Neither Complacency Nor Panic

Submitted by DeDora Capital on March 10th, 2017

by Will Becker, AWMA/AIF

Happy Friday!

My daughter turned 6 this week… where did the time go!?!

Investment Perspective

St. Patrick’s day is almost upon us, so this week I have a perspective on that Shamrock holiday and some reflections from Mr. Warren Buffett of Berkshire Hathaway.

This month the folks at First Eagle Investment Management wrote that “In the eighth year of a bull market, some investors are complacent and think the market is destined to climb onward, and others are ready to sell in a panic at the first sign of a downturn. We think this is a time for neither complacency nor panic.” [my emphasis] If ever there was a quote to capture our general philosophy, it is “neither complacency nor panic!”

So with that in mind, here is a perspective from Warren Buffett’s most recent annual Berkshire Hathaway, Inc. Shareholder Letter.

“One word sums up our country’s achievements: miraculous. From a standing start 240 years ago – a span of time less than triple my days on earth – Americans have combined human ingenuity, a market system, a tide of talented and ambitious immigrants, and the rule of law to deliver abundance beyond any dreams of our forefathers. You need not be an economist to understand how well our system has worked. Just look around you. See the 75 million owner-occupied homes, the bountiful farmland, the 260 million vehicles, the hyper-productive factories, the great medical centers, the talent-filled universities, you name it…”

"Yes, the build-up of wealth will be interrupted for short periods from time to time. It will not, however, be stopped. During such scary periods, you should never forget two things: First, widespread fear is your friend as an investor, because it serves up bargain purchases. Second, personal fear is your enemy. It will also be unwarranted.” ~ Warren Buffett, 2.25.2017

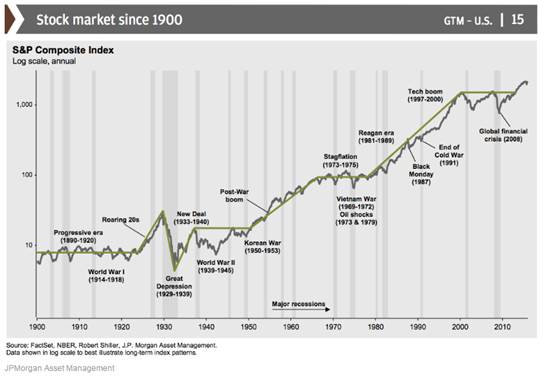

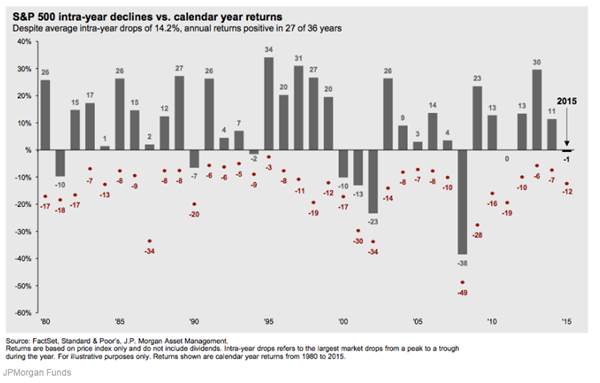

This general sentiment is also shown in two charts from JP Morgan. One shows the Stock Market since 1900… growing through all sorts of calamities. The other shows that each year usually has at least one large selloff. If this history is any indication the market will likely go up in the long run, while at the same time having large selloffs in any given year. Thus, neither complacency nor panic!

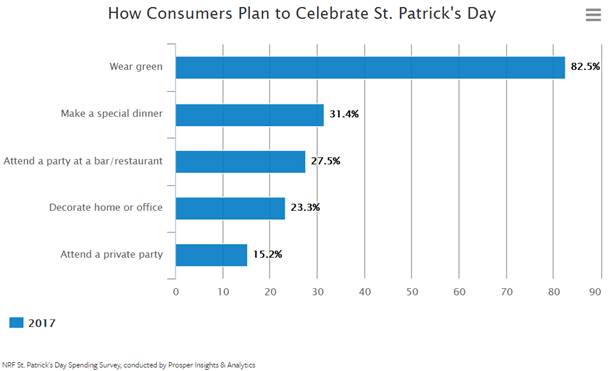

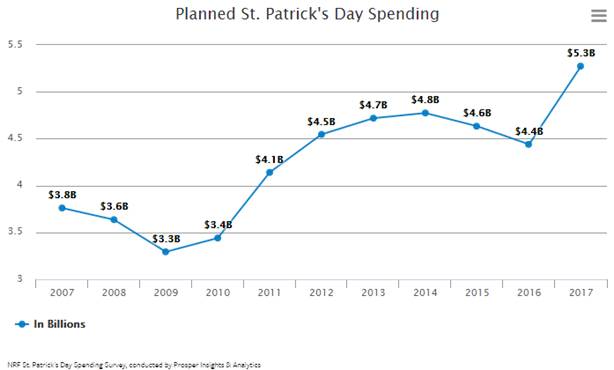

Now on to St. Patrick’s day. The amount of money that Americans spend on holidays never ceases to amaze me, and St. Patrick’s Day is no exception. This year Americans will spend $5.3 billion on St. Patrick’s Day, according to the National Retail Federation. That is more than the annual Gross Domestic Product (GDP) of Belize and Samoa, combined! That ends up being $37 per person, up from last year’s $35 per person. Of course 82% will wear Green, but in case you are looking for any other ideas… Special Dinner, Party at a Bar/Restaurant, decorating the home or office, and attending a private party all scored double digit popularity.

While it may seem like wearing green and getting drinks with friends is the thing to do on St. Patrick’s day… I want to point out one under-appreciated food: Cabbage. It turns out that 2.5 billion lbs of cabbage are produced for the day that everyone is Irish, with the majority from California. And that the week of St. Patrick’s Day holiday has 70% increase in cabbage shipments. So thank you California Farmers!

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.