Non-Typical Pause for Concern

Submitted by DeDora Capital on August 11th, 2016

by Will Becker, AWMA/AIF

While we don’t know her personally and claim any credit, it’s great to see former Santa Rosa, Ca. resident Maya DiRado put the North Bay on the Olympic Gold Medal stand already. Way to go Maya! Personally, I’m also rooting for the Refugee team to score a medal – check out this story.

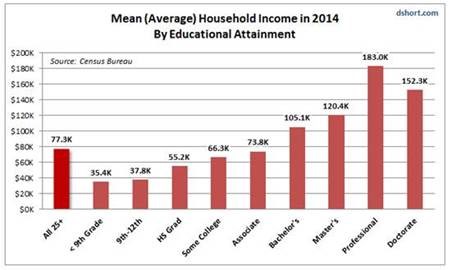

It’s back to school time - good luck to everyone with school age kids! While income and profession are only part of the reason to go to school – and I have a Masters Degree in Anthropology to prove it (really, ask me about the Bronze Age in Northern Mesopotamia!) – here’s a chart showing average income by Educational Attainment.

Investment Perspective

From our perspective, Risk is the likelihood that a client does not reach their financial goals. It turns out that our financial lives – and therefore determining the likelihood of achieving financial goals - are much more complicated than they used to be. For a good portion of last century, retirement was driven by Social Security, a Pension, and some bonds. Today, Social Security is a smaller portion of the overall retirement income stream, Pensions are few and far between, people may have a collection of 401k accounts from various employers over the years, bond yields hardly offer much income, and people are having to self-fund more and more of their retirement.

This brings up a whole host of questions. What should my 401k contributions be? Am I on track or not on track? Do I need a Trust? Am I saving enough for the kids/grandkids/nieces/nephews to go to college? How do I handle this big concentrated stock position in xyz company? How much income will my retirement accounts provide? So when CAN I retire? How can I be more tax efficient? How much can I donate to causes I care about? Does Socially Responsible Investing make sense for me? How does my small business fit into all this? That’s why there is even a specialized Board-level Certified Financial Planner (CFP) designation just to figure this stuff out. I am saying this because Paul (CFP), Forrest (CFP), and I are routinely teaming up to work with clients on these kinds of questions. I want to take a moment to thank you – our clients – for giving us the opportunity to provide clarity on these topics. Three cheers for our CFP’s Paul DeDora & Forrest Hill!

With that being said, we feel very strongly that our clients should know what is on our minds as far as Investment Risks. So I want to take a moment to review the Investment related risks that we are seeing today. Because, frankly, the Investment risks are kinda weird at the moment.

The Typical Investment Risks are actually ok. Not great, but ok.

- Interest Rate Risk – rising interest rates was supposed to be the tsunami hitting fixed income. But it turns out that the developed economies are basically in a whack-a-mole on interest rates… no one wants to go up. In fact, a “third of global government debt now has negative interest rates.” Those are mostly developed economies such as Switzerland, Germany, Japan, Sweden, etc. Emerging economies are in a much better position as far yields, and most of our portfolios reflect a “global search for yield”. While there could be an interest rate hike this year, it seems unlikely that rates will go up very far or very fast.

- Inflation Risk can eat away at what $1 can buy. But in the short run, the Federal Reserve has been trying really hard to get inflation to pick up! There is even some risk of Deflation, as I discussed in the June 17th update.

- Credit Risk and Liquidity Risk are addressed through our security selection and due diligence process.

- Market Risk and Economic Risk are about where they have been for a while now. The numbers are pretty good, though we have concerns about slowing earnings growth rate and global “structural deceleration”. Short term indicators are suggesting more volatility.

But Non-Typical Investment Risks give us pause for concern.

- Political Risk – this is the sixth Presidential Election of my voting life, and if there is one socially acceptable word to sum it up it’s probably “unpredictable.” We can see what is currently priced into the market, and will have to adapt as the election unfolds.

- Health Risk –

- In March, a Zika case was diagnosed in Napa, though the person had been infected in Central America. In July a Utah resident was the first Zika related death in the continental U.S, and again the infection was from another country. This month was the first Zika related Infant death in the U.S. was in Texas, again from an infection contracted in another country. As of August 5th, California has two cases of Zika-associated birth defects. As of Thursday of this week there are six local infections from Florida.

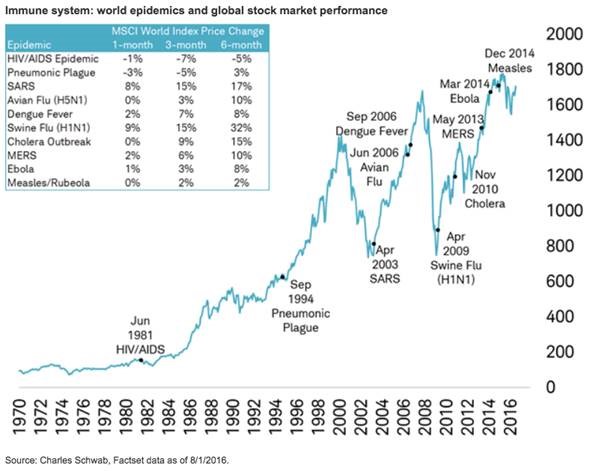

- To summarize: People are dying in the U.S., kids are being born with birth defects in the U.S., infections are starting in the US, and in about a week half a million people will return home from the Olympics hosted in a country that already has 30,000 Zika infections. Honestly, when I read that last part I had to get up and walk around the building a couple times. Speaking purely as a parent, the Zika virus situation scares me; this is too much like the preview to a dystopian Hollywood movie. But what are the investment implications of Zika? Jeffrey Kleintop from Schwab tried to put the economics of epidemics in context with his quote and chart below. The question as always: is this time different?

“History shows us that the impact on the economy and markets has not been significant—even when the global economy was especially vulnerable to a shock.” Here is a chart illustrating his point.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.