The Ongoing Evolution of Socially Responsible Investing

Submitted by DeDora Capital on January 28th, 2016

by Forrest Hill, PhD, CFP®

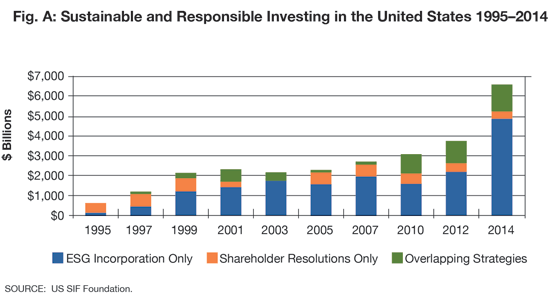

I have been involved with Socially Responsible Investing (SRI) for over a decade now and have seen it go through a phase change in recent years. Back in 1995, Socially Responsible Investing was about a half a trillion-dollar industry. For reference, that is about the Gross Domestic Product of Vietnam. By 2014, Socially Responsible Investing has grown to over $6 Trillion, the size of the Gross Domestic Products of Canada and Brazil, combined. This data is provided by the US Social Investment Foundation, itself an example of the maturing Socially Responsible investment industry.

For a long time, SRI meant just screening out certain securities from portfolios according to ethical considerations (e.g. no sin stocks!). Over the past five years, however, there has been an evolution in thinking. SRI managers are now investing with an eye toward advancing the greater good. Social considerations like gender equality, the environment and good corporate governance are becoming yardsticks to measure a company’s performance, alongside traditional financial metrics such as P/E ratios and sales growth.

Also embedded in the evolving Impact Investing landscape is the concept of a “Benefit Corporation,” a for-profit that is legally required to consider the social & environmental impacts of corporate decisions. This is one reason that DeDora Capital is a Certified B-Corp. We not only personally enjoy considering the broader social impacts upon our investments, we actually built it into the company legal structure.

We often refer to what we call the “honest debates” in the environmental investing community. These debates often have to do with carbon vs nuclear, overseas oil vs fracking, fossil-free vs low-fossil. What is “Socially Responsible” can mean different things to different people. These honest debates are helping to challenge the environmental investing community to consider major ethical dilemmas, and we are enthusiastic participants. In particular, Divestment of Fossil-Fuel companies has emerged as a leading SRI topic, and it is a screening criteria that we take very seriously.

Does Socially Responsible Investing help or hurt performance?

There is a belief among SRI managers that investing in sustainably operated companies may lead to outperformance in the long run. FactSet has some recent evidence to support this. Here is another example: consider Parnassus Investments’ Endeavor Fund, one of the mutual funds we hold in many SRI accounts. This fund invests in companies that are consistently identified as some of the “best places to work” in America. Its 10-year annualized total return (through Sept. 30) was 11.5%, compared to 6.8% for the S&P 500 over the same time period. It’s also one of Morningstar’s top-ranked fund in its category for that time frame. While the fund’s methodology also looks at positive environmental, social and governance (ESG) factors when picking stocks, it appears that happy workers can make for more successful companies.

Of course, not all SRI funds have this kind of track record. I recently found that of the 188 SRI Mutual Funds listed on Bloomberg, 102 (54%) of them were ranked in the top 50% of all mutual funds in terms of risk adjusted performance. While there are some very poor performing funds in this group, this result is slightly better than what you’d expect if SRI funds performed the same as convention funds (but not by much). So the jury is still out as to whether SRI improves performance, but it is a pretty big deal to be able to say that it does not necessarily detract.

Conclusion

It will be interesting to see how the debate over SRI shakes out in the coming years. There is certainly more and more interest in SRI, especially among the millennial generation. For example, one recent study found that 49% of high net worth millennials (greater than $1 million net worth) said that social responsibility is a factor for them in choosing an investment. This probably bodes well for the future performance of socially responsible companies. After all, in the end what makes a stock go up or down is supply and demand. If more people want to buy a stock then sell it (for whatever the reason), the price goes up. As the desire to buy stocks of responsible companies increases, we might expect a corresponding jump in their stock performance. That more than anything is likely to drive more assets into SRI.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.