"Millennials are parents to 50 percent of today’s children"

Submitted by DeDora Capital on May 3rd, 2018

by Will Becker, AWMA/AIF

Happy Friday!

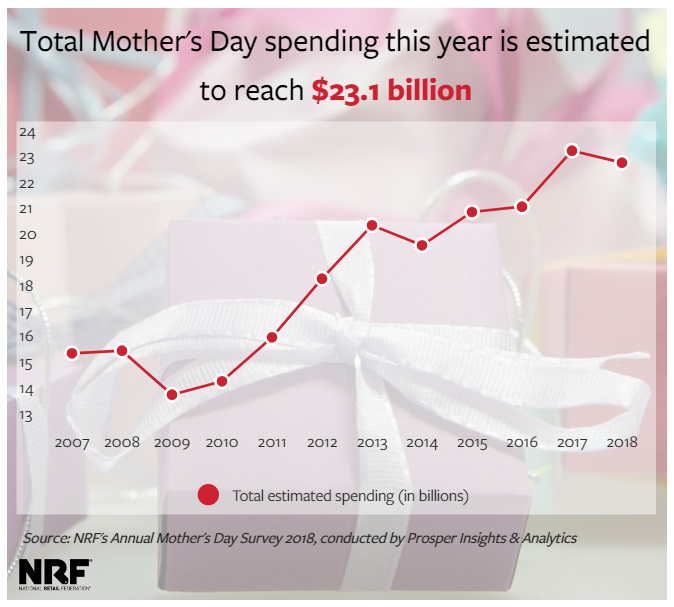

Mother's Day is around the corner on May 13th, and this is projected to be the second straight $23 billion year for the holiday. Last year, Mother's Day spending reached $23.6 billion, this year it is estimated to come in at $23.1 billion.

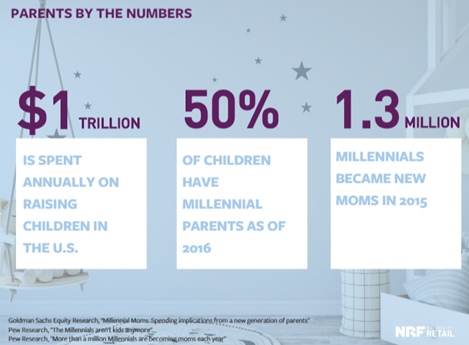

Speaking of motherhood, it turns out that "millennials are parents to 50 percent of today’s children, more than 1 million millennial women become new mothers each year." Millennials were born between 1981-1994, depending on the source, so that puts them in the 24-37 year old range. For this update, I'll use the National Retail Federation's data. When they were born, none of these things existed yet: Netflix, Twitter, Facebook, the Toyota Prius, Harry Potter, or the Euro. But today's millennials are not only the most technologically connected generation in history - they are also an increasingly significant block of consumers. For example, $1 Trillion is spent annually on raising children in the U.S and half of today's children have millennial parents. So not only are millennials increasingly powerful as an economic force, but their buying preferences are impacting the entire consumer experience. Let's take a look.

Given many of the negative stereotypes about millennials, here are some things that may come as a surprise:

- Millennials are engaged consumers: "71 percent will leave a review, process a return or chat with customer service after purchasing, compared with 43 percent of other parents."

- Millennials prefer to stick with a brand: "The survey found 49 percent remain loyal to a brand despite cheaper options, compared with 30 percent of other parents. And 52 percent will remain loyal despite more convenient options, compared with 35 percent of other parents, and 64 percent will shop at a brand they are loyal to before looking at a competitor, compared with 54 percent of other parents."

- Millennials are saving: Not only are 71% of Millennial workers saving for retirement, but 39% are "super savers" that sock away more than 10% of their salary. As a result, 47% have $15,000 or more in savings, and 15% have $100,000 or more in savings.

- Millennials are conservative investors: they prefer higher cash (25%) and bonds compared to other generations. The 2008 Great Recession was clearly formative for them.

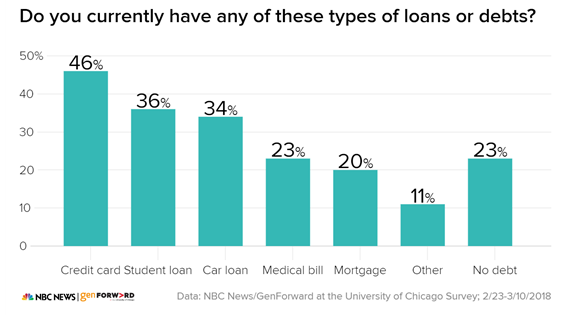

At the same time, rising education and health care costs are taking their toll: 36% have Student Loan debt, and 23% have Medical debt. With debt loads that high, it is not a huge surprise to see the car and credit card debt numbers as elevated as they are.

I have to admit that the characteristics above make sense when I think about many of the 24-37 year olds that we know either professionally or socially. They tend to be do-it yourself'ers, careful with money, excellent at research, not afraid to speak up if something doesn't sound right, and really tired of hearing how cheap college used to be. As a general group, I'm very confident in them. If you are one of these millennials, let me know what you think about the data and the stereotypes!

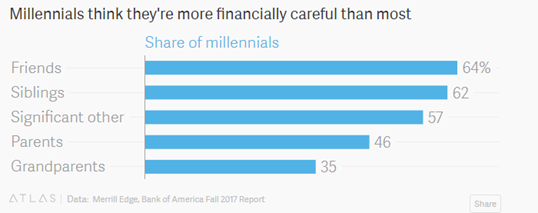

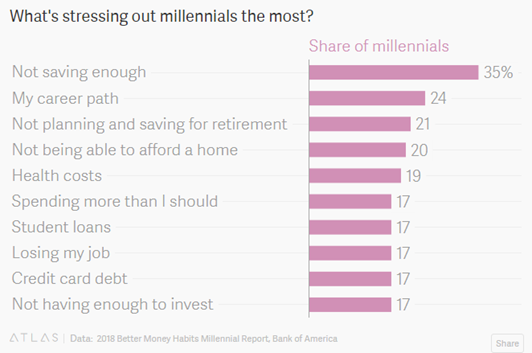

But here is something very specific that I want to mention. If you have a millennial grandchild, here's something to consider: they are stressed about saving enough, their career, saving for retirement, and affording a home. And they very likely view you - Grandma & Grandpa - as the most financially careful in the family. So maybe it's worth a conversation about what's stressing them out and what to do about it... they may lean on your advice more than others! If there is a millennial that might benefit from a check-in with one of us, just let me know! We are more than happy to talk about money, education, career, etc.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.