Summer Camps & Gen Z

Submitted by DeDora Capital on June 2nd, 2017

by Will Becker, AWMA/AIF

Happy Friday!

Is there a a financial topic that you have said, "I've always wondered" about, or that you want to understand better? Is there a recent article or financial topic that you found really interesting or helpful, and other clients might benefit from it also? If so, let us know on the I've Always Wondered Survey!

This update talks about Summer Camps and Generation Z. Enjoy!

Summer Camps

The school year is almost over. By the next update, Summer Camps will be up and running across the country, including a whole bunch of them here in Napa. First, a note for teachers: Thank you for another year of educating the kids! From 2008 - 2011, I was one of the 1.5 million people that worked at Summer Camps each year (I was at Conservation Corps North Bay). That experience gave me profound respect for the folks that run camps every year. They are often the unsung hero's of a great summer, though if you attended a camp and had a great camp counselor then you know exactly how much of a positive impact they can make! Without further ado, here are some highlights from the 107 year old American Camp Association.

- "Camp is an $18 billion industry."

- "More than 14,000 day and resident camps exist in the U.S. 8,400 are resident (overnight) and 5,600 are day camps."

- Plus, these numbers are trending up: "82% of camps report enrollment that stayed the same or increased within the past five years,"

- What do the camps typically do?

- The American Camp Association says that "86% of camps offer recreational swimming, 63% offer camping skills, 47% offer climbing/rappelling, 34% offer horseback riding, 75% teambuilding, 41% community service, 23% farming/ranching/gardening, and 21% wilderness trips."

- What do the camps typically cost?

- The American Camp Association says that "199 a week up to $800+ a week" is a typical price range. Heads up that if you have a Flexible Spending Account through your employer, you may be able to use it for Camp expenses.

Generation Z

Speaking of the youth... two recent studies on "Generation Z" caught my eye this week. Gen Z is generally defined as the crop of kids born after Millennials, or those born after about 1995 and mostly under the age of 21. Before I go any further, let me say for the record that there are tons of assumptions and generalizations in these generational stereotypes. Plus, these youngsters are only just now starting to enter the workforce... so there is a lot we still don't know about how they approach work and careers. But initial info can be helpful as this large segment of our population enters adulthood.

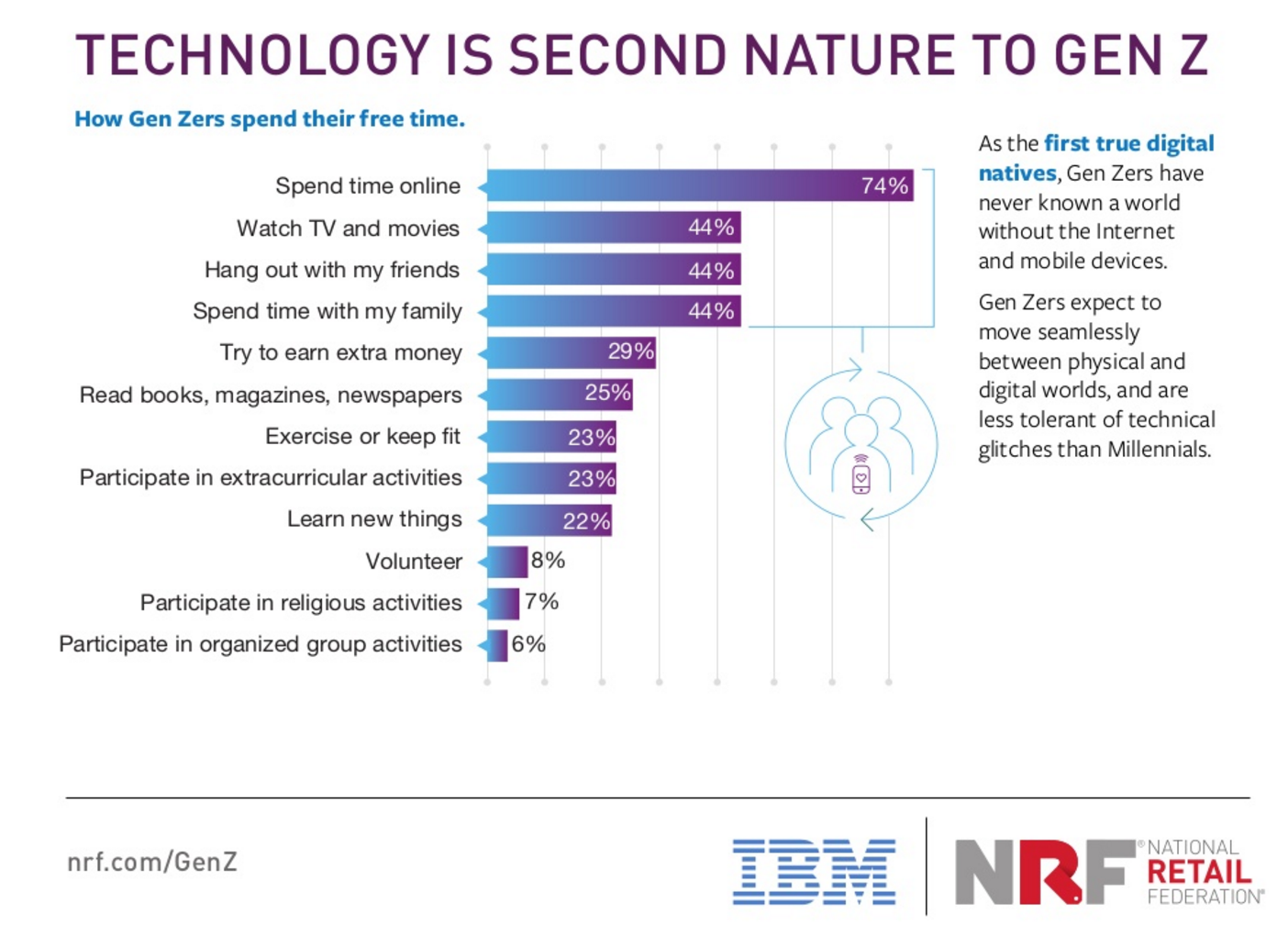

The National Retail Federation's study with over 15,000 participants reports that 75% of Gen Z'ers spend their free time online. Plus, Industry Analyst Mark Mathews says "60% of the time they are on two devices." So not only are they online a LOT, but the majority of THAT time they are multi-tasking multiple devices. For example: posting pictures on one device while also texting with friends on a second. Or to put it another way, this generation has "never known a world without the internet and mobile devices." In Japan, this generation is called "Neo-Digital natives."

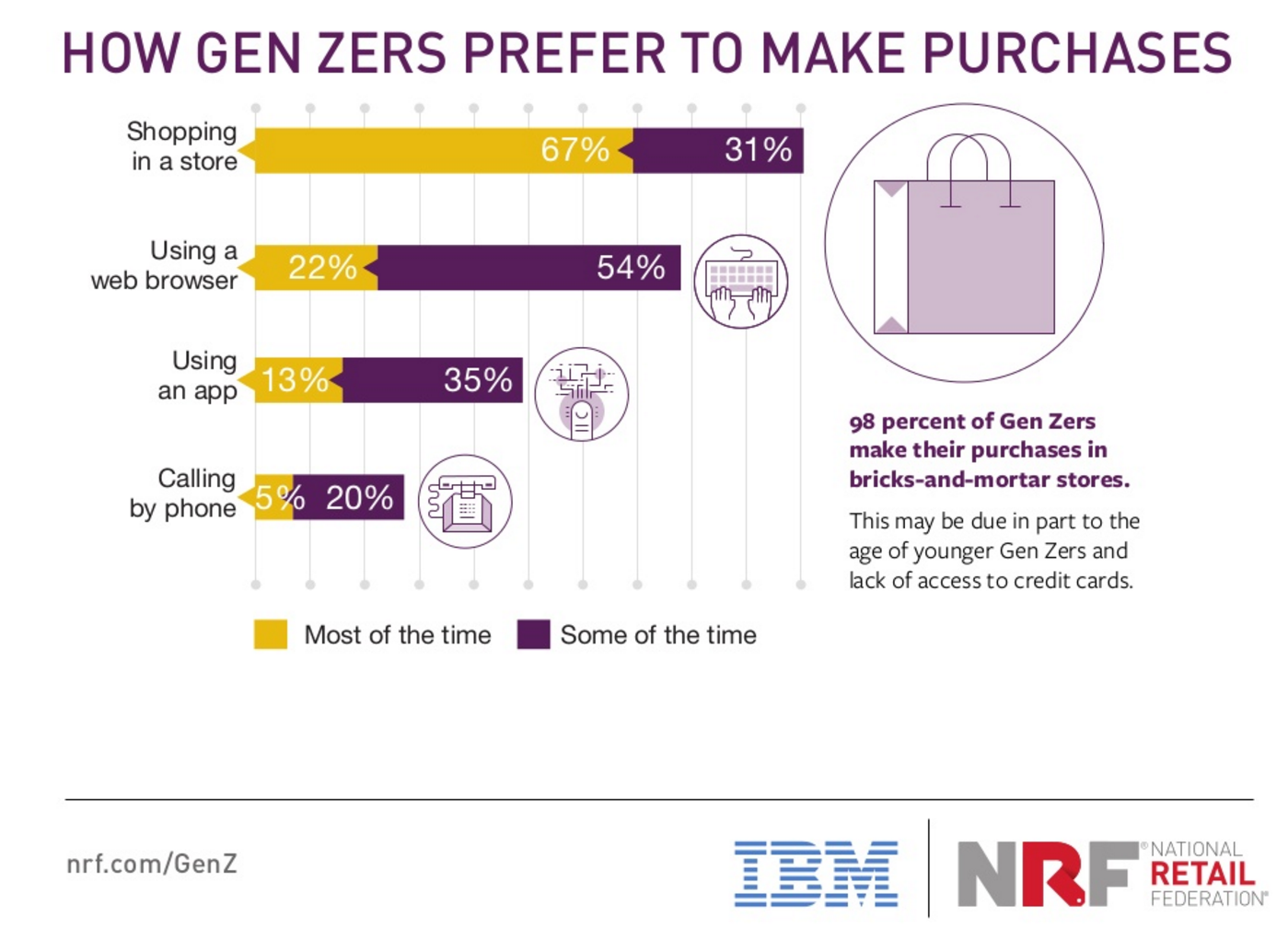

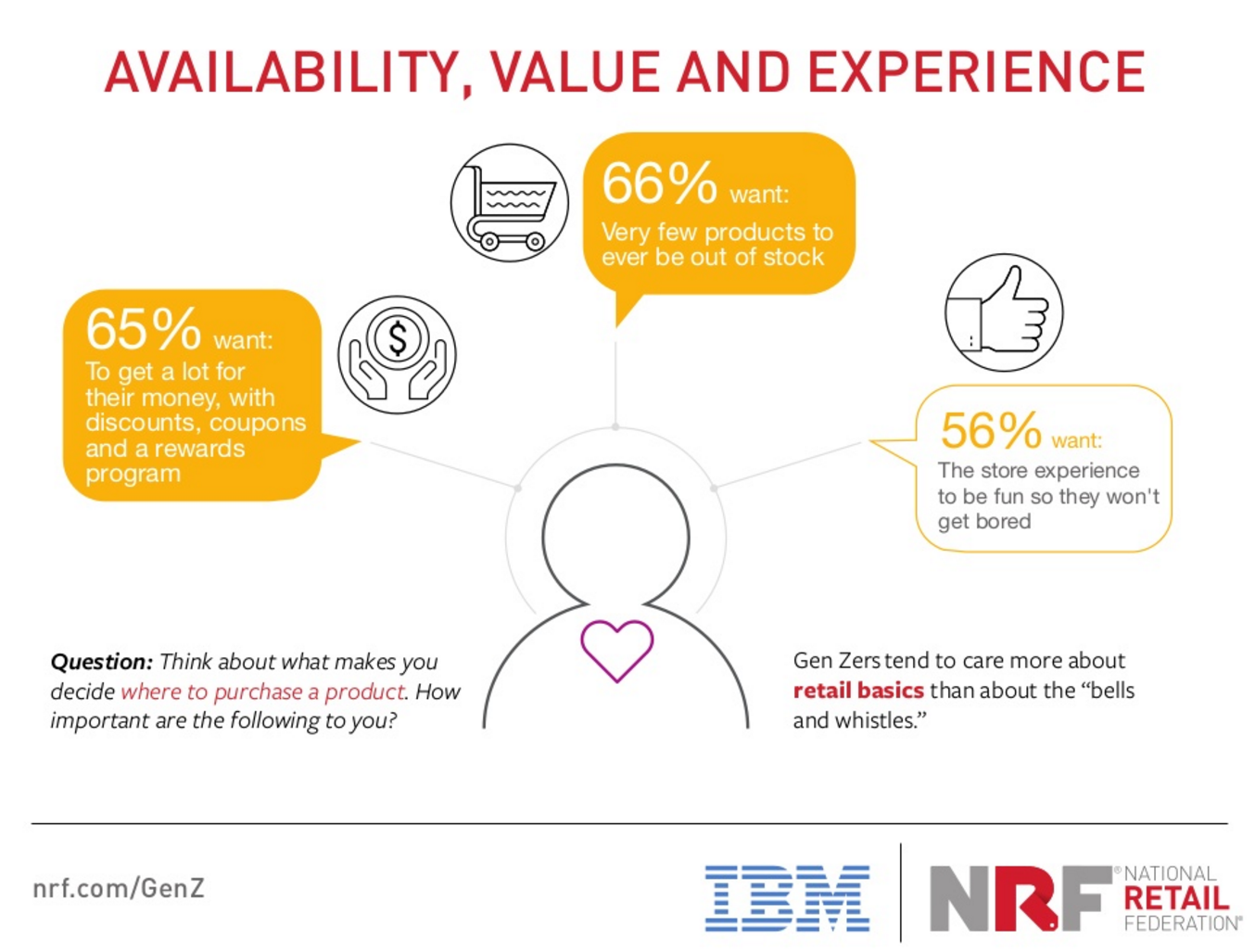

Is this generation the death of brick-and-mortar retail? This part surprised me: 98% make their purchases in bricks-and-mortar stores. Although now that I think about it some more, my 6 year old loves going to her favorite stores. However, they dominantly do their research online first, look for deals, expect products to be in stock, and that the store experience is fun. So no pressure, retailers; just be cheap, have all the right things in stock, and be fun.

If that sounds a bit, well, high maintenance... the generation has a dose of practicality also. Another study is finding that Gen Z'ers may be a "Throwback Generation" in terms of relationship with money. In quotes & italics below are several of the study highlights.

- "Gen Z is working— and earlier than you might expect"

- "77% of Gen Z currently earns their own spending money through freelance work, a part time job, or earned allowance. This is a powerful finding because we discovered that the percentage of Gen Z members who are earning and spending money is about the same as the Millennials we surveyed, who are ten years older!"

- "Millions of members of Gen Z plan to work during college." Despite being in school still.

- "Gen Z is already thinking about retirement"

- "In the national study, a surprising 12% of Gen Z is already saving for retirement. That is a much bigger number than one might anticipate given the youth of Gen Z in the study."

- "Gen Z and debt: 1 in 5 say it should be avoided at all costs."

- "Gen Z is already thinking about debt. In fact, 29% of Gen Z believes that personal debt should be reserved for a few select items and 23% believe personal debt should be avoided at all costs."

- "Parents are the source of Gen Z’s financial education."

- "56% of Gen Z have discussed saving money with their parents in the past six months and 53% have discussed earning money with their parents. Unlike previous generations of parents who did not talk about money or financial topics with their kids, Gen Z’s parents have taken a very different approach. The fact that so many members of Gen Z are talking about money with their parents may represent a real shift in parenting perspective from the Baby Boomers to Gen X. It may also reflect the frustration or lack of preparation that Gen X (and even Millennials) felt when it came to personal finance and their own emergence into adulthood. Talking about personal finance is one of the best ways that parents can help their children to make better money decisions, and it appears that Gen X parents are heeding this advice with their Gen Z kids."

- Also, a 2016 report from the Annie E. Casey Foundation found additional differences between Millennials and Generation Z: Teen birth rates fell, drop in drug and alcohol use, and more teens graduating High School on time.

In short, the kids are thinking about money and this generation is increasingly open to talking about financial topics. They are actively looking to their parents as financial role modeling and to discuss finances. This is where we can help! We often meet with the kids or grandkids of our clients to have introductory conversations about money, careers, education, etc. Many of these "kids" are now out of college and thriving in their young careers! This is just part of what we do. There is no pressure and no agenda other than answering their questions and giving them a resource in addition to Mom & Dad. If you would like Paul, Forrest, or I to meet with a youth in your family, just let us know!

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.