The Recession word, and being Greedy/Fearful

Submitted by DeDora Capital on February 12th, 2016

by Will Becker, AWMA/AIF

Now… what is going on with markets this year? Just when things were starting to *kind-of* look better a week ago, this week started with a thud. Ted Pick from Morgan Stanley says there are three reasons for the market drama: "One is China and its adolescence, two is the relentless decline of crude and its impact on the credit complex and sovereigns. And then three is the Fed."

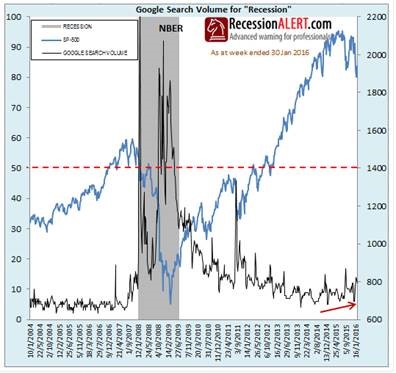

TV pundits are playing a bit fast and loose with the “Recession” word again, and people are starting to search that word more on google (chart below). Headwinds are picking up; we are particularly concerned about Freight Shipment, Inventories, and Credit Spread indicators. For the most part, though, the indicators that suggest recession are highly influenced by the decline in the price of oil. If you are filling up the gas tank, low oil prices are a pretty friendly these days.

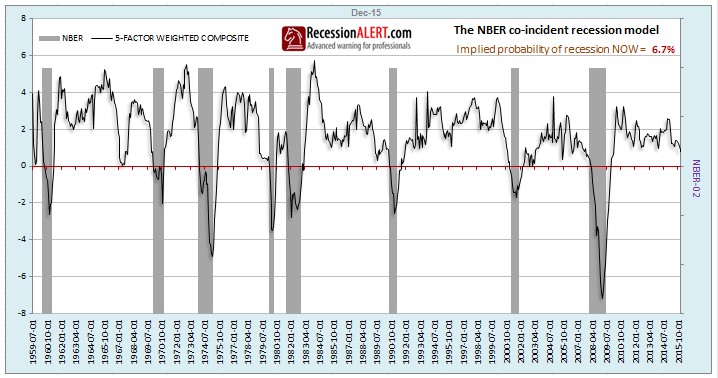

Are we in a Recession now? The National Bureau for Economic Research (NBER) has a set of four indicators that they use to make the official call on Recessions in the US. Currently, these indicators show a 6.7% probability that we are currently in a recession. Note the word “currently.” Some folks are beginning to wonder if we are entering a Bear Market (20% decline) without a Recession. That idea is based on oil bankruptcies truncating a cyclical Bull Market that started in 2013. There is actually some precedent for this in the 1980’s.

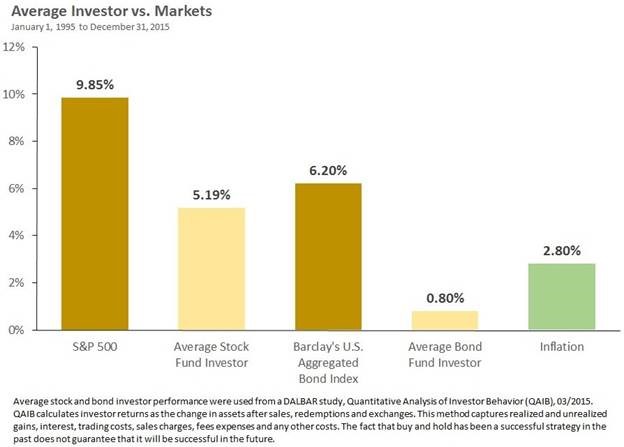

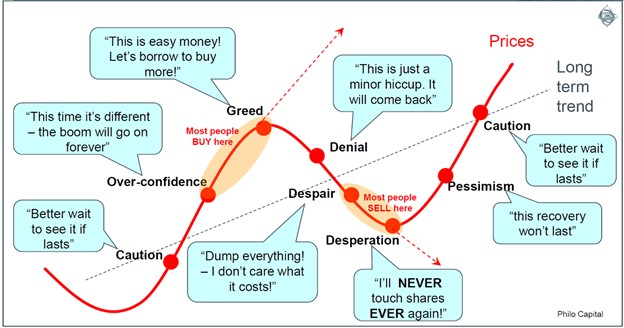

Here’s the thing: humans are notoriously bad investors. According to Dalbar (chart below), for the past 20 years the average Stock Fund investor earned 5.2% annually while the S&P 500 earned 9.85%. Our natural instincts to dive for cover when the Mastadon charge us is pretty good for surviving on the open range, but it turns out it doesn’t work so well with investing. Unfortunately, people are all-too-tempted to sell when the going is rough and buy after the growth happened, as the chart below from Philo Capital shows. This is why we use broadly diversified portfolios that are stress-tested ahead of time, and based on clients personal tolerance for risk and financial plans.

Famed investor Warren Buffett said “You want to be greedy when others are fearful. You want to be fearful when others are greedy. It's that simple.” He also said "The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd." This does not mean that we won’t make changes to your portfolios as market conditions change. As managers our job is to try and anticipate where there are investment opportunities that will benefit our clients in the long-term. Our job is to make these decisions based on economic and financial analysis, so that we can help our clients meet their financial life goals.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.