Reverse Mortgages & World Markets

Submitted by DeDora Capital on June 30th, 2017

by Will Becker, AWMA/AIF

Planning Perspective

Thank you to folks that responded to the "I've Always Wondered" survey! This update addresses one of the questions. Please let me know if you would like more information on the topic below!

Client Question: What are the particular benefits / risks of a Reverse Mortgage and at what point in life does consideration make sense (if at all).

- What is it?

- A Reverse Mortgage (also sometimes called a Home Equity Conversion Mortgage or HECM) is a kind of home loan that converts your home equity into cash. The idea is that instead of paying a mortgage payment or being low on cash, the equity in the home is paid TO you monthly or in a lump sum.

- What are the Benefits/Risks and at what point might it make sense?

- A New York Times article points out that "for many Americans, their home equity is their life savings. For the average retiring American couple, home equity represents about two-thirds of their total net assets." So it is a fair point that this hefty part of the average retiree's personal balance sheet should be included in their Financial Plan.

- In terms of the Benefits, we have run many Reverse Mortgage analyses over the years and there is a pretty specific situation where a Reverse Mortgage might make sense. I'll use Jane Doe as an example. In this example, Jane owns her home outright or with a small mortgage, she has a strong desire to live in the home the rest of her life, there is not much money left in savings/investments, the house is worth a lot, and the kids are planning to sell the house after she passes away. As Jane's health declines and in-home care costs increase, Jane is running out of cash. In this situation, a Reverse Mortgage could fund in-home care during the last phase of Jane's life. After her passing, the home would be sold to pay off the Reverse Mortgage and then her beneficiaries get the rest of the home value in their inheritance.

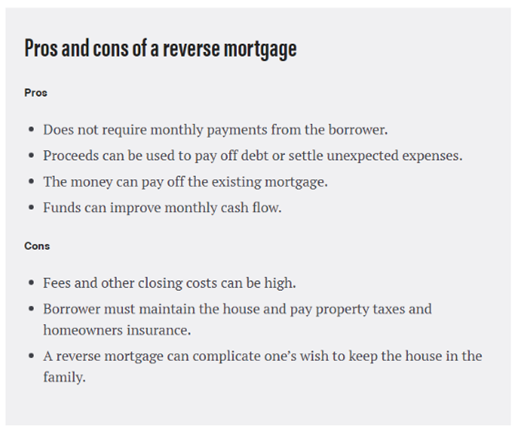

- But there are serious downsides, too! Reverse Mortgages are expensive, the house still has to be maintained, and if the heirs change their mind and try to keep the house in the family the "buy-back" might not actually be possible. Here are some questions to get started:

- Does your Financial Plan show that there is likely a need for increased income?

- Do you own your home outright?

- Do you plan to live the rest of your life in your home?

- Is there a strong desire to keep the home in the family for the next generation, or to sell it?

- What is the likely hood that in-home care costs will exceed the Reverse Mortgage value and your home will have to be sold earlier than expected?

- Can you keep up with the home maintenance work and costs?

If you are considering a Reverse Mortgage, let us know! We can run scome scenarios in your Financial Plan, review the Reverse Mortgage documents, and identify the best way forward. There are usually alternatives, though, so even if the description above sounds appealing we would want to review some alternatives. As with many financial products, the details vary with every policy. If you are curious to read more about Reverse Mortgages, here are a few articles: Housing & Urban Development (HUD) program, Bankrate, The New York Times, and then a lively response to the New York Times article.

Also, a quick review of the benefits and risks are outlined pretty well in this article (image below).

Investment Perspective

This month a new survey came out showing that "49% of Americans are currently living paycheck to paycheck" and "68% say their investment strategy does not account for a recession." The sample size of the report was frustratingly small, but overall the report showed a familiar theme:"most Americans are not prepared for the next recession. And, our data suggests many Americans are still struggling from the effects of the Great Recession." This lines up with many of the statistics we see: overall, the economy is improving but way too many people were left behind economically... and for too many Americans it feels like their personal finances are still in the Great Recession.

But it is the second statistic that I want to focus on in this Investment Perspective section: "68% say their investment strategy does not account for a recession." Even worse, 74% of women said their investment strategy did not account for a recession. No! The good news is that YOU [Clients!] are part of the 32% overall (or 26% of Female respondents) whose investment strategy DOES account for a recession. Our client accounts are stress tested against the Financial Crisis, the Great Recession, Interest Rate spikes, etc. Plus - and this is potentially just as important - your Financial Plans are also stress tested through the Great Recession AND Great Depression. If you are concerned about your allocation or want to see some of the stress test details, just let us know. In the meantime, if the phone rings and a surveyor asks if your investment strategy accounts for a recession, you can confidently say YES! Also, if you have a friend or loved one whose investment strategy does not account for a recession... you know who to refer them to. :)

Now a brief market commentary before closing out.

The collision of politics and economics continues, with delays in health care leading to delays in tax reform. Without getting into a political discussion on the merits of the President's proposals, Mutual Fund behemoth PIMCO is reporting that "Investors should not hold their breath about seeing much to lift U.S. growth coming out of Congress in 2017 – or possibly even in 2018." Meanwhile, Bank stocks had a solid month as Federal Reserve Bank Stress Test results were strong. Tech and Consumer goods gave up some ground, despite a report that Consumer Confidence is up in June. The Tech-heavy Nasdaq pulled back -.85% this month (as of Thursday when I am writing this), but is still well ahead of the S&P 500 and Dow Jones in 2017 (see Orange line in chart below)

Also, global markets are doing well this year. Vanguard's VEA International Developed and VWO Emerging Markets ETF's are well ahead of the S&P 500 and Dow Jones thus far in 2017. (Chart from www.Morningstar.com, my addition in Red.).

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.