Taking Regret Seriously & What Inflation Did To Wages

Submitted by DeDora Capital on June 14th, 2018

by Will Becker, AWMA/AIF

Happy Friday!

Likely Future Regret

One of the things we do in the planning process is to look for areas of likely future regret, pull them into the present, and see if there is a better alternative. If so, check it out; if not, at least there is clarity on the path forward.

Because planning is so personally intimate, let me give you a personal example. In my early 20's, I knew I would experience regret if 1) I did not have at least one kid, 2) I missed the kid's childhood due to working too much, and 3) If I didn't own a home. So when my mother passed away from cancer in my early 20's and I inherited a modest amount of her hard-earned money (she was a nurse - go nurses!), I had clarity on what to do. I pulled those areas of likely future regret into the present and realized that I needed to invest the money to fund these priorities. While nothing was guaranteed, at least I was giving myself a fighting chance at avoiding these likely future regrets. Today I have a7 year old daughter, took a sabbatical from the working world to be a stay home dad, and live in the home that I bought. Just so you don't think I am bragging, don't worry - plenty of other things did not go according to plan. I have a separate - and very long - list of things I didn't see coming. But that is life, right?

Why am I talking about a psychological idea such as regret? Psychology Today says that regret is:

"blaming ourselves for a bad outcome, feeling a sense of loss or sorrow at what might have been or wishing we could undo a previous choice that we made. The pain of regret can result in refocusing and taking corrective action or pursuing a new path. However, the less opportunity one has to change the situation, the more likely it is that regret can turn into rumination."

From our perspective, taking regret seriously is a no-brainer. First of all, we don't want clients to experience avoidable pain or rumination. Second, when likely future regret is identified, there is potential opportunity - and that is usually a function of money or time. We encourage folks to take a look into the future, well into the future. It could even be the well-being of your loved ones after you have passed away. What would you regret or feel sorrow about? What opportunities are there for an alternative path? Is there an element of money or time involved? Give us your likely future regrets, and let's see if we can bring clarity on alternatives!

Beveridge Curve & Quit Rate

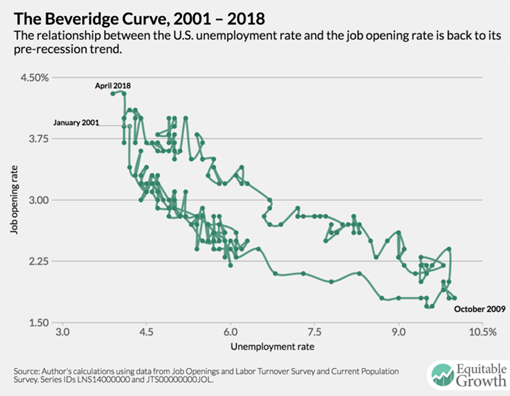

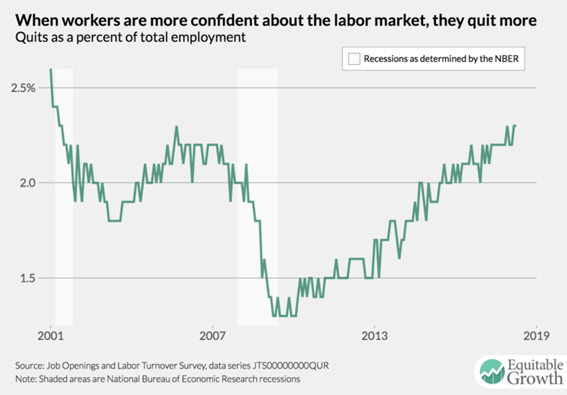

This Quarter the employment market hit a milestone, and the LA Times headline says it best: "There now are more job openings in the U.S. than unemployed workers to fill them." Obviously that doesn't mean that each unemployed individual is qualified or interested in the open jobs, and it doesn't mean that the jobs pay particularly well. But still, this is a big deal. The most direct way for employers to fill those positions is to raise wages. And it looks like employers may need to do something to keep employees, because the "Quit Rate" is at pre-recession peaks. The "Quit Rate" indicates that workers are pretty confident they will be able to get a new and better job. All of this is in keeping with the later stages of the business cycle, and the increased wages should coincide with increased inflation (see more on that below) and flattening of corporate profits. Since I am talking about the business cycle and employment, let me add one more thing that many folks don't know about: the Beveridge Curve. The Beveridge tracks the relationship between unemployment and job opening rates over time. It is now back to its pre-recession level in terms of low unemployment and high job opening rate.

Wages and Inflation

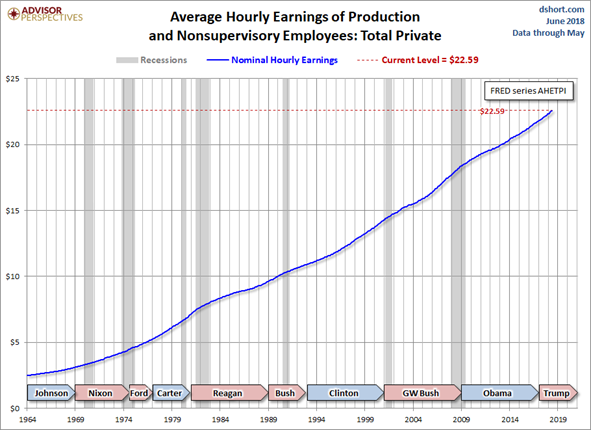

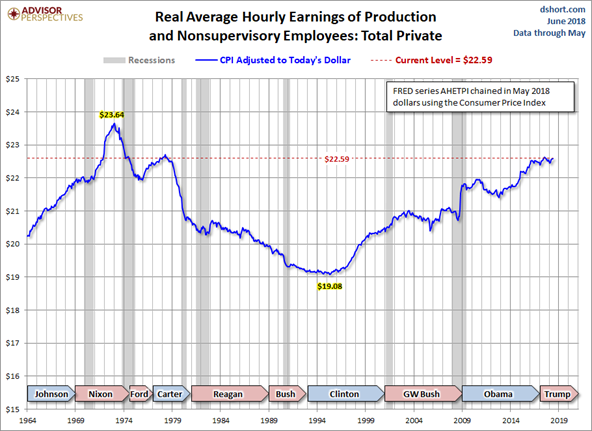

I mentioned Inflation in the paragraph above, and want to dig into the relationship between wages and inflation just a bit more. Inflation is a frequent topic in our conversations and in the data that we track. Besides the pain at the pump when gas prices rise, sometimes inflation can seem detached from normal everyday living. So here is another view at Inflation. What if I told you that the average hourly earnings for non-supervisors is at an all time high? (first chart below) That sounds great! Everyone must be rich, right? But you and I know that's not the complete story... because it seems like EVERYTHING ELSE costs more, also. It turns out that adjusting those wages for Inflation tells a very different story (second chart below). The good news is that wages have steadily increased - even adjusted for inflation - since the mid 1990's. The bad news is that it took so long to reach these levels... that we last saw in the Carter administration.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.