Natural Disasters

Submitted by DeDora Capital on September 8th, 2017

by Will Becker, AWMA/AIF

Greetings,

I usually open up with "Happy Friday", but I'm just not feelin' it this week. As I am writing this, there is an unexpected light sprinkle of rain in Napa. It is a welcome reprieve from the recent +100 degree days. But on the topic of weather: imagine getting 140% of your annual rainfall in FOUR DAYS. That is what Hurricane Harvey brought to Texas, and the flooding aftermath was catastrophic both in loss of lives and the overall devastation for communities. (Note: Texas Avg Annual rainfall is 28 inches, +40 inches fell). This storm is so crazy that one guy caught a fish in his living room, locals performed evacuations by Jet Ski and Monster Truck, and hundreds of residents brought boats for evacuation. Now Florida is bracing for Hurricane Irma, "one of the strongest storms ever recorded in the Atlantic." There is also chilling footage from floods happening in South Asia.

What is the economic impact of storms of this magnitude?

I'll take a look from the overall economic perspective, then drill down to the family finances perspective.

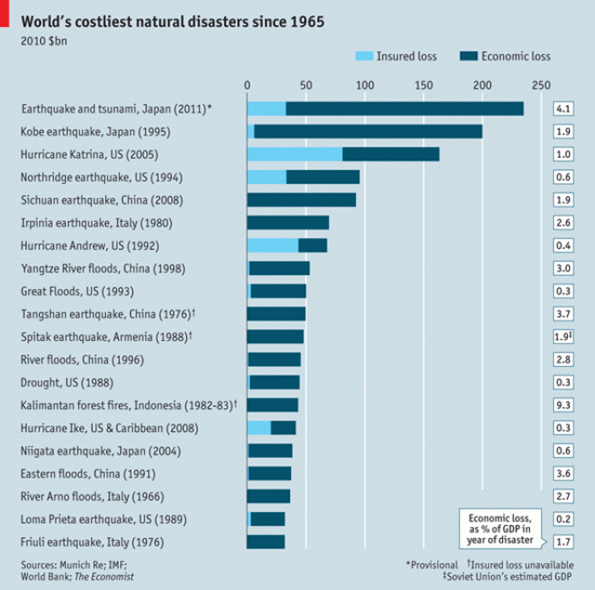

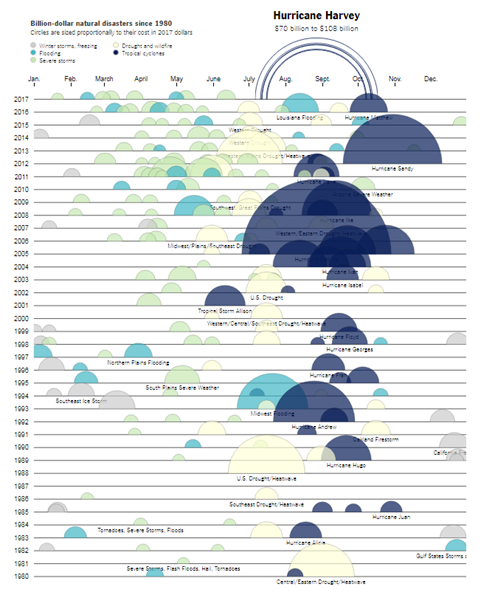

Early estimates put the Hurricane Harvey economic damage at $70-$108 billion. It is looking pretty likely to be the 2nd most expensive natural disaster in the US since the 1980's, second to Hurricane Katrina. AccuWeather estimates the costs will end up being as much as Hurricanes Katrina and Sandy combined. Globally since 1965, Hurricane Harvey may be in the top half dozen natural disasters in terms of economic loss. However, the national economic impact is mostly focused on gas/energy prices and restoration of the flow of goods through the ports, train stations, and airports. The rebuilding process can actually be somewhat stimulative both in consumption of materials as well as jobs associated with the rebuilding process. I would be very worried if a portfolio was 100% allocated to equities in the property and casualty insurance space where there is upwards of $20 Billion in insured damages due to Hurricane Harvey. Being broadly diversified provides a buffer from that degree of single-industry risk. Tobias Levkovich from Citigroup says that "without trying to diminish the devastating consequences of such weather, the stock market typically does not get roiled even when Sandy knocked out much of lower Manhattan in 2012."

More on the impact on family finances to follow.

Here are some examples of the destruction left by Hurricane Harvey:

- 500,000 totaled cars. GEICO insures about 10% of the Texas car market, and Warren Buffet estimated that they will see 50,000 claims, "most of them will be total losses." That is twice as many cars destroyed by Hurricane Sandy.

- 100,000 homes damaged or destroyed. Worse, much of the damange is uninsured. For example, 80% of homes are without flood insurance.

- 325,000 applications for FEMA assistance.

- Hurricane Harvey's impact on jobs was bad enough to throw the unemployment numbers.

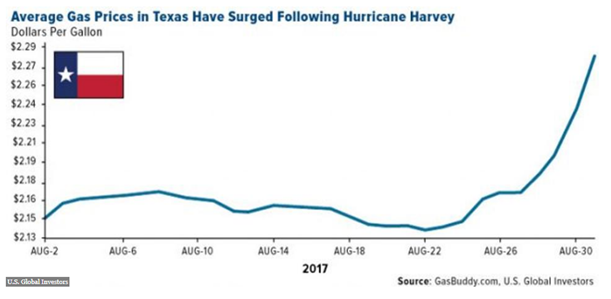

- "As much as 31 percent of total U.S. refining capacity has either been taken offline or reduced dramatically because of Harvey." As a result, gas prices are up.

How is Hurricane Harvey impacting family economics and small businesses?

Badly. Very badly. "If you go up and down the list of impacted businesses in any storm, the bulk of them will be private or mom-and-pop. Some rebuild and bounce back; some stay boarded up for years. Their closures and costs are a huge deal to those directly impacted." For example, around 80,000 homes are damaged and don't have flood insurance (basedon 100k homes damaged, 80% uninsured rate). That is a lot of people having to either walk away from the house or pay for the repairs out of pocket. But wait, it gets worse! What if their small business also suffered catastrophic losses? What if they are out of a job because of the storm? What if they still have a mortgage to pay off? This is so bad that even "Wells Fargo, the nation's largest mortgage lender, said Monday that it was suspending all negative reporting to credit bureaus, collection calls and foreclosure procedures against customers in the impacted communities at least through the end of September." I'll say it again - Even WELLS FARGO gets it.

A bright spot compared to other disaster is that one analyst is expecting a faster recovery due to a solid local economy, ample cash reserves in local governments, and flowing Federal Aid. Nonetheless, it will be a long road ahead for those impacted; whether personally or financially.

In other economic news, Manufacturing is up while Inventories are down (good combination!), Business Activity is growing at a 21 month high rate, and the Trade Deficit is better than expected th rough July. So there is some good news floating around out there. Speaking of which, one Texas resident knew what to do when his house flooded and he needed to evacuate. He called in a fast food delivery. "I ... ordered two grilled chicken burritos with extra egg – and a boat.” A few minutes later, the store manager's husband trolled up in a boat and took them to safety, along with other folks on Jet Ski's that joined in the effort. This helped restore my faith in humanity.

All the best to you and yours.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.