The Tubman $20 & Prince

Submitted by DeDora Capital on April 22nd, 2016

by Will Becker, AWMA/AIF

Investment Perspective

For the first time since 1929, our nation’s currency is getting a thorough update. This week, Treasury Secretary Jack Lew announced that the front of the new $20 bill will feature abolitionist Harriet Tubman (image below). In addition, the back of the $5 and $10 will feature women’s suffrage leaders Lucretia Mott, Sojourner Truth, Elizabeth Cady Stanton, Alice Paul and Susan B. Anthony. The back of the $5 will include Eleanor Roosevelt and Rev. Dr. Martin Luther King Jr.

It turns out that women have been on our currency before. Not just the dollar coins that were oddly similar in size to Quarters and jammed up the vending machines of my youth, but also paper money. According to the LA Times, First Lady Martha Washington was on the $1 (image below) in the 1891, and Pocahontas was on the $20 in 1865. Sacagawea and Susan B Anthony were also on those dollar coins. No matter the political orientation, it is refreshing to see our currency reflect the ending of slavery and the right for women to vote.

Now on to the investment markets.

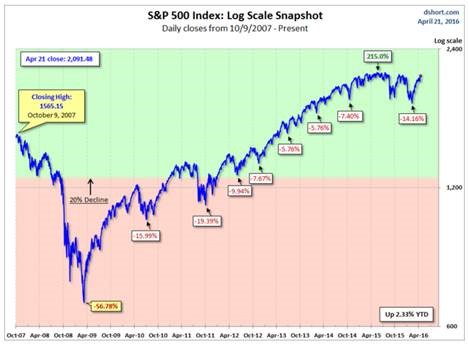

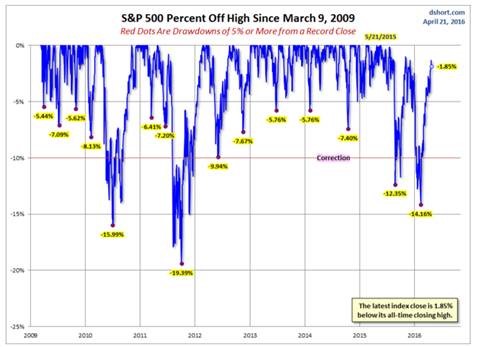

As of Thursday morning when I am writing, the S&P 500 is up +2.3% year to date and is -1.85% off its high from May of last year. Emerging Markets are even a little bit further ahead this year. This is one reason we are broadly diversified; owning non-correlated or semi-correlated assets smooths out the ride and keeps the investment eggs in multiple baskets.

With tax day still fresh in our minds, many of our client conversations have focused on tax efficiency. Just as a refresher, the planning and investment management that we do is based on three priorities: Custom, Active, and Tax Sensitive. Custom because we factor in custom legacy positions and each client’s unique circumstance. Active because we strive to adapt to market and economic conditions as well as changes in our clients financial lives. Tax sensitive because what you keep is as important as what you earn. If your tax preparer made any tax efficiency recommendations, please send them to us if you have not already. Some examples of tax efficiency might include using Municipal bonds, maxing out IRA contributions, opening a Donor Advised Fund, opening a 401k or Defined Benefit plan at your local small business, etc. Some of these items are highly influenced by your tax rate, so let us know if you want to check-in on tax efficiency and see if any adjustments should be made.

In closing, I feel compelled to mention that the rock legend Prince passed away this week. Whether you enjoyed his music or not, he stands up among some of the most influential musicians of our lifetimes. Here is a video of him playing at the Rock’N’Roll Hall of Fame on a stage of fellow legends. Rest in Peace.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future res

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.