Is vs Should, $109k median retirement savings.

Submitted by DeDora Capital on January 27th, 2017

by Will Becker, AWMA/AIF

Happy Friday!

Planning Perspective

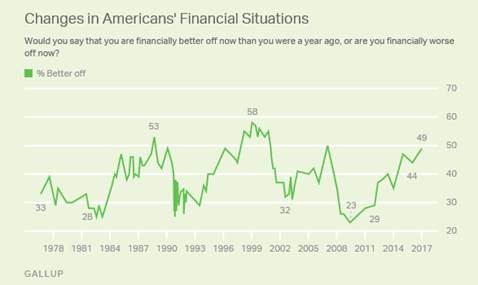

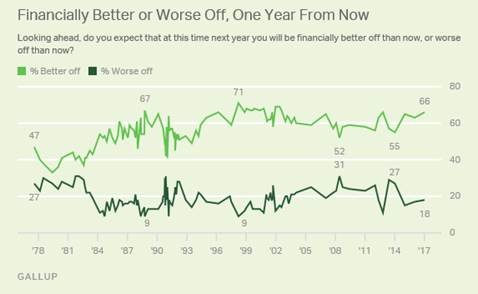

This week Gallup published their Personal Financial Assessment results, showing that “Americans are more upbeat about their personal finances today than at any time in the past 10 years.”

Even more encouraging, “66% of Americans expect to be financially better off a year from now.” And that is really good because the Government Accountability Office found that “52 percent of households age 55 and older have no retirement savings in a DC [such as a 401k] plan or IRA… Among the 48 percent of households age 55 and older with some retirement savings, the median amount is approximately $109,000–commensurate to an inflation protected annuity of $405 per month at current rates for a 65-year-old.”

So let’s hope that Americans use the recent financial optimism to build retirement savings that they can live off of! Or at least make some dent in one of these: pay down debt, fund a cash reserve, add some taxable investments, and build up the retirement investments.

Investment Perspective

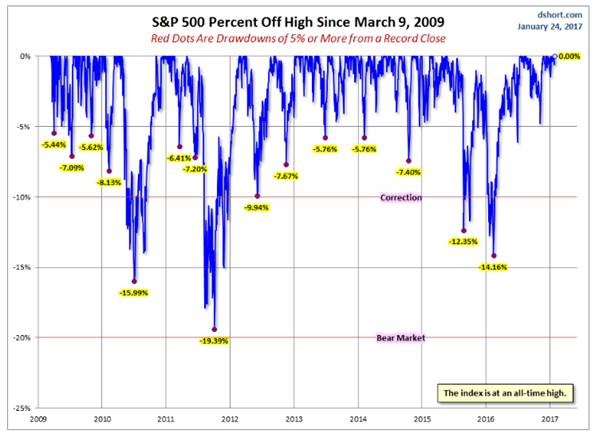

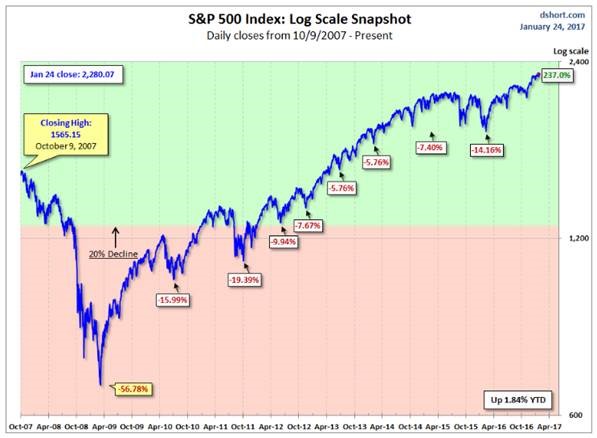

Speaking of financial optimism, this week the Dow Jones reached a major milestone - it closed above 20,000 for first time. It is natural to think “we are at an all-time high… is it time to sell?” In many ways it should be a time to sell. This is the longest that the S&P has gone without a 5% pullback since 2009, there is policy “uncertainty” with the new Presidential administration, interest rates are going up, and there is generally slowing economic growth.

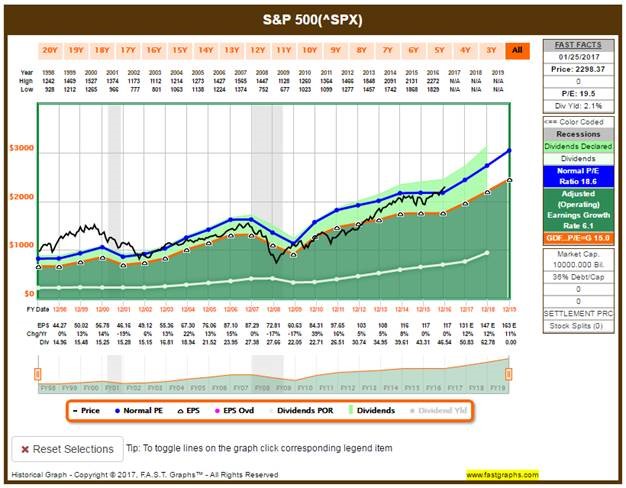

However, the price being high does not necessarily mean that a market or a stock is too expensive. That is because expensive vs cheap has a lot to do with the direction that earnings go. In many ways, investing is the art and science of buying future earnings. If companies are earning more, then they are generally worth more. When earnings dry up, they are typically worth less. Paul DeDora likes to say that “We have to invest based on what is, not what should be. Because what should be might never happen!”

In this case, what IS happens to be earnings growth (see the dark green area in the chart below) and the expectation of tax, regulation, trade, and infrastructure policy that is friendly to companies.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.