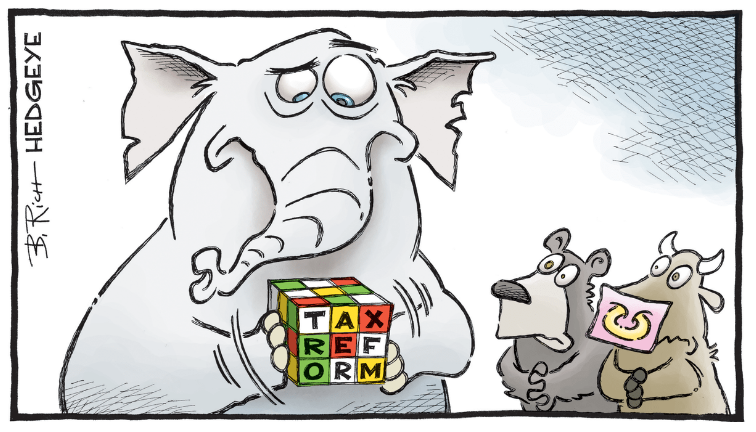

Risk Happens & Tax Reform Rubik's Cube

Submitted by DeDora Capital on December 15th, 2017

by Will Becker, AWMA/AIF

Happy Holidays!

This is a quick update as we head into the Holiday season. This will be the last update of the year, barring something really weird happening in the markets between now and 12/31/17... so see you in January 2018!

As I am writing this, wildfires are back and consuming hundreds of thousands of acres in the Los Angeles, San Diego, Ventura, and Santa Barbara areas of Southern California. Here are before and after photos of one Southern California fire that are eerily similar to the neighborhood that burned in Santa Rosa in October. And if you haven't already, please check out this video footage from along the 405 freeway in Los Angeles. Southern California hasn't had rain in 250 days, hence the flammable conditions so late in the year.

Why do I keep talking about the weather, reservoirs, and fires in an update for Investors? 2017 reminds us that Risk Happens. It might not be the S&P 500, which is up +19% as I write this. It might be Hurricanes, of which 2017 was the costliest season on record. Or it might be the year where California experienced 5 of the Top 20 most destructive wildfires according to CalFire. As a Fiduciaries, we have the clarity that it all matters when it comes to your financial wellbeing. If a hurricane floods your land, that matters. If your home burned down and you are trying to figure out whether to rebuild or move, that matters. If you have a vineyard and the well goes dry, that matters. If there is a bad health diagnosis, that matters... whatever the event is, please lean on us to help sort out what it means for your financial wellbeing.

On a lighter note, we enjoy doing pro-bono financial education for local groups. Last week our very own Dr. Forrest Hill, CFP met with students at the Culinary Institute of America (CIA) to field their financial questions. They had a lot of questions about student loans, retirement accounts, building good credit, and how to prepare for one day opening up & running their own restaurants. What a great group! Earlier this year I spoke to the local Boys & Girls Club staff at their annual training also. If it would be helpful to have one of us speak to a group at your company, nonprofit, or school, let me know!

Heading into the last two weeks of the year, we are keeping our eyes on the markets as they keep going up. Prices are getting a bit ahead of earnings, which is indicative of the later stages of a business cycle and it gets us on edge for a short-term pullback. Federal Reserve Chair Janet Yellen raised interest rates by .25%, citing strong labor market and better than expected economic growth - both good things. Inflation is still low, unless you are looking at health or education costs... but more on those another time. Congress continues to hammer out the details of a tax plan that is most likely going to be voted on next week. A comparison between the House, Senate, and proposed Reconciliation bills here.

On behalf of all of us on the DeDora Capital team, Merry Christmas and Happy Hanukkah to all!

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.