What does "Flat 'Till August" mean for the rest of the year?

Submitted by DeDora Capital on August 21st, 2015

by Will Becker, AWMA/AIF

Happy Friday!

Weekly Perspective

Last week I mentioned our increasing concern over market conditions. That came to a head on Wednesday and Thursday of this week. On Wednesday, the market initially responded well to the Federal Reserve’s published comments. In fact, I was on the phone with a client discussing this as the markets turned positive. But then the enthusiasm evaporated, and led to selling as the market closed. Then on Thursday morning China opened -3%... so Thursday was fixing to be a rough day in Global Markets. Wednesday and Thursday we placed trades to exit some small-cap, large-cap, and materials positions. We also added a modest position in Gold. Each account’s investment objectives are different, and we are sensitive to tax consequences… so the trading varies by degree of embedded gains and by account. If you didn't see trades in your account, there was a good reason for it.

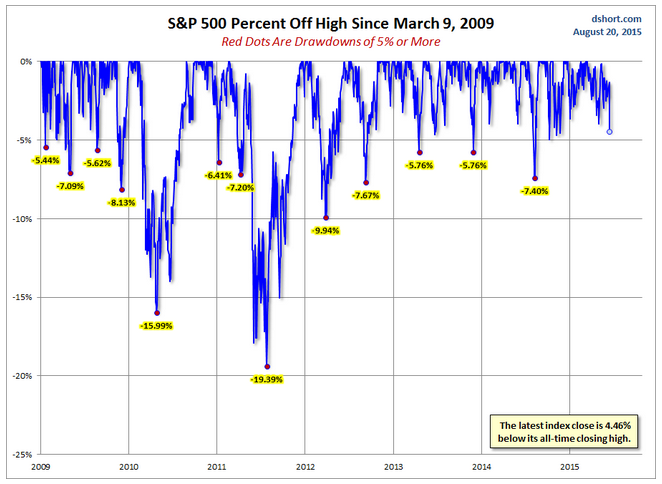

As of Thursday evening, the S&P 500 is -4.46% from its record close on May 21st... about half way to the conventional definition of a 10% correction.

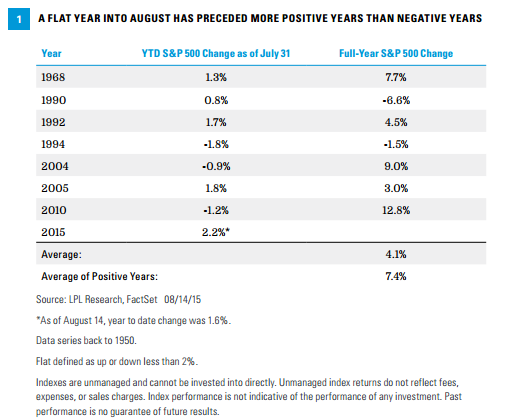

What does this mean for the rest of the year? First, something counter-intuitive; the chart below illustrates that a flat year in August actually preceded more positive years than negative years. So just because the markets are treading water (and hiccuping) in August doesn't mean they will drown.

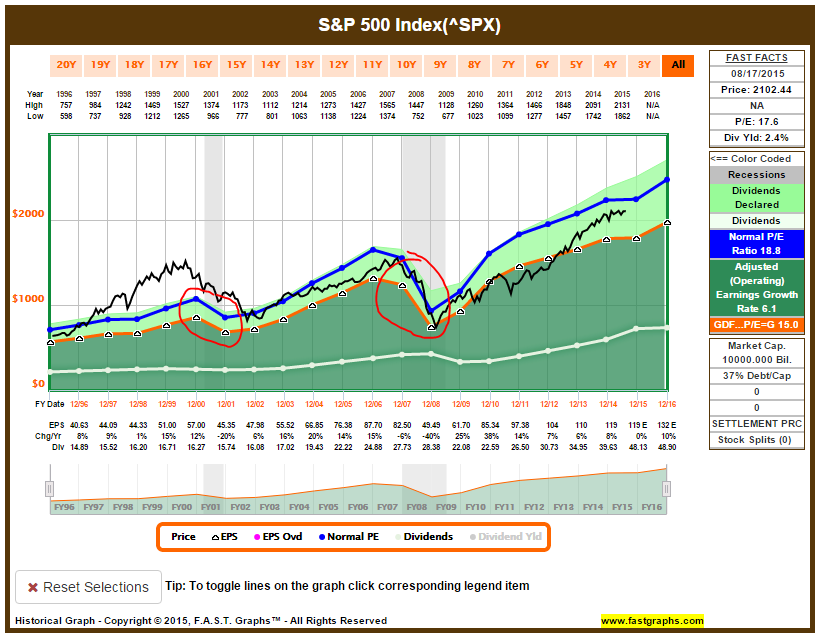

Also, the markets are currently being hamstrung by low earnings from the energy sector, a strong dollar reducing overseas profits generated by U.S. companies, contagiousness from China, angst over interest rates, and the fact that the markets have not let off steam from a 10% correction in... 4 years. So what could be a catalyst for growth headed into the holiday season? Earnings. There are others, but earnings is a big one. Below is a chart of the S&P 500 showing earnings growth in green. I circled two times when the earnings growth of S&P 500 companies went DOWN - and the market plummeted. When the economy is growing, this is one reason that we are careful about running for cover when there is a short term hiccup in the markets. On the other hand, decreasing earnings growth is a major red flag, and is a signal that the market is turning from Peak to Recession – such as 2000 and 2007/08. As the chart below illustrates, the S&P 500 has grown a bit faster than earnings growth; this gives us concern for a pullback. However, this is within the context of continued earnings growth.

We can't control the markets; but can do our best to respond to developing market conditions. The United States economy is more resilient than we often give it credit for. That resiliency is being tested.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.