Opening Thud

Submitted by DeDora Capital on January 15th, 2016

by Will Becker, AWMA/AIF

Happy 2016!

The movie The Big Short opened in Theatres over the holidays, and I encourage you to check it out. We are big fans of Michael Lewis’s books (Go Billy Beane & Oakland A’s!), and Mr. Lewis’s Book/Movie review of the economic collapse of 2008 is entertaining, disheartening, amusing, and enlightening. If it is any indication of how much I was looking forward to seeing The Big Short, I saw it before Star Wars. The Star Wars movie, for its part, is the first movie to take only 12 days to reach $1 Billion in sales. Just for a little reference, that’s the annual Gross Domestic Product of ten different countries… in one weekend. So yeah, kind of a big deal.

The Dow Jones gained +225 points Thursday, and if the year started Yesterday we would be off to a great start. It didn’t, so I’ll get back to 2016 at the end. But first a roundup of last year.

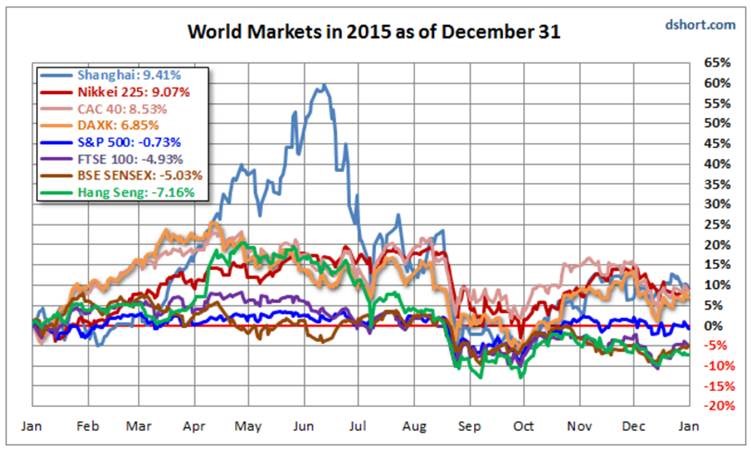

In 2015, global stock market returns were led by China. I can’t believe I just said that. The media like to jump on China’s epic decline from June-September, but remember that was after a +60% run-up the first half of the year. Check out the Light Blue line in the chart below. If it makes you feel any better, China’s gains were short-lived; the Shanghai market gave up all those gains by January 8th 2016. There is so much to say about China’s economy, but let me leave you with one fact that helped me understand why the Chinese stock market is so unruly. It’s only 25 years old. By comparison, the Dow Jones Industrial Average was 25 years old in 1921. The 1920’s were not exactly a beacon of calm & sustainable markets in the USA. Otherwise, last year Japan, France, and Germany posted gains. The US was basically flat, UK down almost -5%, India down -5%, and Hong Kong down -7%. Emerging markets were down about -14% according to JP Morgan.

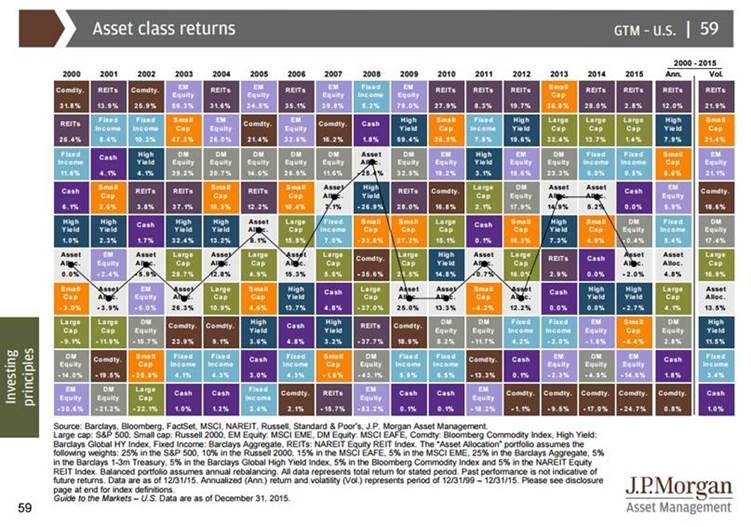

When we look at 2015 from the perspective of Asset Classes, it’s a year that nothing really worked in the markets. For the past fifteen years, at least one Asset Class went up +5%. But not last year. REITS (Real Estate Investment Trusts) were the leading Asset Class with a lowly +2.8 according to JP Morgan’s review below. In fact, even JP Morgan’s numbers show “Asset Allocation” pulling in -2% for the year.

2016 started with a thud. Why? Part of the decline is due to profit-taking of companies that outperformed last year – such as Facebook, Amazon, Netflix, and Google. In addition, it turns out that kind-of low oil prices are nice, but our global economy is oddly reliant on not-too-low oil prices. Finally, China is being a 25 year old and giving us headaches again. Here in the USA, unemployment is low, Gross Domestic Product is rising, and Economic Stress measures are ok. Not great, but ok. We keep coming back to earnings, and the big green area on this chart from www.fastgraphs.com shows continued earnings growth. Not as rapid as 2009 and 2010, but still growing.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.