Most Destructive WildFire & Black Swan vs Trend

Submitted by DeDora Capital on October 19th, 2017

by Will Becker, AWMA/AIF

Happy Friday!

Planning Perspective

October brought the most destructive wildfire in California history in terms of Structures (5,700) and Deaths (40). Thankfully our team, homes, and office are ok. Many clients and friends have lost much more; houses and businesses burned, families displaced, or significant injuries. Here are a couple ways to support relief in the region: Napa Valley Community Disaster Relief Fund & Redwood Credit Union's North Bay Fire Relief Fund (includes Sonoma, Napa, Mendocino, and Lake Counties). This is on top of a rough Hurricane season that affected (and continues to affect) so many people.

We have been on the phone with a number of affected clients during the past week, and just want to make sure that everyone knows that you can call us for anything that has to do with a dollar sign; especially for helping to sort out what to do after enormous property damage. We have two Certified Financial Planner (CFP) professionals on our team to help sort out these kinds of financial situations!

Investment Perspective

Black swan events are rare, extreme, and in retrospect seem like they could have been anticipated. For example, Black Swan events range from the Chernobyl nuclear disaster, to the 2008 Financial Collapse, to the assassination of Franz Ferdinand that prompted World War I. Trend, on the other hand, is the general direction over a period of time.

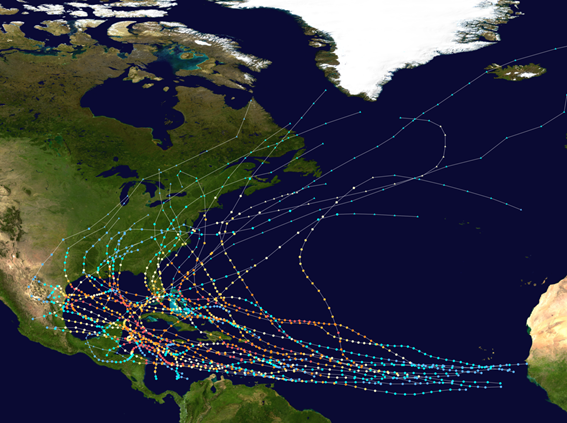

Are Hurricanes Harvey & Irma Black Swans or Trends? What about the 2017 North Bay fires? These events are extreme, and when taken with a narrow enough window of time, are rare. But when we expand the timeline from years to decades, these sorts of disasters seem at least recurrent. For example, here is a chart showing Category 5 Atlantic hurricanes from 1851-2014. Lots of them. Plus there were six years that more than one Category 5 Hurricane formed. So while Hurricanes such as Katrina ($108b) and Sandy ($75b) are outliers in terms of the Billions of Dollars in damage, there is also a Trend of damaging Hurricanes that now includes the 2017 Hurricanes Harvey, Irma, Maria, and Ophelia.

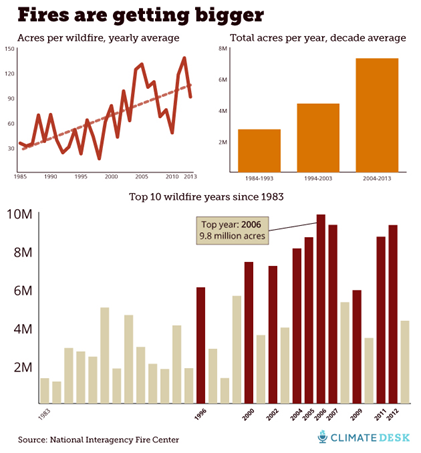

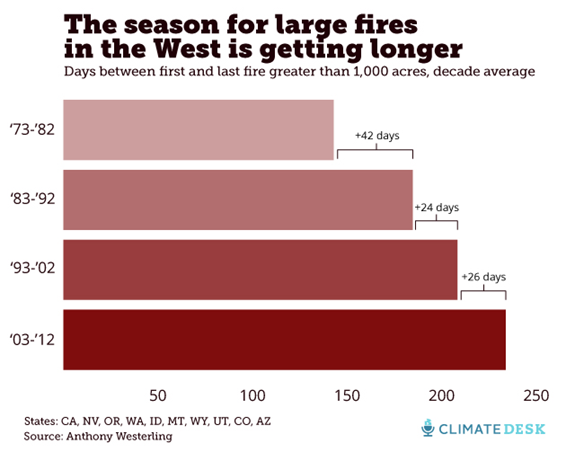

What about the wildfires? Just looking at Lake County, there was the devastating Valley fire in 2015, the Clayton fire in 2016, and now the 2017 North Bay fires. Looking at these fires, high winds are a recurring issue. The 2015 Valley Fire had wind speeds at 60 mph, and a weather station in Santa Rosa registered wind gusts at 41 mph. According to ClimateDesk, the trend indicates a fire season in the Western US that is getting longer and the fires are getting bigger.

Bringing this back to Investing, we continue to see a Trend of strong earnings. That said, FactSet reports "nearly half of S&P 500 companies citing negative impact from hurricanes in Q3 Earnings calls." Where earnings are weak, Hurricanes are the number one culprit! Nonetheless, higher than average percentage of Companies are beating their Earnings estimates. This has pushed the Dow Jones above 23,000 for the first time.

Be safe, and be well.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.