Trade & Coronavirus

Submitted by DeDora Capital on February 7th, 2020

by Will Becker, AWMA/AIF

Happy Friday!

Team Update

Last week Paul DeDora was in Orlando for the annual TD Ameritrade conference. At the conference, he led a workshop with “NextGen” Financial Advisors – students that are considering careers in investing and financial planning.

Growth Leading Value

2020 is starting out with the "Growthier" companies leading the pack. The first chart below (from www.Finviz.com) shows companies such as Amazon, Google, Apple, and Microsoft leading performance while old stalwarts such as banks, health care, and industrials are hit and miss.

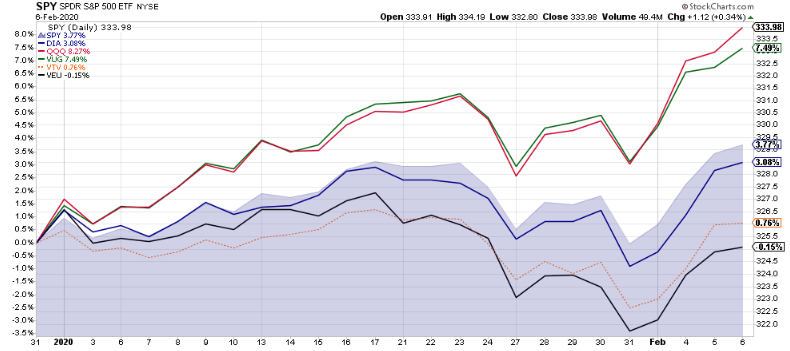

The second chart (from www.StockCharts.com) shows this another way, with the Growth style companies (Green) performing in line with the Nasdaq (Red), while the Value style companies (dotted Orange line) are barely treading even along with International equities (Black).

Many years ago I was reviewing a portfolio with a prospective client. He had a dozen investments in his portfolio, and proudly described how well allocated he felt he was. Except that all the companies were in the same industry and sold the same kind of product! He had diversified out of the single-company risk, but otherwise the positions were 'correlated' - they moved together, up and down. He didn't like the idea of diversifying to include other industries, so we didn't end up working with him. Just a couple years later, that industry imploded due to the commodity price of oil, with colossal loss of principal. My point being that diversification means positions that do not move in lock-step with each other and that there is typically something to loathe in a portfolio.

I mention this because the US Equity markets keep hitting new highs this year. But not all of the markets are going up in unison. This is actually a good thing. If all of the companies in the first chart below were bright green, then that would suggest that they are 'correlated'... and may all go down together. This is one reason that we diversify holdings, so that accounts have a variety of investments that are expected to behave differently.

Trade Deficit

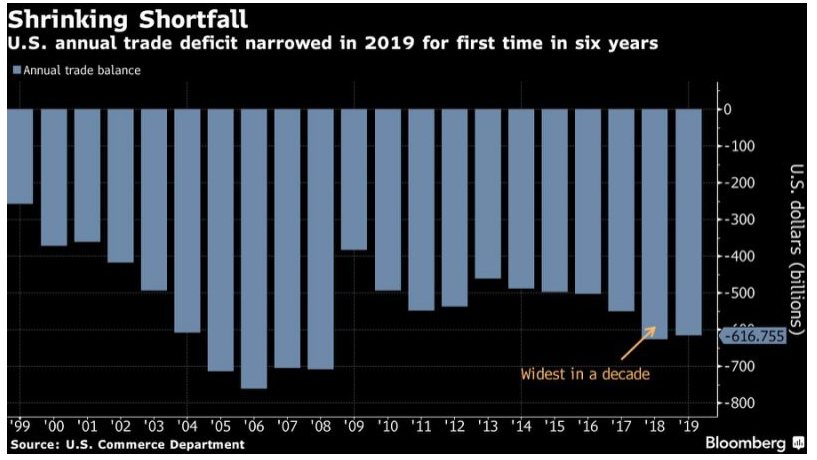

In 2018, the Trade Deficit reached a 10 year high. The numbers from 2019 are looking friendlier, with the Trade Deficit shrinking by 1.7%... for the first time since 2013. While the Trade Deficit with Europe remained high, there was a notable 20% reduction in crude oil imports in 2019. That news sounds better than the chart below looks. I mean, last year there was still a +$616 billion deficit, but at least it was less than the year before (see chart below). Notably, China just lowered tariffs on $75 billion worth of goods.

Wuhan Coronavirus

In the last Update, I mentioned this in the Wildcards section... since then, the Coronavirus that is coming out of Wuhan, China, continues to spread. This results in more than 50,000 flights canceled, thousands of cruise ship passengers under quarantine, and residents of Wuhan China singing out their windows. China also built a 600,000 square foot hospital in 10 days. No really, check out this link for a timelapse of construction. We continue to keep an eye on the Coronavirus from an economic perspectve.

Here are some Doctor's recommendations as precautions to protect from this and other viruses.

Impeachment

I also referenced Impeachment in the Wildcards section of the previous Update. While the President was Impeached by the House of Representatives in December of 2019, this week the Senate acquitted (i.e. did not convict) him of the charges. Having said that, there are continued investigations on several topics, each of which will have its own timeline.

Tesla

Let me preface this by saying this is not a recommendation to buy or sell Tesla stock and that things are most definitely subject to change with this company. That being said, in the past week Tesla did something that we saw Amazon do on a couple occasions: grow by an insane amount in just a few days.

In January, Amazon grew by $90 Billion in one day. That is more than the entire Market Capitalization of TWO FedEx’s in ONE day. In the past week, Tesla took a turn at the big-companies-growing-insanely-fast record books, and grew by $60 Billion in a week (gave half of it up a day later, for what it’s worth). For reference, that is more than the entire Market Capitalization of General Motors… in one week.

Video

- Some folks have seen this video that is making the rounds, but it bears sharing far and wide. Can we be like the Coyote and Badger, off on their great adventure with their own versions of enthusiasm?

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.