Survey Finds 42% of Americans Will Retire Broke

Submitted by DeDora Capital on March 9th, 2018

by Will Becker, AWMA/AIF

Happy Friday!

Investment Perspective

I once had a baseball coach that taught us to "only worry about what you can control." In a game where failing in the batter's box 2/3 of the times makes you an All-Star, learning to focus on the things that can actually be improved is one of the biggest challenges. As a parent, I think about this all the time, too. It works for economics, also. All of this is to say don't freak out about this week's topic, because it can be intimidating but a goodly portion of it is in your control. The topic this week is Anxiety... Economic Anxiety... and what to do about it.

Let me start by saying that money and financial decisions are intensely intimate. Determining how much to save for a child's college fund, for example, can quickly morph into a conversation about parenting philosophy, and that can easily veer into the ditch of judgement. But we are not here for that. We are here for financial clarity. So as I dive in, let me invoke the wisdom of my Little League baseball coach, and ask for a collective "deep breath, big smile." Ok, let's do this.

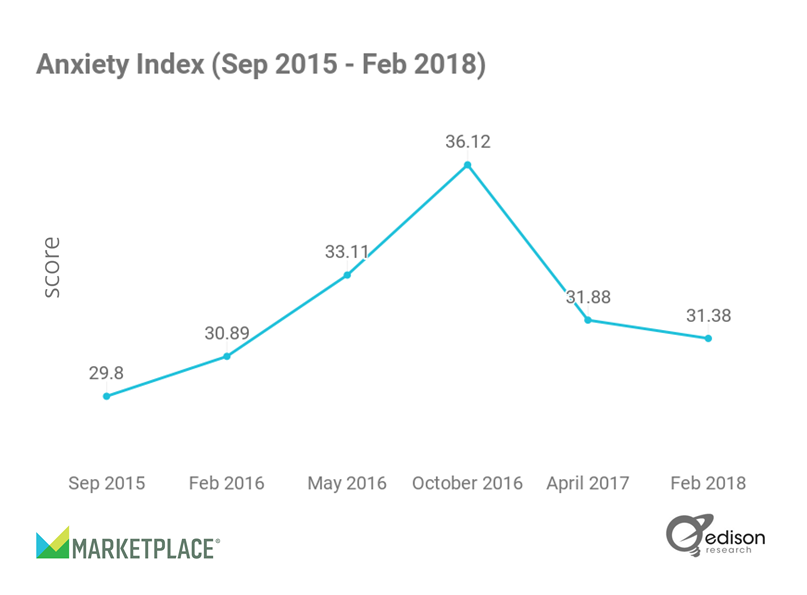

This week Marketplace and Edison released the annual "Economic Anxiety Index" poll results. The good news is that our overall national Economic Anxiety is slightly improved over last year. The bad news is that way too many people have Economic Anxiety, and much of it is avoidable. To give a flavor what the survey is like, here are two of the questions: "Does concern about your personal financial situation currently ever cause you to lose sleep?" and "If you were to lose your job, how confident would you feel about finding a new job within six months?"

- What to do: Please take the Economic Anxiety Index poll to see where you land in the results, and let me know the results so we can address areas of Anxiety that come up! https://features.marketplace.org/anxietyindexpoll/. It just takes 5 minutes, and I found the results personally illuminating. This is an open invitation to share your Financial Anxiety with us!

- What to do: If you are losing sleep about money, think that losing your job in the next six months is likely, or don't know what you would do if you lost your job in the next six months, please let us know so we can help work out the financial implications.

We know from the field of Psychology that Anxiety is a defense mechanism. One article put it this way: "Anxiety is a sign that a brain has been hauled into the future, and is thinking about the things that could go wrong." Sometimes we put it this way: much of what we do in Planning is to identify areas of future regret, pull them into the present, and see if there is a better alternative. Financial Anxiety can be a helpful tool to identify what is really on our clients' minds, and then we can address it in the Financial Planning or Investment process.

Having gone through the Financial Planning and Investment process with hundreds of clients over the years, here are a few examples of things that we worry about and ways to address them:

- Expecting Social Security to fund almost all of retirement.

- While Social Security provides benefits for 173 million folk, the average benefit is $1,269 per month. That equates to just $16k per year. You can contact the Social Security Administration for your estimated Social Security payout, which is often much higher than this average. We can factor your Social Security benefit into your Financial Plan to see how much of the retirement income it funds.

- Not saving enough to supplement Social Security.

- Financial Plans answer the question "How much do I need to save for retirement." But a rule of thumb called the "4% rule" can be a quick starting point. This rule of thumb says that 4% of an investment account can be withdrawn each year and the Account should keep its balance relatively stable over the long run. That translates to $40k of income for each $1m invested. In the Financial Plans we take this further, and pinpoint both the income stream needed and the degree of risk that is appropriate.

- Taking way more risk than is needed.

- Forrest Hill CFP in our office reminds us that there is no such thing as a low risk/high return investment; If there was, then everyone would own it and then it wouldn't have a high return any more. We emphasize educated risk. Sometimes this means that an account has much more risk than is actually needed to accomplish the goals. There are ways to deal with this in a tax sensitive way! For example, in some cases donating appreciated stock to a Donor Advised Fund can accomplish reduction of overall risk, funding of philanthropic goals, and tax efficiency. win/win/win.

- Leaving 401k match on the table.

- If your employer has a 401k, and you are not contributing, please contact Human Resources to find out if you have an "Employer Match." If so, please contribute at least that much, if not more!

- Not factoring Health Care Costs into early retirement.

- If you are planning to retire before Medicare Eligibility, we will likely include a separate line item for Health Care costs in your financial plan so that they are in the budget. Also, we often include Medicare "Supplemental" costs in plans and inflate them at a higher rate... because that is what's happening with health care costs.

- Not having a retirement account for saving money.

- We can help with this! Whether it is an IRA, Roth IRA, SEP IRA (Self employed?), SIMPLE IRA, 401k (I'm looking at you, small business owners!), or simply an individual account... we can make sure that you have the right accounts set up. For example, we just opened a Roth IRA for a Millennial client to start saving now that she has her first job. Off to a good start!

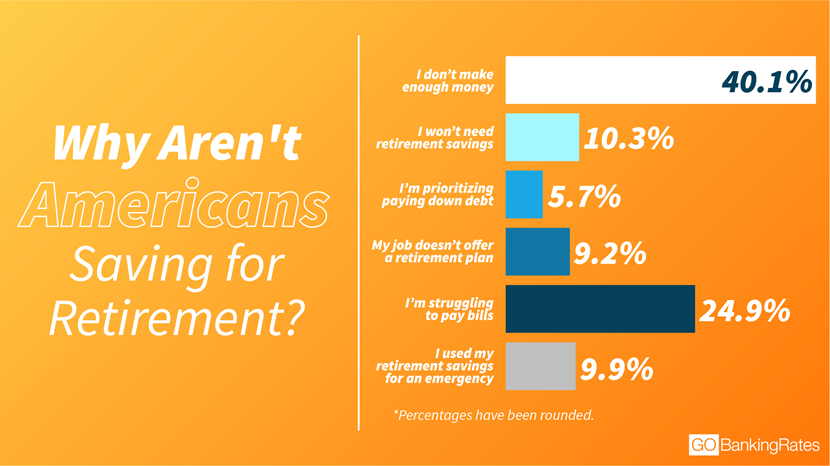

Here is something I worry about: people I know and love retiring broke. This is by no means an idle fear... just this week another survey came out with the distressing headline: "Survey Finds 42% of Americans Will Retire Broke." We can't solve this for everyone. But for those we work with, we can bring clarity and have those financially intimate conversations to address what is really on your mind. So, if Financial Anxiety has you down, let's listen to it and get to work on it. It might just pave the way for better golden years. :)

You made it this far! This animal video is for everyone that has a sheet of ice between their paws and goals, like this cat!

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.