What Is "The Market", Anyway?

Submitted by DeDora Capital on November 6th, 2015

by Will Becker, AWMA/AIF

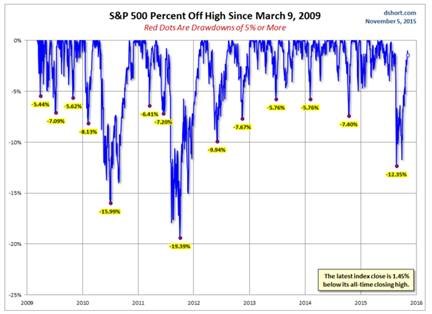

This week we have a quick market update, and then comments on what we mean by “the Market.” The S&P 500 had a good week, and is now slightly positive for the year. Two charts from one of our favorite economics writers, Doug Short, illustrates both the past week, and drawdowns in the market since 2009.

What do we mean when we say “the Market”? The Dow Jones Industrial Average (the “Dow”) was created way back in the 1885, and is often referred to as “The Market.” But there are a couple quirks to the Dow. First, there are only 30 companies in it. Granted, they are among the largest companies – names such as American Express, General Electric, and Home Depot. But still, that is only 30. Also, each company’s allocation in the Dow Jones is based on its price. Not its size. Its price. As a result, Visa is near 8%, while Coca Cola is closer to 1%. That is odd. So when we refer to “the Market” we generally mean the S&P 500. We do this for two main reasons: 500 companies is much more representative than 30, and the companies are allocated based on company size. So the bigger the company, the bigger their allocation in the S&P 500. The Nasdaq is also a common bellwether, but bear in mind that it is over 50% technology companies. In fact, 25% of the entire Nasdaq index consists of just three companies: Apple, Microsoft, and Amazon. By the way, I'm not saying that this is a recommendation to buy or sell any of those companies; just describing how indexes are made up.

Thanks to the folks at www.finviz.com, here is a map showing the companies in the S&P 500, with colors to indicate performance year-to-date. The map illustrates how broadly the S&P reflects our overall economy, both in terms of number of companies, allocation of those companies, and sectors represented. This is one of the tools that we use to view sector performance.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.