What do Movies, Aluminum, Banking, and Cruises have in common?

Submitted by DeDora Capital on January 29th, 2016

by Will Becker, AWMA/AIF

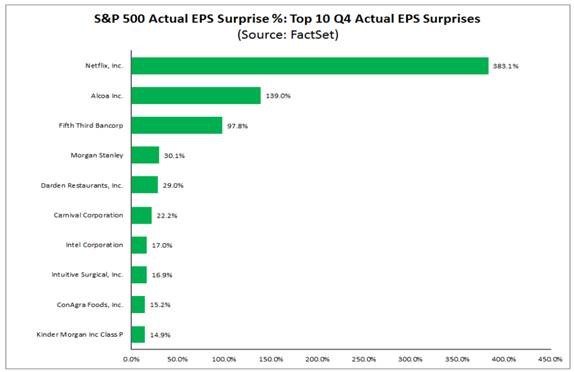

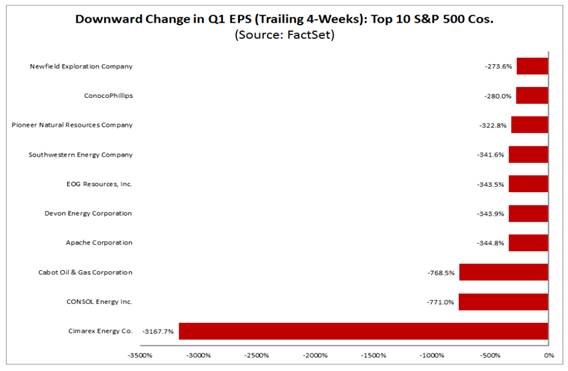

What do movies, aluminum, banking, restaurants, and cruises have in common? Companies focusing on each of these items beat their Earnings targets, according to a report released last week from FactSet. There are an overwhelming number of financial indicators. Thousands of them. But we find that common sense brings us back to the simple philosophy that we should pay attention to which kinds of companies are making money. The chart below from FactSet shows the top 10 Earnings Surprises, as well as the top 10 Downward Changes in Earnings. Notably, the top companies that beat their earnings represent a wide variety of products and services. That is what you would expect from a modestly growing economy where consumers have enough money to go on cruises and download the latest movies.

Meanwhile, the companies with the largest Downward Changes are Oil Exploration companies. Oppenheimer is even projecting that 50% of US shale drillers may go bankrupt. We have been reviewing the Oil situation in detail, and found that while oil prices have been tumbling down… the actual consumption of oil is up over 2% in 2015 from the previous year according to this report. This suggests that the problem with oil is massive over supply by the oil producers and not necessarily due to a slowdown in global growth.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.