Sustainable Investing, SRI, ESG and Best-In-Class. What Gives?

Submitted by DeDora Capital on February 26th, 2016

by Forrest Hill, PhD, CFP®

In my last blog update, I wrote about the use of positive screening to build Socially Responsible Investing (SRI) portfolios. SRI has come to mean many things to different investors, but to us it connotes the idea of identifying what is often called “best-in-class” companies. A couple of questions I often get when I talk to folks about this investment style are 1. what information is used to evaluate companies and 2. how are companies graded? Good questions.

Positive stock screening is based on the use of numerous factors that fall under three general categories; Environmental, Social and Corporate Governance. This has given rise to the acronym ESG investing, which is most often used to describe the practice by investors of considering corporate behavior when purchasing stocks. Evaluating ESG criteria has now become synonymous with the term sustainable investing, which itself is now the bedrock of SRI. Clear as mud, right?

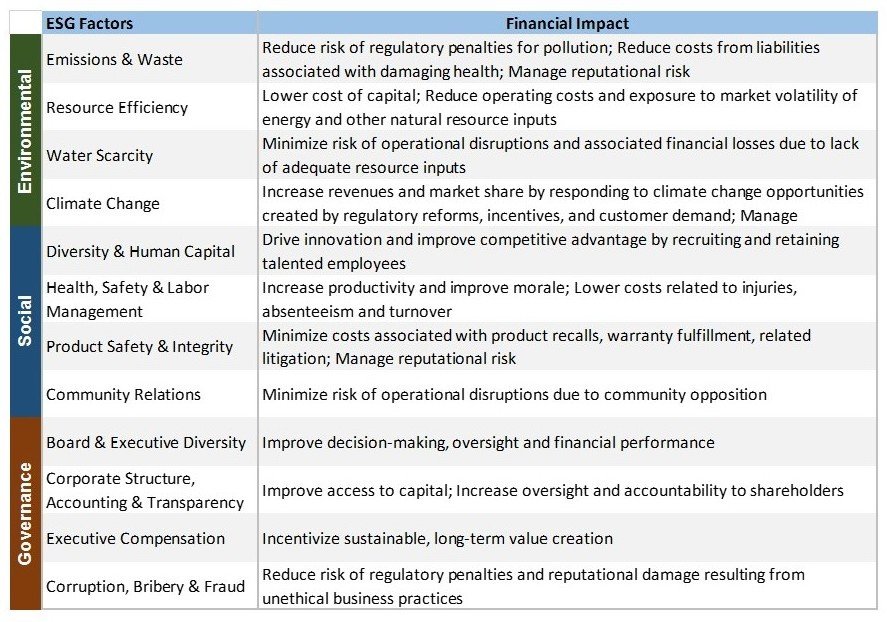

It gets a bit more confusing than that, because each of the three criteria, E, S, and G are themselves broken down into many categories. The table below provides an example so some of the major categories, along with the rational as to why they are considered important for financial performance.

The theory behind ESG, and sustainable investing, in general, is that effective research, analysis and evaluation of these “non-financial” issues is a fundamental part of assessing the risk and performance of an investment over the long-term. This practice differs from conventional investing that tends to focus primary on financial risks such as debt, earnings growth and valuation (sustainable investing does this as well). The philosophical foundation behind sustainable investing is that leading global companies of the future will be those that provide goods and services that reach new customers in ways that address the world’s major challenges – including poverty, climate change, resource depletion, globalization, diversity, human rights, etc. Thus, by using ESG criteria we can begin to identify those companies that are favored for future growth.

Just looking at the partial the list of ESG factors shown here, you might begin to wonder how in the world can all off this information be acquired even for a single company, let along every publicly traded company in the U.S. (and the world for that matter). In 2005, when the United Nations first published its Principle for Responsible Investing (PRI – more on this in an upcoming update), it was very difficult to get ESG information on a company, unless they did something egregious (e.g. Chemical spill at a Union Carbide plant in Bhopal India causing thousands of deaths).

Fortunately, things have changed today, thanks to technology, the internet and a host of large research organizations such as Bloomberg, MSCI, Thompson Reuters and Sustainalytics. These firms provide investors with the tools and data needed to compare and contrast ESG performance of companies within and across all economic sectors. Considering the growing number of companies and asset managers that are PRI Signatories, the number of experts analyzing ESG performance information is predicted to expand rapidly to meet the growing demand.

As investors increasingly demand more ESG information on companies, more publicly traded companies are focused on improving their ESG scores, and are willing to publish metrics related to ESG performance. Sustainability is no longer just for hippies (although perhaps I still quality), as corporations are beginning to realize it makes more and more financial sense to consider these factors. It is becoming more obvious that the world is being reshaped by immense forces and companies ignore these changes at their own peril. Chief among them is the growing limitations on the availability of natural resources and a population that’s not only living longer, due largely to medical advances, but also expanding, from 7.2 billion people today to a projected 9.6 billion in 2050. This is going to bring immense challenges including meeting our energy needs without heating up the planet, growing food without destroying our limited soil base, using resources efficiency without producing waste, etc. Companies that get this, who are not stuck in the old models of the past, are more likely to be around in the future and provide the catalyst to solve future problems.

So what does this all mean for us as investors? I think the answer is two-fold. First, by tilting our portfolios towards companies that understand the importance of ESG, we are part of a growing movement in the investment world trying to push companies in the direction of sustainability. As more investment dollars flow to companies with higher ESG scores, the laggards should feel pressure to step up their game. That’s good for everyone. Second, I believe it’s good for our portfolios. More and more studies are showing that sustainable investing methods utilizing ESG data can improve performance over the long term. As the old adage goes, “you can do well by doing good!”

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.