Mothers Day, Social Networks, & TED

Submitted by DeDora Capital on May 6th, 2016

by Will Becker, AWMA/AIF

Happy Mother’s Day this Sunday!

Last weekend I had the pleasure of attending the TEDxNapa Valley Event hosted by Napa Valley College. TED stands for Technology, Entertainment, and Design. Back in the 1980’s TED started as an invite-only annual conference held in exotic places, but several years ago they changed gears and started a variety of regional events that they call TEDx. Napa has hosted one of these regional events for a few years. Each event’s presentations are based on a common theme, but the topics vary widely. Nonetheless, here are three memorable quotes from last weekend:

- “There is an inverse relationship between how serious we take ourselves and how seriously others take us.” ~ Paul Osincup

- “Once I stopped living someone else’s life and started living mine, the phone started ringing.” [her business started doing better] ~ Edi Osborne

- “Statistics are stories with tears wiped away.” ~ Alex Regenstreich

Investment Perspective

Mother’s Day is this Sunday, and this year U.S. consumers “are expected to spend on average of $172.22.” Greeting Cards are the most commonly purchased gift at 78%, followed by Flowers (66%), Dinner/Brunch/Activity (55%), Gift Certificate (43%), Jewelry & Clothing tied at 35%, and such things as spa/book/consumer electronics/housewares/gardening tools pulled in at-or-below 20%. Some people do multiples of these items, hence the total is more than 100%. On a personal level, in general I tend to be a proponent of giving gifts of experience. So I find it noteworthy that the National Retail Federation just started surveying about that this year and it turns out that 24% want a “gift of experience.” This data is courtesy of National Retail Federation.

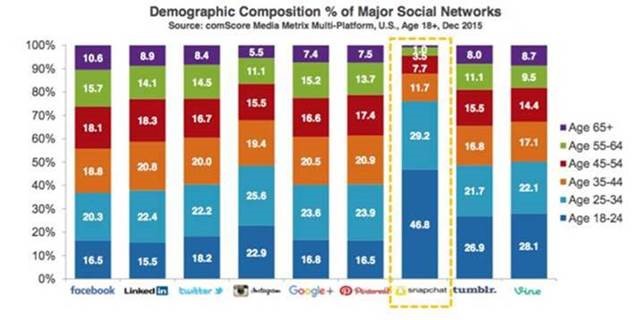

One of the great pleasures of being on the DeDora team is having regular interraction with such a variety of clients. This includes a variety of views on social media. Many of our clients are active on social media; and many also abstain from social media use entirely. So with that in mind, I found it noteworthy that Facebook recently reported 1.65 billion (yes, Billion) people using Facebook products (including FB, Messenger, Instagram, Whatsapp, etc) each month, and an average of 50 minutes spent on their sites per day. These days it seems like a stretch for 1.65 billion people to do anything together, let along for 50 minutes a day. So that’s pretty impressive.

Before I continue, I must add that I consider myself to be a fairly proficient user of social media. You can imagine my surprise when I found out that Facebook isn’t even the most popular social media site for those 18-24 year olds… or 25-35 year olds. That honor belongs to a company called Snapchat, followed by Tumblr and Vine (in the 18-24 camp). I actually took a few minutes trying to understand the difference between those sites, but in the end I realized that this must be what my Grandfather felt like in the 1990’s when I was a teenager trying to explain to him the difference between AOL, eWorld, and CompuServe.

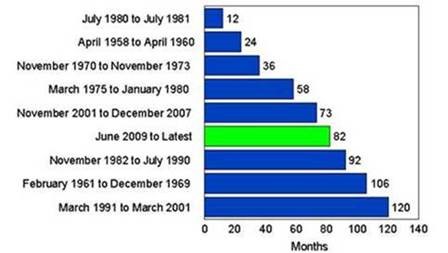

I should add some perspective on the markets before closing out. We are 82 months into the economic recovery, putting this at the fourth-longest expansion according to Dr. Bob Dieli (chart below and more from him in a moment).

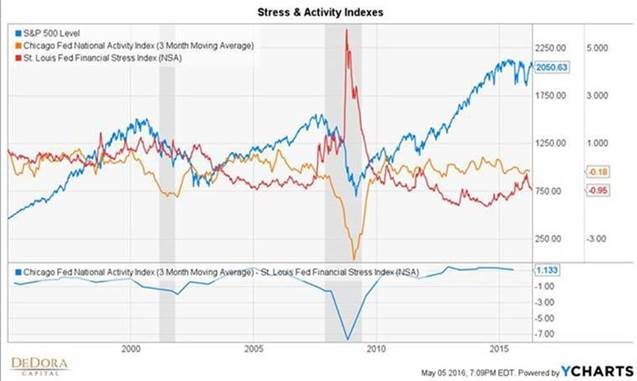

The US economy is growing, but slower and the economic stresses are generally rising but not to alarming levels yet. Below is a chart showing the Chicago Fed National Activity Index and St. Louis Fed Fniancial Stress Index as examples. Back in Feb/March, these indicators were becoming concerning, but then they relaxed a bit.

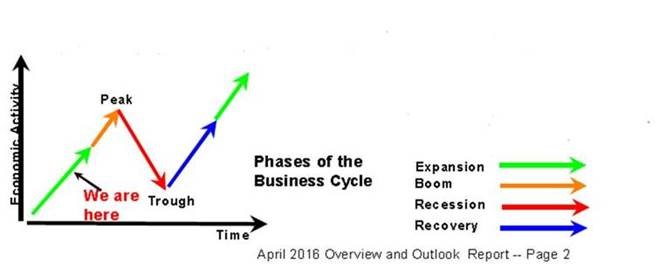

Dr. Bob Dieli’s work continues to identify this as Expansion phase of the business cycle (chart below). A series of indicators are used to identify when there is a shift from Expanion to Boom. Those indicators might shift soon - suggesting that a change is not far off - but they do not appear to be here yet. One example of a concerning indicator is the percentage of states with growing unemployment. Falling oil proces have had a particularly bad impact on jobs in Energy-rich states such as Wyoming and North Dakota, and this is something we are monitoring particularly closely. Having said all that, short technical indicators started getting choppy again this week… anyway, never a dull moment in the world of investing. These are just some of the things we are monitoring. If this sounds like a foreign language and you want to discuss in more detail, just let me know. After all, we wake up each morning entrusted to responsibly manage clients’ money. This is one reason it is so important for us to send updates such as these and stay in touch with you!

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.