Partsian Conflict Index & World Markets

Submitted by DeDora Capital on July 28th, 2017

by Will Becker, AWMA/AIF

Happy Friday!

Investment Perspective

This week's update includes a review of Markets, and the impact of Political Conflict on markets.

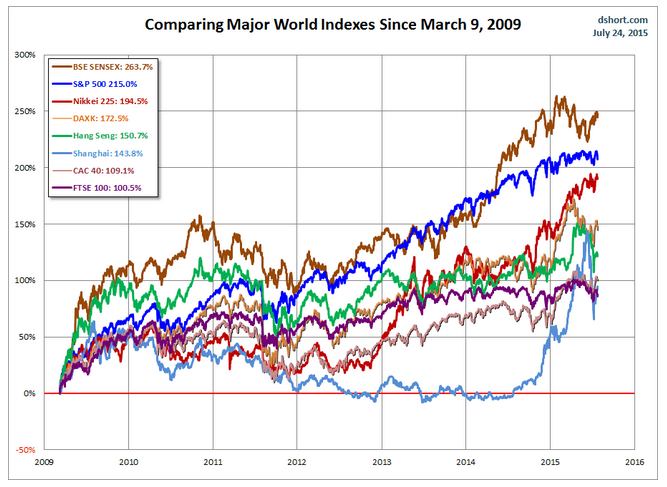

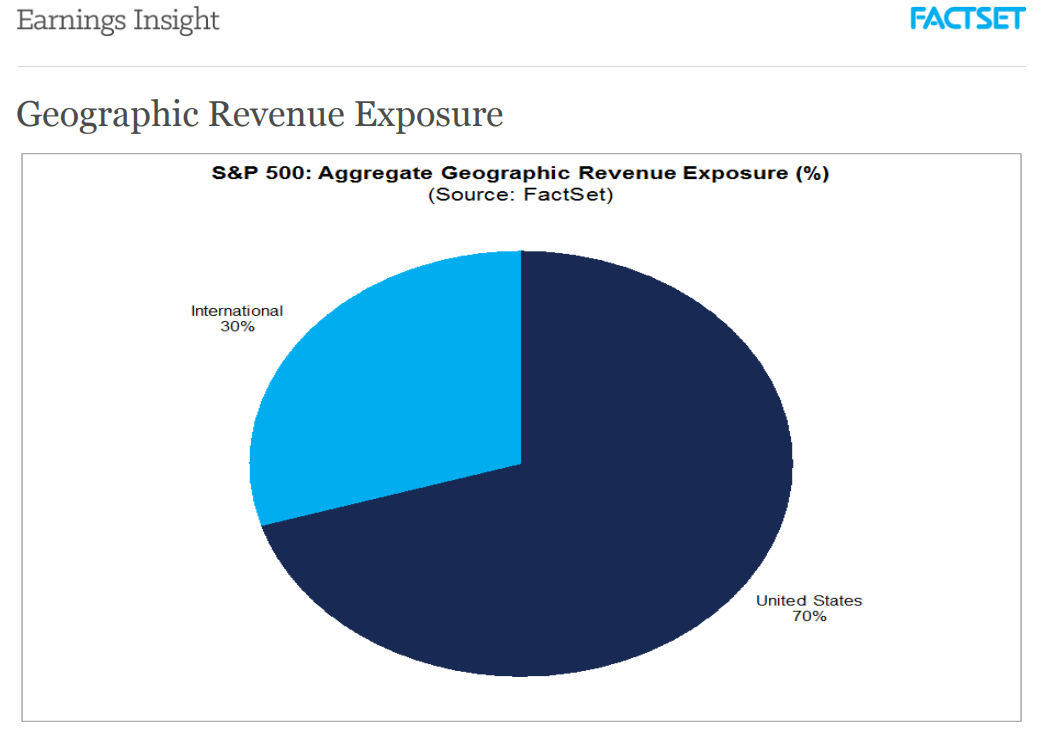

World markets continue to perform well this year, with broad gains led by Hong Kong (Hang Seng +22%) and India (BSE SENSEX +21%). International positions are in many client accounts through investments such as VEA (Vanguard Developed Markets), VWO (Vanguard Emerging Markets), First Eagle Overseas (SGOIX), and American Funds New World Fund (NFFFX). By the way, folks might be surprised to find out just how much global markets impact companies in the US: FactSet reports that 30% of the S&P 500 revenue is derived from outside the United States. FactSet goes on to break it down by Sector, and over half of the Revenue for Information Technology companies comes from other countries. So even the S&P 500 benefits from foreign markets doing well.

One cartoon addressed the up-up-and-away behavior of markets this year.

Does this mean the Stock Market is expensive?

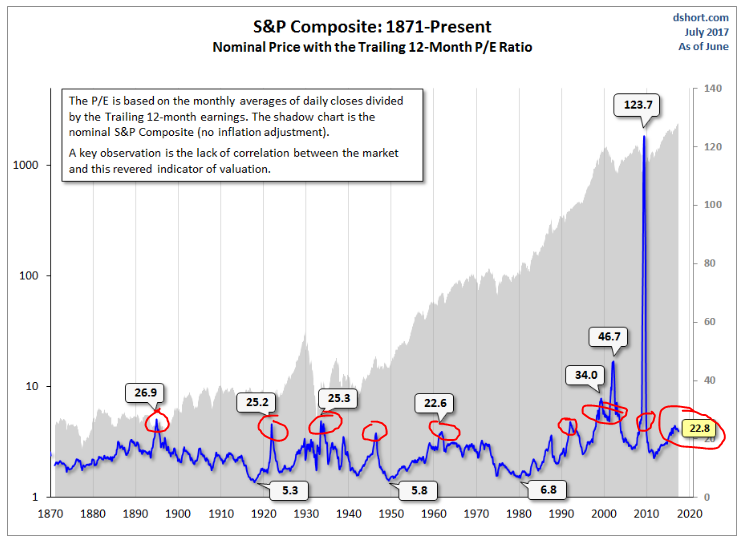

"Expensive" is more than price; it is the relationship between price and value. For example, is a $500,000 investment property a good value or not? If it would rent for $4,000 per month, that would make it seem like a much better deal than if it only rented for $1,000 per month. The same goes for companies and markets. As the chart below shows, the PRICE of the S&P 500 has gone up tremendously over many decades. While the Price to Earnings Ratio (blue line in chart below showing Trailing 12 month P/E Ratio) bounces around somewhat, it is typically between 5 and 25. This is because EARNINGS have also grown! So have Sales: FactSet reports that this is "the highest percentage of companies reporting sales above estimates for a quarter since FactSet began tracking the data in Q3 2008."

To answer the question about whether the market is expensive... the market is currently on the expensive side. And as long as Earnings keep coming in strong, price increases can continue to be justified. As Liz Ann Sonders from Schwab said recently, "My quick down-and-dirty on valuations is that they are elevated; but in the context of low inflation, still-low interest rates, and ample liquidity, the stock market can support them."

I will close out with a perspective on Partisan Conflict.

There is a common perception that Partisan Conflict causes Market turmoil; or at least these two things are correlated. Having said that, both the Investment Markets and the Partisan Conflict Index are near alltime highs. In fact, a New York Times article on Partisan Conflict reported that "conflict doesn’t just seem to have become more intense this year: It has actually reached new levels of nastiness." How do we end up in a situation where Partisan Conflict AND the markets go up together? "Gridlock is Good" is the leading theory at the moment. Basically, the idea is that lack of action in Washington DC isn't that bad for markets. For example, it turns out that the S&P has higher historical performance when the Partisan Conflict Index is also high (see table below). As the New York Times summed it up regarding the high Partisan Conflict Index levels, "the stock market simply doesn’t care. In fact, the rising acrimony has been a fine environment for stocks." We are not taking that for granted, though. We view complacency as one of the largest investment risks at the moment!

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.