The Market Won’t Go Up Just Because We Want It To

Submitted by DeDora Capital on March 21st, 2019

by Will Becker, AWMA/AIF

Happy Friday!

Local Perspective

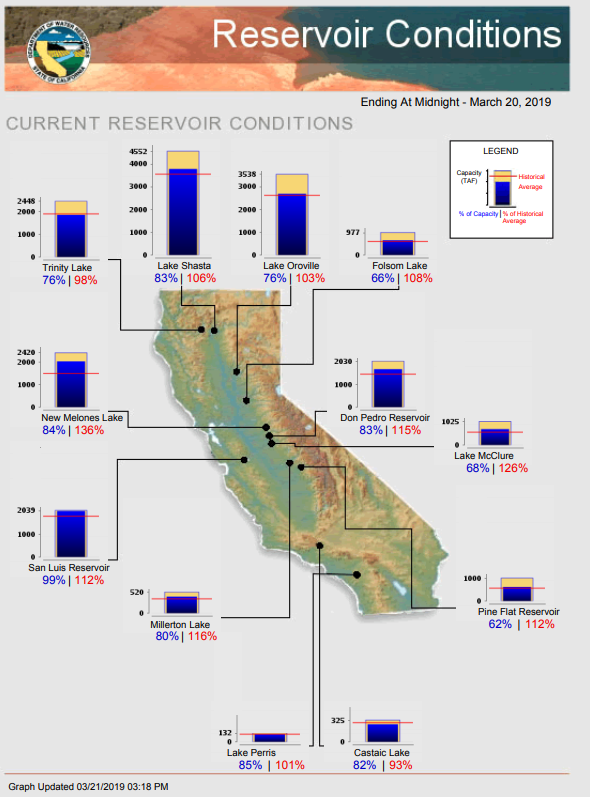

As we hit the tail end of the rainy season 10 of the 12 biggest reservoirs in California are at or above their historical averages.

Federal Reserve Holds Steady

Citing low inflation and a lower Gross Domestic Product growth rate (2.1% instead of 2.3%), the Federal Reserve elected to not raise interest rates in their most recent meeting. Federal Reserve Chairman Powell also referenced Brexit and US-China trade issues as risks. Slowing earnings growth, pretty high valuations, and rising unemployment in some areas are other current concerns.

The Market Won’t Provide High Returns Just Because An Investor Needs It To... so Private Equity?

When it comes to investing, there is a Zen-like simplicity to remember: the market does not care about you, me, Winnie Cooper our office dog, or any of our investment accounts. As Peter Bernstein said, “The market is not an accommodating machine. It won’t provide high returns just because you need them.”

With that in mind, pretend for a moment that you run a $356 billion retirement system that is depending on 7% annual returns. Then imagine that the smart folks at places such as Vanguard begin projecting lower returns, closer to 5% annual return instead of the historical average of 7%. You have three options: add tax money into the retirement plan to make up for the shortfall, reduce benefits for the retirees, or increase the risk profile with the hope that the performance pays off. Oh, and the consequence of failure? Police officers, firefighters, teachers, and librarians lose their pensions. So what do you do?

This example is CalPERS, and last month the pension behemoth decided to add $20 billion in Private Equity to boost returns. CalPERS Chief Investment Officer Ben Meng went into significant detail on this topic at the last board meeting:

“So if I could give you a one line exact summary of this entire presentation would be we need private equity, we need more of it, and we need it now. So let's talk about the first question, why do we need private equity? And the answer is very simple, to increase our chance of achieving the seven percent rate of return, and to stabilize employer contribution, and to help us to secure the health and retirement benefit of our members.”

Private Equity is simply ownership in companies or in debt that is not publicly listed, and it is generally limited to investors that are Accredited. Mr. Meng said “we need it now” four times in his presentation about increasing Private Equity for CalPERS. I don’t know. Call me a skeptic, but he sure started to sound a bit desperate.

Private Equity is a broad category, so what kind of investments is Mr. Weng referring to? In the presentation, he referred to missed opportunities with pre-IPO Facebook, Instagram, and Uber. So who knows, the next big App might be funding a firefighter’s pension. For what it’s worth, individual CalPERS Private Equity investments have returned between +78% and -34%, based on the CalPERS website.

For the record, we are not categorically against Private Equity. We have seen all sorts of Private Equity over the years, and several clients have some portion of Private Equity in their overall investment portfolio. But it is a type of investment with unique risks and rewards, and one very important factor is that Private Equity can't be sold as easily as a stock, mutual fund, exchange traded fund, or bond.

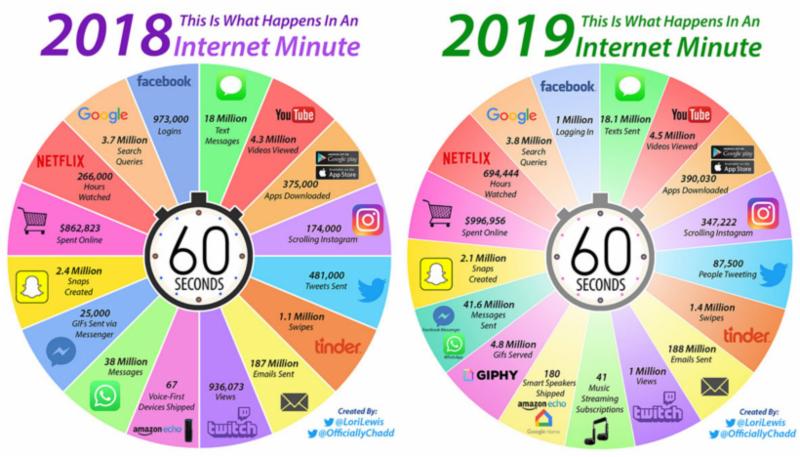

What Happens In One Minute On The Internet?

The folks at Visual Capitalist sifted through a giant amount of data to come up with a pie chart showing what happens on the internet in 60 seconds. If you’re wondering what GIPHY is… here is an example of a GIF featuring Penguins.

Ok, I thought I’d seen it all when it comes to dogs doing cool things. But Ice skating?

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.