Philly Fed says...

Submitted by DeDora Capital on July 16th, 2015

by Will Becker, AWMA/AIF

Happy Friday!

The Markets

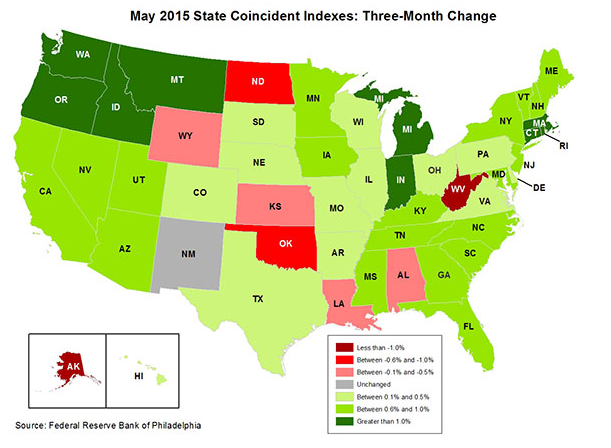

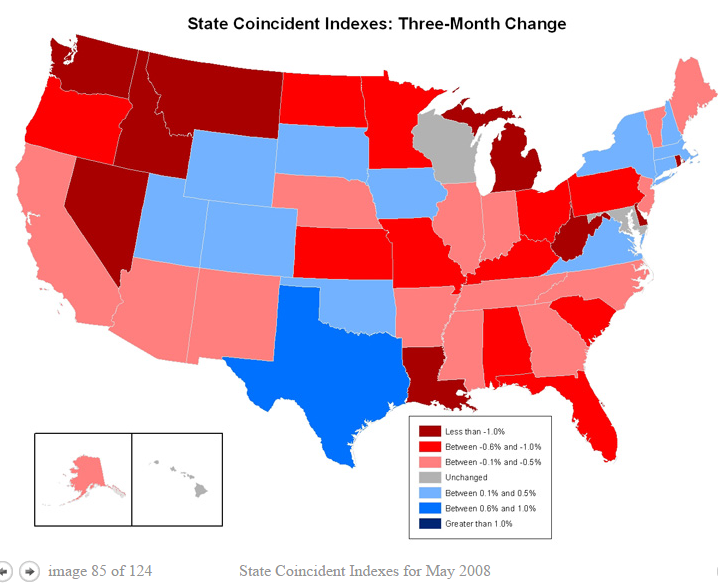

Global markets bounced back this week, following a bailout deal for Greece and calming in the Chinese markets. This week’s economic perspective (chart images below) is courtesy of the Federal Reserve of Philadelphia. The Philly Fed runs a monthly “coincident index” for each of the states, focusing on employment, hours worked, unemployment, and wages/salaries. North Dakota, Oklahoma, and Wyoming have been particularly affected by the decline in oil prices earlier this year, and are showing up red or pink on the chart. West Virginia’s coal country continues to struggle economically. The coasts are generally growing strongly, with the Pacific Northwest and Great Lakes regions leading the way. The chart below also echoes a particularly welcome trend: manufacturing returning to the U.S.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.