Tariffs, Interest Rates Go Up, and Facebook/Cambridge Analytica

Submitted by DeDora Capital on March 22nd, 2018

by Will Becker, AWMA/AIF

Happy Friday!

Interest Rates

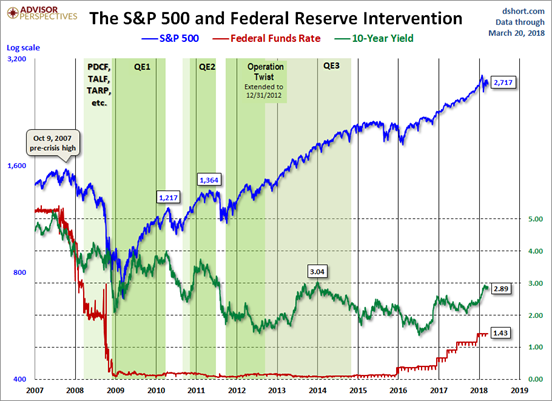

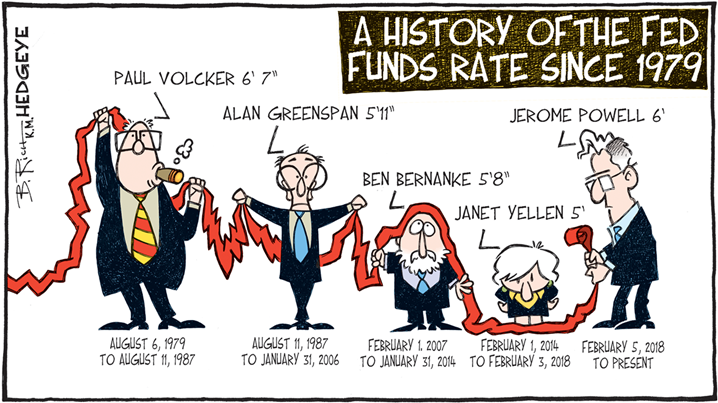

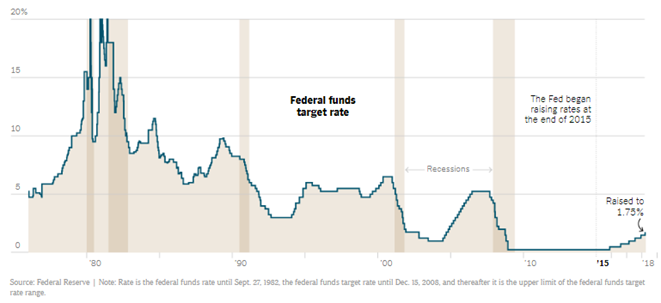

This week the Federal Reserve raised interest rates to 1.75%, the sixth increase since the Great Recession. Federal Reserve Chair Powell said that he wants to continue to gradually increase interest rates, according to the New York Times, "particularly if economic growth continues to accelerate and unemployment remains at or below the 4.1 percent level it reached in February." The stair steps towards the right of the chart below (the red line) show how interest rates are gradually normalizing. I say gradually, because the rates are still historically low. Also note that the S&P 500 continued to go up while interest rates stepped up since 2016.

Why do low interest rates matter? Low interest rates are a turbo boost for the economy. If your Bank Savings acct is paying .01% interest, and you need income, then taking more risk to get that income sounds appealing... so maybe you buy some dividend stocks that yield closer to 3%. That is taking more risk in order to achieve a higher yield, and it moves money from cash into Stocks. Plus, Low interest rates mean that companies can take on cheap debt to invest in growing the company. Similarly, home prices are more affordable with lower mortgage rates... same with auto loans, credit cards, and other variable rate debt or new debt. But as Interest Rates rise, the cost of owing money goes up dramatically. For example, just a 1/4% increase "will cost credit card users roughly $1.6 billion in extra finance charges during 2018." That is because Americans have a LOT of debt. Just looking at Credit Cards for a moment, a report this month showed that "Americans now owe more than $1 trillion in credit card debt for the first time ever."

If low Interest Rates are so positive and rising Interest Rates are so disruptive, then why not keep Interest Rates low? If we are in the later stages of a business cycle, raising interest rates can cool off the economy so that it does not contract as dramatically in a recession. Note that I said "can" ... not "does" or "guaranteed to." The chart below shows that in the past five recessions, interest rates peak prior to recessions... and then interest rates begin to fall just as the recession begins. So, Interest Rates are a tool that the Federal Reserve uses to either put the brakes on too-fast growth of a booming economy or accelerate recovery in a decline. If interest rates are perpetually low, the brakes don't work as well. The really big Interest Rate issue is an "inverted yield curve." That is when long term debt has a lower yield than short term debt. As the chart below shows, recessions tend to follow an Inverted Yield curve... that is something we are watching closely as interest rates increase.

Geopolitical Risk

US Markets are down as I am writing this, citing fears on Tariffs and Tech fallout stemming from Facebook and Cambridge Analytica.

The Tariffs topic ramped up in March when President Trump announced Aluminum and Steel tariffs. Since then, the administration has exempted the European Union, Argentina, Australia, Brazil, South Korea, Canada and Mexico. On Thursday this week, President Trump announced Tariffs on China that relate to Intellectual Property theft. This comes out of an initiative from 2017 to determine ways to stem the Intellectual Property issues in China. When Tariffs are announced, just remember that they are proposed Tariffs, not implemented Tariffs. There is a pretty strong argument that President Trump is using Tariffs as bargaining chips for other issues and may back down on Trade if/when there are other concessions.

And now a comment on Facebook before closing out. Facebook is in a heap of trouble for allegedly allowing troves of data to be used for political purposes in the last election. Facebook is now -10% in the past five days, and that leads to a conveniently timed cartoon below. Courtesy of the Electronic Frontier Foundation, here is a link to instructions for changing your Facebooks settings to turn off integrations with third party apps.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.