Two Koreas

Submitted by DeDora Capital on August 11th, 2017

by Will Becker, AWMA/AIF

Happy Friday!

Planning Perspective

This week I had the opportunity to provide financial education for our local Boys & Girls club staff. This is a great group of educators, and doing these kinds of financial education events fits right in with our mission. If you work with a group that you think would benefit from a financial education workshop, let me know and I'll see what we can do.

Investment Perspective

Let's talk about North Korea.

This week President Trump and North Korea stepped up a war-of-words at each other. North Korea is apparently making missile-ready nuclear weapons, Trump says there will be "Fire and Fury" if North Korea threatens the US, then North Korea threatens an "enveloping fire" in Guam, Secretary of State Rex Tillerson tries to calm the situation by saying there is "no imminent threat", other important people downplay the situation, and then President Trump says that maybe "Fire and Fury" wasn't strong enough language. Most of this I read on a South Korean smartphone (Samsung!), then I drove home in a Japanese car (Subaru!), and I am writing this update on a computer made in China (Dell!). So while those countries are far away, the products made in the general region are certainly part of everyday life for many Americans. With that in mind, here is a quick view on the two Koreas.

One day I was walking out of the cell phone store with my new Samsung smartphone (a South Korean company), and walked by a Hundai and a Kia (both South Korean car companies) on the way to my car. In that moment I realized I really need to write an update on South Korea - this faraway land that makes so many of our smartphones and cars. Let me preface this by saying that I am by no means an expert on the Korean peninsula. I haven't been there, and there is so much history between China, the Koreas, Japan, and the US that I really don't want to risk over-simplifying the thornyness of politics in that region. Having said that, the Texas sized peninsula is home to what may be one of the most dynamic economies in the world right next to one of the most insular. That is interesting.

"It seems like North Korea is still fighting the Korean war," I said to a friend recently, "wasn't that over 60 years ago?" Perhaps I missed this part of world history in school, but it turns out the Korean war has not officially ended. There is a cease-fire dating to 1953, but it never turned into a peace treaty. And even that cease-fire is on thin ice... with North Korea announcing six times from 1994-2013 it would no longer follow it. So yeah, apparently it's still a war. But in the 60 years since the cease-fire, North and South Korea have gone down completely different paths. Here is a quick view, with a focus on what the two countries currently produce.

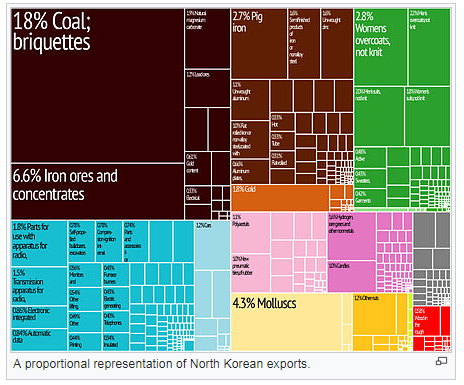

North Korea is the size of Pennsylvania, with a population the size of Texas and a Gross Domestic Product the size of Vermont. This notoriously restrictive country arrested the leader's son for trying to visit Tokyo Disneyland (the son was later assasinated in 2017), and an american died after being arrested for allegedly taking a poster from a hotel. But we do investing, so let's look at what the country produces - its exports. Exports from North Korea are driven by raw materials such as Coal and Iron, and the vast majority of imports and exports are via China.

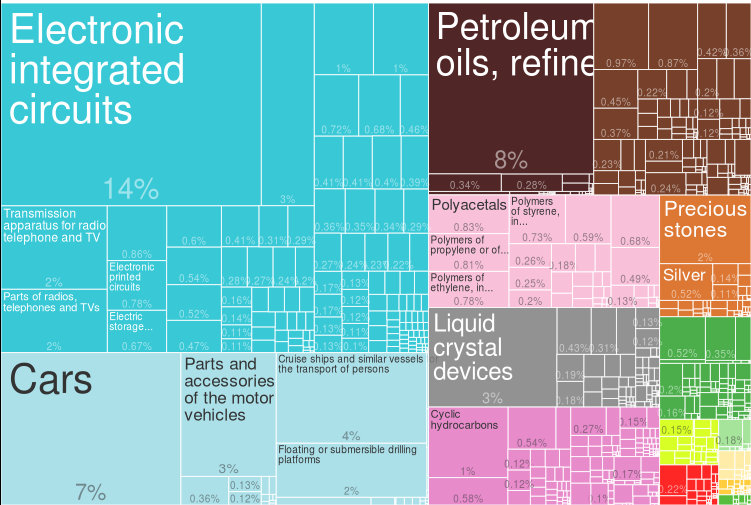

For a comparison, South Korea's exports are driven by Electronics (Samsung!) and Cars (Hyundai & Kia!). In short, North Korean exports are dominated by raw materials sold to China while South Korea exports are driven by electronics parts and finished consumer goods such as smartphones, fancy TV's, and minivans that are sold to western countries.

To sum it up another way, here are the two most common things I hear about the two Koreas:

- North Korea: please don't bomb us.

- South Korea: how do I invest there?

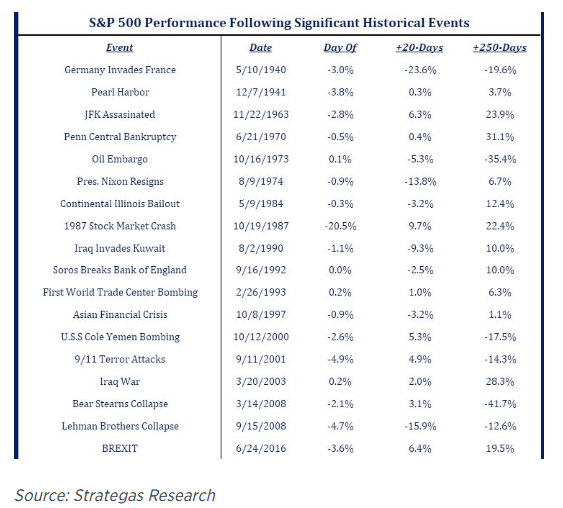

Today the Dow dropped 200 points owing to the North Korea situation. What if the sabre rattling turns into more than words? Strategas Research looked at the stock market reaction to some of the biggest geopolitical events since World Sar II, leading to the chart below. These were crises such as Germany invading France, President Nixon resigning, and the World Trade Center bombing. Really bad stuff. In 10 out of 18 cases, the S&P 500 was positive 20 days later, and in 12 of 18 cases was positive 250 days later. What were the worst situations 250 days later? Bear Stears collapse (-41%), the Oil Embargo (-35%), Germany invading France (-19%), USS Cole bombing in Yemen (-17%), 9/11 attack (-14%) , and Lehman Brothers collapse (-12%). This is a situation that we continue to monitor.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.