Rain, Reservoirs, Should We Sell And Go To Cash?

Submitted by DeDora Capital on February 10th, 2017

by Will Becker, AWMA/AIF

Happy Rainy Friday!

Rain Rain Rain! So much rain that one local High School canceled classes this week. Why do I keep talking about the rain? In addition to being the world’s sixth largest economy and fifth largest supplier of food and agricultural commodities, California produces almost all of the almonds, artichokes, lemons, pistachios, and processed tomatoes grown in the United States. I like food, especially Pistachios. So I get concerned when my Pistachio supply is threatened! But affection for my beloved home state aside, anything that would jeopardize the tremendous agricultural production of the fifth largest global food supplier is something we need to keep an eye on.

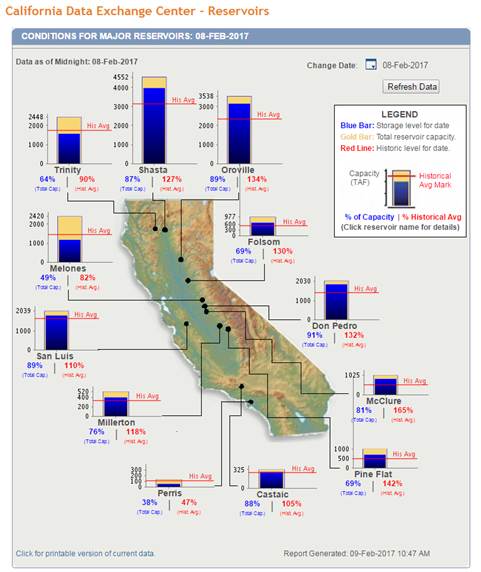

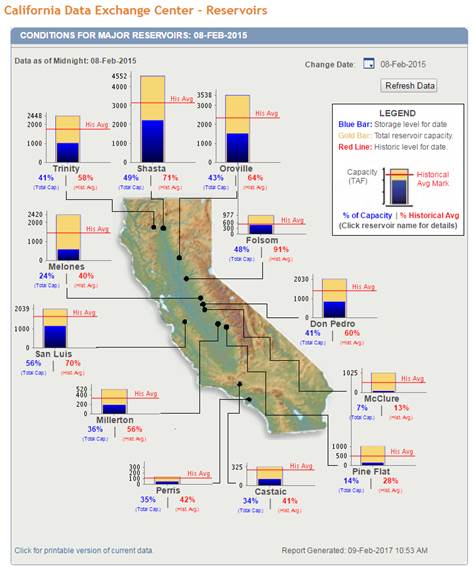

So there is good news on the drought front. As of this week, 9 out of California’s largest 12 reservoirs are ahead of their Historical average for the date. The chart on the left is from this Wednesday, the chart on the right is from two years ago when NONE of the major reservoirs were on track.

Investment Perspective

“Should we sell and go to cash?” This is the question-of-the-day, so let me dive into it. If you want to spare the explanation below, then here is the answer: not yet, but we are on heightened alert.

First of all, we hear you on anxiety about the new President and his administration. As of today, President Trump has signed eight Executive Orders and nominated a slew of Cabinet positions. One nomination was controversial enough that the Vice President Pence became the first Vice President to cast a decisive vote on a Cabinet nominee. Looking back at the history of Executive Orders, Presidents Reagan, Clinton, Bush I, Bush II, and Obama issued a range of 34 - 47 Executive Orders per year. So if President Trump is in line with the averages – and this president conforming to averages seems like a tenuous assumption at best – then we should anticipate many more Executive Orders. Here is my point: this is an uneasy time. The country has a new President, new cabinet, and a bunch of new Executive Orders that folks are still trying to sort out.

For us, the question is how the new President and Administration will affect economic policy, and how that policy will affect the markets. Some examples: Will a tax holiday on repatriated overseas cash stimulate the economy? Will lower corporate tax rates boost earnings? Will interest rates stay low, keeping borrowing costs at historically low levels? Will policy changes result in social unrest that spills into selling pressure? Clearly, there are more extreme possibilities and we are on the lookout for them as well.

From a purely Investment perspective, we have to consider all those and more – in addition to the regular economic indicators that we monitor. But where this becomes more important is how any of these potential outcomes affects each client’s plan. It is times like these that our role in clients’ lives and with financial plans can be most valuable!

Given all of that background, something changed since January 1st. From Election Day through December 31st, Latin America (ILF) and Gold (GLD) sank 12% and 9%, respectively, while the S&P 500 (SPY) soared +4%. But this year, Latin America and Gold are ahead of Europe (IEV), China (ASHR), Japan (EWJ), Australia (EWA), Canada (EWC). For all the talk of the US economy outpacing the rest of the world, all of those regions except Europe are actually ahead of the S&P 500 (SPY) this year to date. (charts from www.morningstar.com, I added the red circles). And yes, gold going up this year is concerning.

Last year was the worst start to the year in… well… history. The Dow Jones was in pullback, and the topic-of-the-day was how to address the pullback that did happen. This year the topic is how to handle the pullback that hasn’t happened yet – but should. At the moment - and I take great effort to highlight just how quickly this could change – we are mostly invested. In most accounts we kept elevated cash going into the election and we have continued to do so. Staying mostly invested paid off through the end of the year, and it has paid off thus far in 2017. Focusing on IRA’s, in the past two weeks in many accounts we have been taking profits and maintaining elevated cash or adding to mostly fixed income positions. We are very careful about the tax consequences of taking profits in taxable accounts.

Markets have a long history of acting oddly. Influential economist John Maynard Keynes (1883 – 1946) wrote that “markets can remain irrational longer than you can remain solvent.” Back February 12th, 2016 I wrote that:

“humans are notoriously bad investors. … Our natural instincts to dive for cover when the Mastadon charge us is pretty good for surviving on the open range, but it turns out it doesn’t work so well with investing. Unfortunately, people are all-too-tempted to sell when the going is rough and buy after the growth happened.”

In this case, the question is whether the economic going will get as rough as it should or whether it will continue to plow forward. I’ll close out with two more cartoons because sometimes a picture can explain better than words. The markets going up can seem like this holiday lights cartoon (left)- what could go wrong? (a lot!) Meanwhile, remember that markets are made by people and people routinely make irrational decisions.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.