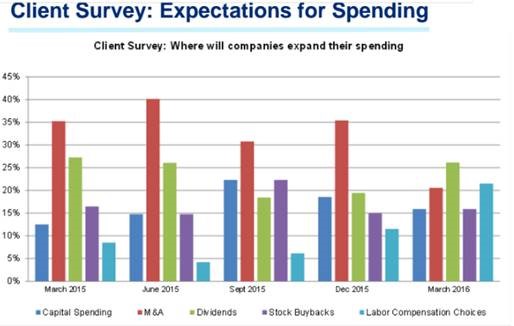

A recent Citi report looks at how companies are planning to spend money this year. Specifically, the report looks at capital spending (big stuff), Mergers & Acquisitions, Dividends, Stock Buybacks, and Labor (payroll). Notably, March was the first month in a very very long time that spening on people (light blue in chart below) was more than on everything other than Dividends. That’s not actually so great for stock prices, but it is really good for the economy overall. Plus, it lines up with a tightening labor market that we are seeing in the Beige Book report and elsewhere. And that tightening labor market is despite the hemmorage of jobs in the energy sector.

This brings me back to the earlier question: What’s going on? The Global economy is doing about 45 mph in the fast lane. That’s better than the ditch it was in during 2012, but still not so great. The U.S. economy looks pretty good by comparison… but your ever-vigilant team isn’t taking that for granted!

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.