What's the deal with Inflation?

Submitted by DeDora Capital on February 26th, 2016

by Will Becker, AWMA/AIF

A few comments on the current state of the markets, and then on to Inflation. As of Thursday when I am writing this, the S&P 500 is trying really hard to have a positive February. This follows last week being the best week in a year when “best” is a pretty low bar to reach. The S&P 500 is down -4.51% thus far on the year, and down -8.4% from its record high from May of 2015. James Bullard, President of the St. Louis Federal Reserve, says the stock correction prevented a bubble. Thanks, correction. Did my sarcasm come though? Part of the correction had to do with Traders factoring in four interest rate hikes in, Sovereign Wealth Funds selling stock to balance their budgets, China’s market continuing to be all over the place, lingering hangover from the end of Quantitative Easing, natural pullback after a multi-year expansion, plus the wildcard that sometimes markets decide to move a few percent for no apparent reason. We are actually concerned about other items at the moment, specifically about earnings growth rates and weekly leading indicator levels.

Now on to Inflation. The Federal Reserve is targeting 2% annual Inflation rate. Since employment is basically where it needs to be for interest rates to go up, the inflation number is a pretty big deal when it comes to Federal Reserve decisions on interest rates. Since the Fed is widely viewed has having messed up the last interest rate hike, they are being even more cautious now. So here’s a little more info on Inflation and what it means for investors.

In 1998 I was on an Archaeology crew in far eastern Turkey, excavating an ancient Bronze Age city. That year Turkey had a 69% inflation rate, the 28th consecutive year of double digit inflation. I remember feeling pretty good about myself as I was walking down the street with a thick wad of 10 Million Turkish Lira in my pocket, only to find out that it was worth a measly $40 US Dollars. Decade after Decade, Turkey experienced Hyper Inflation – rapid and sustained inflation that wreaks havoc on economies.

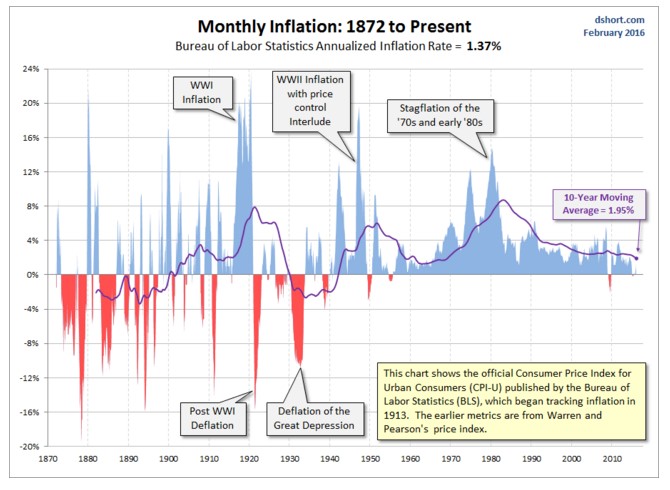

We have experience double-digit inflation several times in our country’s history, specifically during World War 1, World War 2, and periods of time in the 1970’s and 1980’s. But inflation can be a problem at the mid-single digit levels, also. For example, Warren Buffett’s 1977 Letter to Shareholders was written at at ime of 6.5% inflation. Even at that middle-single-digit rate, he describes the challenge of pricing insurance premium when he knew that the insurance settlement payments will have to be adjusted for future inflation. This is actually one reason why he started investing insurance profits in other companies; he recognized that he had to do something to help swim against the inflation current. Mr Buffett, the Oracle of Omaha, wrote in 1977 that:

“We estimate the costs involved in the insurance areas in which we operate rise at close to 1% per month. This is due to continuous monetary inflation affecting the cost of repairing humans and property, as well as “social inflation”, a broadening definition by society and juries of what is covered by insurance policies.”

Some – key word “some” - inflation is a good thing. With really high inflation, consumers hoard products out of concern that prices will keep increasing in the future. If there is bad deflation, then consumers don’t buy very much because they can just wait for things to get cheaper. But in general, modest inflation is a sign of a growing economy that is pretty healthy. 2-3% per year is the sweet spot for inflation. Over the past ten years, we have averaged 1.95% inflation. So that’s pretty good.

Trust me, I enjoy prices going down. My beloved first computer – the Commodore 64 home computer (on the left) - retailed for about $595 in 1982. Inflation brings that to about $1,500 in today’s dollars… but today you can buy three iPad Air 2’s for the same amount of money.

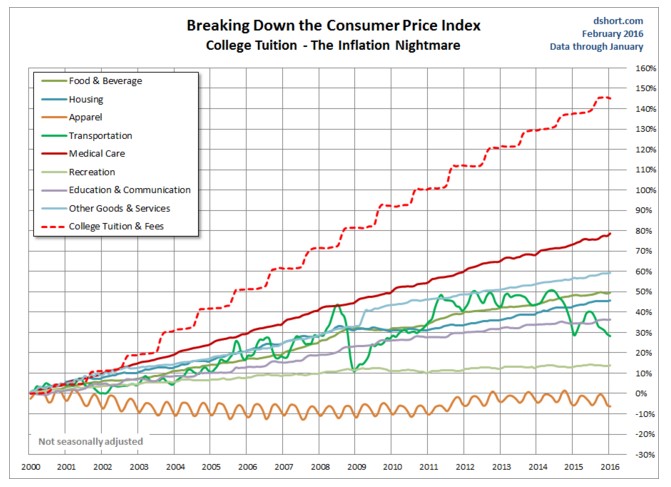

But many other products inflate over time, and affect families differently. The recent decline in gas prices helps commuter families, for example. On the other hand, families with College and Medical Care expenses face bills that are inflating much faster than wages.

I should add that some folks are aware of surprisingly popular metric called “Core Inflation.” Since this has come up in some client meetings, I want to say a word about this very odd metric… because it doesn’t make much sense for people that drive, heat their home, or eat. Really! I’ll let blogger Doug Short explain:

“This is a somewhat peculiar metric in that one of the exclusions, Energy, is an aggregate that combines specific pieces of two consumption categories: 1) Transportation fuels and 2) Housing fuels, gas, and electricity. The other, Food, is the major part of the Food and Beverage category. Note that "beverage" for the BLS means alcoholic beverages. So coffee and Coca Colas are excluded from Core Inflation, but Budweiser and Jack Daniels aren't.”

The bottom line is that Interest rates are likely to stay low for the foreseeable future because the Federal Reserve is waiting for Inflation to go above 2%, and at the moment that doesn’t appear imminent. When it does, it’s actually a good thing because it indicates that the economy is continuing to grow. There is also the increasingly real possibility that the Federal Reserve and other Central Banks don’t actually know what they are doing with all this interest rate drama, but I’ll save that for another day.

By the way, here is a nifty Inflation calculator that you can use to answer questions such as how much a 1913 Model T Ford would cost in today’s dollars. Just click the link for the answer.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.