Is There A Big Mean Bear?

Submitted by DeDora Capital on April 7th, 2017

by Will Becker, AWMA/AIF

Happy Friday! Heavy rain today, winding down the wet season here in northern California.

Investment Perspective

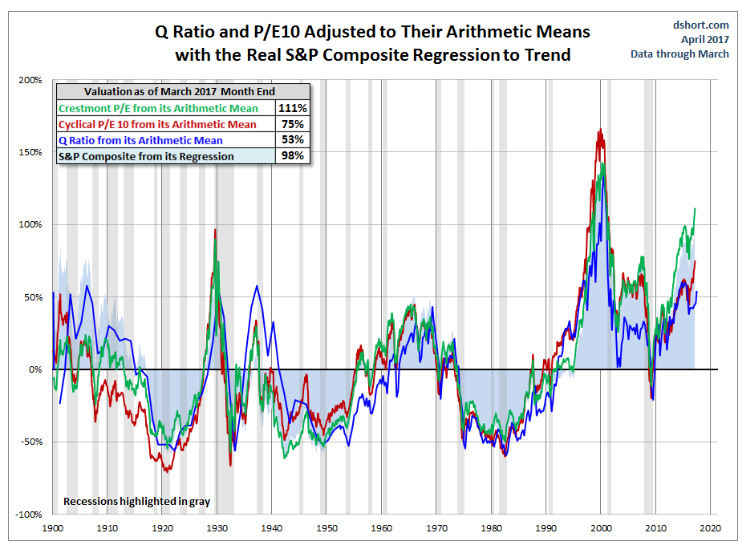

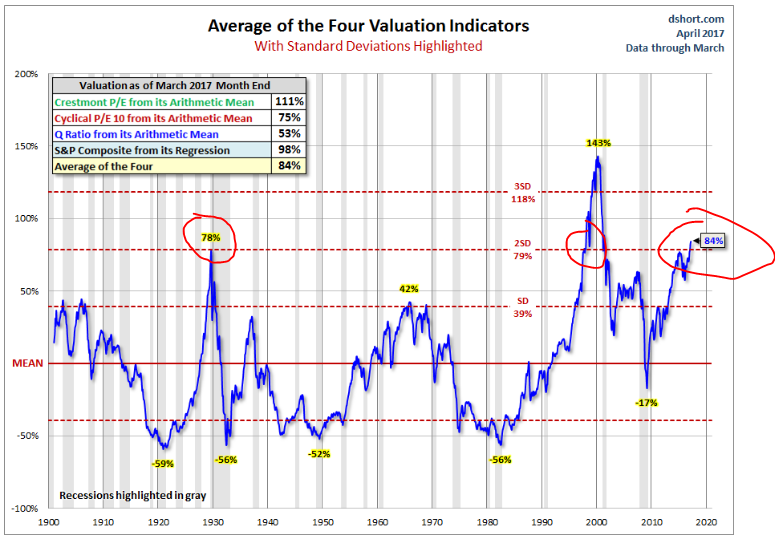

Now that the S&P 500 has increased significantly over the past few months, there is a question that I feel compelled to address: Is the Stock Market expensive? This question is increasingly popping up in media coverage of the markets. Yes, by historical standards the Stock Market is expensive from a Price-To-Earnings perspective. Sure it is not as highly valued as *the-most-expensive-time-ever* (2000), but that's ok it's right up there with 1929. Before you spit out your coffee like I did, let me take a moment to explain why this is not a time for panic. Hold on, though, because this is going to take more coffee. (For those interested, the Cyclical P/E ratio referred to below is based on Robert Shiller's CAPE ratio. Other indicator details here.)

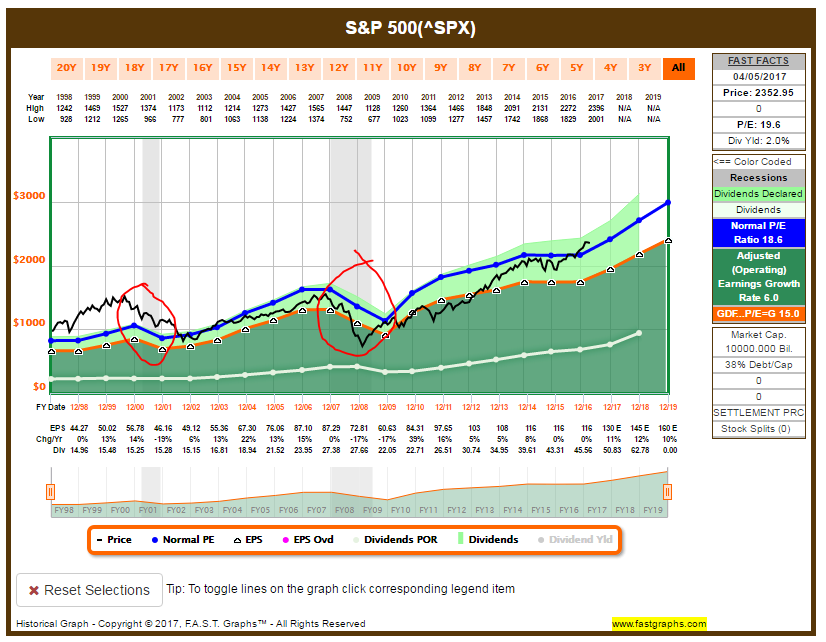

Sometimes it seems like there is a big mean Bear at the top of the market valuation hill that is just waiting to ruin the party. Does that mean that the market needs to crash? Not necessarily. When the Stock Market is overvalued AND has declining earnings... that's bad news (see last two recessions in red, below). But today's situation is an overvalued market with growing earnings. Using the train as an analogy, earnings are kind of like the fuel of the stock market. If the train is steaming up the hill AND has fuel it should keep going at least somewhat further; if it is steaming up the hill and runs out of fuel... bad news for those on board. So all this is to say that 1) the market is overvalued, 2) that is a problem, 3) but that doesn't mean immediate recession. The Stock Market *should* have a modest pull back for the price and earnings to line up better. One potential catalyst for a pullback would be issues with the much anticipated Infrastructure spending bill. At the moment, the markets are assuming that Trump's $1 Trillion Infrastructure spending plan will happen. Such a plan would take significant deficit spending, something that the Freedom Caucus may jettison. As I mentioned back on January 27th, Is vs Should "We have to invest based on what is, not what should be." So we have a watchful eye on the fuel gauge as this plays out.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.