Retirement isn’t what it used to be.

Submitted by DeDora Capital on October 8th, 2015

by Will Becker, AWMA/AIF

Happy Friday!

Investment Perspective

This week’s perspective is on something that affects virtually everyone we work with: how long to work, and what retirement will look like. Specifically, what are the employment trends for those +65 years old?

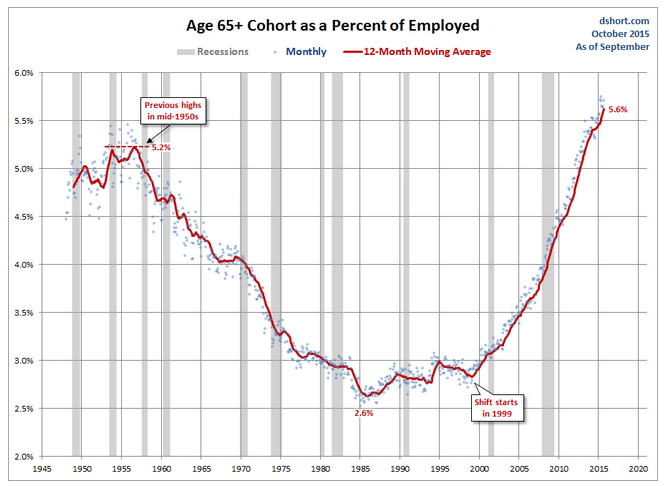

Paul and I are still reeling from the loss of the late, great, Yogi Berra, so this observation is made in his honor: Retirement doesn’t work the way it used to. A recent article in the Atlantic spells this out with the clear title, “Retirement isn’t what it used to be.” Conventional wisdom regarding retirement used to be based on the economics of Pensions + Social Security = reasonable standard of retirement living. Basically, work for a company for your career then retired between ages 50 - 60 with a pension & social security. By then, the house was paid for and the kids were grown. The Pension + Social Security system grew in strength from 1955 – 1985, resulting in the percent of +65 in the workforce dropping in half (to 2.6%) as folks were retiring in droves and STAYING retired. This became the conventional wisdom, and it was true for nearly thirty years! It is still the case for a number of our clients, especially those in public sector professions.

The more recent thirty years is the opposite. Today, 5% of the employed workforce is over age 65 – double the rate from the mid 1980’s. Notably, this dramatic increase began before the last two recessions. So this is a long term trend that is crossing over multiple business cycles.

Economist Doug Short describes the long term trend as having “multiple root causes, most notably longer lifespans, the decline in private sector pensions and frequent cases of insufficient financial planning. Another major factor is the often surprising discovery by many of the elderly that, financial consideration aside, the "golden years of retirement" are less personally satisfying than productive employment.”

The last part may or may not be consistent with your view on retirement, but it is consistent with many of the conversations that we have had with folks. For example, we have worked with several Senior Executives that truly enjoy their professions and gladly continue working for a few more years, in other cases folks are earning for a couple more years in order to fund a specific planning goal. Still more common, we are seeing folks retire - but then begin part time work or take on a regular volunteering schedule. I recently asked an Uber driver about his day job, “Oh, I’m retired!” he said happily. “I do this driving for a little extra vacation money.” Check out the chart below.

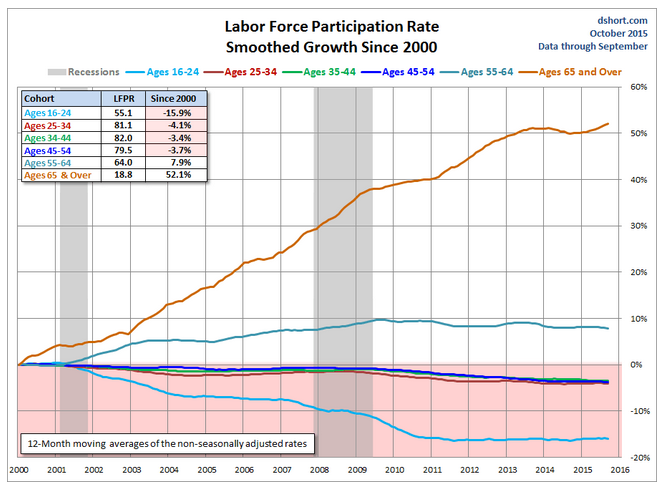

While the increase in employment among the +65 age group is clearly a major trend, check out the noticeable decline in employment among the 16-24 age group. Much of this is due to more years in higher education, though I am not sure that having so many able bodied youngsters out of the workforce is such a good thing.

As planners, we regularly tackle the question of when and how to claim Social Security to either maximize the amount of estimated benefits or to help protect a hard earned nest egg from spend-down. While not the cornerstone of the retirement picture that it used to be, Social Security is still a very important component of a thorough financial plan. A recent Nationwide Retirement Institute study found that, "83 percent of recent retirees started taking their benefits before their full retirement age, receiving 49 percent less in benefits than if they would have waited." Also, the study found that clients that work with financial advisors receive an average of 24% higher monthly benefit than their peers without qualified advisors. Many variables are considered when determining the best individual Social Security claiming strategy, but one thing is clear: Americans are leaving a lot of money on the table. When you are ready to explore this question, we are here to provide insight and guidance.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.