Modern Monetary Theory & Impact

Submitted by DeDora Capital on May 2nd, 2019

by Will Becker, AWMA/AIF

Happy Friday!

Modern Monetary Theory

Back when I was first learning about investing and economics, the entire area of study was so nerdy. It was dry and academic. It was far from political, far from edgy, and definitely far from exciting in any kind of a news way. One thing that I really respect about Jim Cramer, for example, is that he makes investing fun. I mean, the guy clearly loves investing with such vigor that it is contagious. The same with Motley Fool. More recently there are legitimately interesting business shows such as The Profit, Shark Tank, and a plethora more.

But then I open up the news feed and see a headline on Modern Monetary Theory in the next election. Hey, wow, nerdy topic on page 1! Based on how the political situation is looking, we are likely to hear a lot more about Modern Monetary Theory, so let me take some time to briefly introduce and describe it.

A central appeal of Modern Monetary Theory happens to be the same major factor that separates the way a government budget works from the way that a family or business budget works: a government with its own currency can print more money. If only we could do that in financial plans!

Modern Monetary Theory folks have a wide variety of views, but a central tenet of their philosophy is to bring interest rates to near zero, print money to regulate economic growth (instead of messing with interest rates and quantitative easing), and not worry too much about deficits because you can print more money to pay the interest.*

If the near-zero interest rates and growing deficits sound awfully familiar, then it appears we are on that road already. That is a key point in Ray Dalio’s lengthy piece on this topic. The conventional wisdom has been that some government debt is ok as long as it doesn’t get out of control, and may actually be a central aspect of the US Dollar serving as a global reserve currency. Having said that, we continue to be in a situation where the already-large national debt continues to grow faster than GDP. From a purely political-pragmatist perspective, balanced budgets just haven’t been happening… so I can see how the political machine may like a ‘print more money’ approach.

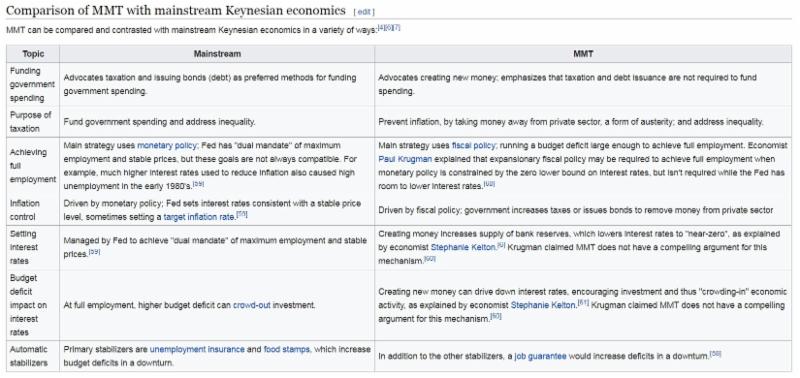

There will most likely be more to say on this as the economic and political debate brews and more specific proposals come to light. Below is a chart showing a comparison of current mainstream economics vs Modern Monetary Theory (MMT), click here for a larger version to view.

*You win a gold star if you thought 'but won't printing all this money cause inflation to get out of control'?

Impact

We say on the website that “DeDora Capital was founded on the principles of running successful businesses, spending time with family, enjoying retirement, and making a lasting impact in the community.”

I want to take a moment to discuss the last part – impact. The conventional wisdom has been ‘make your money, then start a foundation to give it away.’ But there are some pretty glaring problems with that approach. The first is that we are each members of communities, and tend to be involved with people and causes that we care about. Second, it is pretty darn human to want to help. Third, there are tons of ways to help – time, advice, money, logistics, etc.

Also, there is an increasing ethic of making money in a way that is aligned with personal values. For example, working for a company whose mission you believe in, or investing in companies that conform to personal values such as Socially Responsible Investing.

Just to be clear on our perspective, we earned B-Corp Certification in 2015 because we choose to operate our business is in a way that values more than just the bottom line – and we put that into practice and into the certification.

What are some examples? If a client wants us to help a friend or family member, we’ll do it no matter how much money that person has. When a community organization asks us to help out their staff with financial education, we do it. When a member of the team wants time off for a volunteer activity or to help someone in the community, then they take it. When there are needs that pop up, we quietly give. When a client wants their investments to align with their personal values, we do it.

I will sign off with this question: What impact do you want to leave, and are there portions of it that can start today? If you would like to revisit how impact is factored into your Financial Plan, just let us know!

Time for a video. I wouldn't normally include a commercial, but this is really more of a public service announcement, so drive safe!

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.