A Lot of Little vs. the BIG ONE & Marginally Attached.

Submitted by DeDora Capital on May 19th, 2017

by Will Becker, AWMA/AIF

Happy Friday!

Team Update

Abby, or canine ambassador that sits up front with Janie, was out sick for a few days last week. She's back and feeling better now!

Investment Perspective

Growing up in earthquake country, I came to appreciate the importance of letting off some pressure every now and then... as opposed to the BIG ONE. On Wednesday morning, the markets woke up to one-too-many bad political headlines and the Dow Jones dropped 370 points by the end of the day. The VIX Volatility index woke up from its long slumber. A day like Wednesday is a reminder that investing is about educated risk. After all, without at least some risk there isn't reward in investing! There are going to be some days like Wednesday, and that's normal. By the way, the next day the Dow Jones went up 100 points. As I like to say, "A lot of little earthquakes beats a big one." As financial writer Josh Brown eloquently said,

"You know what isn’t normal? The period leading up to this day, during which we hadn’t seen a 5% pullback from the high since July 2016! That’s the aberration. 215 days without a 5% pullback is a record dating back to 1996. It almost never happens. This stuff right here, with a spiking Vix and red as far as the eye can see? This is what ought to happen from time to time."

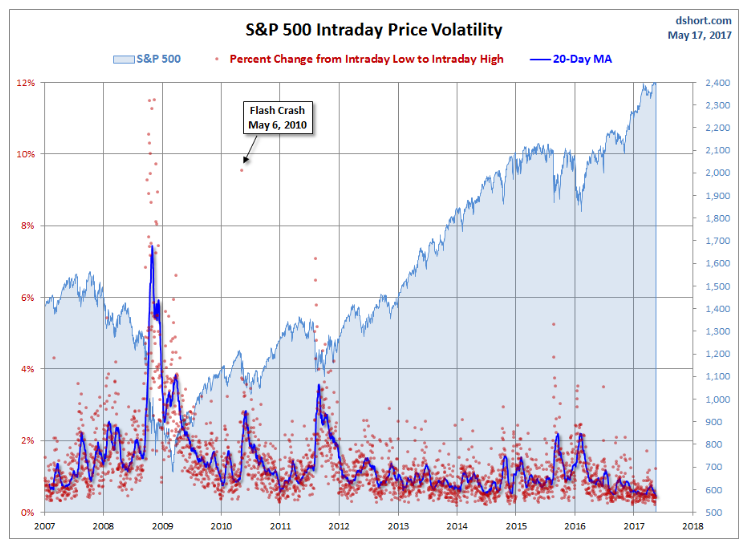

For example, here is a chart showing how low Volatility has gone (red dots and dark blue line at the bottom) while the S&P 500 has grown dramatically.

The first three headlines I saw on Thursday morning were positive on the economics front: Conference Board Leading Economic Index: Growth in April, All-Time High, Philly Fed Manufacturing Index: Expansion Continues, and Weekly Unemployment Claims: Down Yet Another 4K. So let me add a couple thoughts on the concerning side. First, the strong market returns since the election have been explained as anticipating legislative changes under President Trump. At this point, significant legislation - and I say that without judgement about whether it is significant in a good or bad way - is stalled.

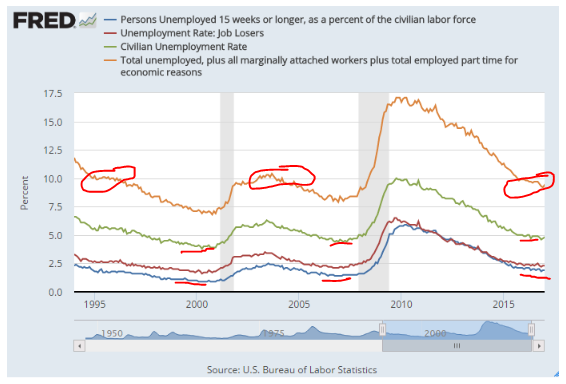

Second, the Unemployment Rate. The unemployment rate is at a post-recession low of 4.8% (Green line on the chart below). That is effectively half what it was during the recession, and an indication of strength in the economy. Historically, the labor market peaks an average of 9 months before the next recession. So we keep a keen eye on Unemployment ticking up. Why am I talking about this when it seems like such good news? We certainly noticed the announcements this week that Ford and Cisco are cutting jobs. Plus, overall there is a persistent sense that things just ain't what they used to be with employment... diving into the data, this is reflected in the Unemployment data that includes those that are looking for work but got so frustrated that they gave up the 4 weeks before the employment survey and those that want full time work but are part time because their hours were cut or they could not find a full time job (See Marginally Attached and Employed Part Time for Economic Reasons). That rate, in Gold on the chart below, remains stubbornly high. In fact, the current rate is still as high as the peak from the last business cycle (2003-2004). So while overall unemployment is back to a normally low rate, there are still an unusually high percentage of workers frustrated with their lack of hours or job prospects.

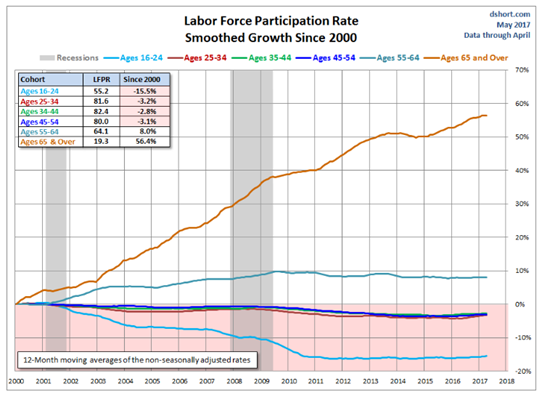

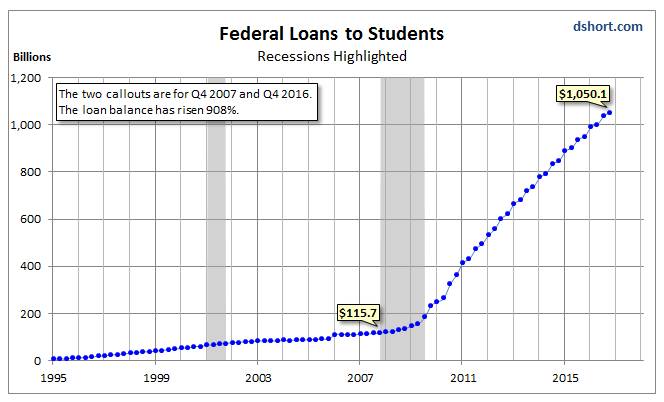

Who are the folks most affected by Unemployment trends? As we look back through the past two recessions, it turns out those age +55 and +65 have more employment while the other age brackets all have declining employment. (All this and more available here). In fact, those age 16-24 have the most declines in labor force participation... while at the same time Federal Student Loans have gone through the roof. So yeah, it's concerning to have a generation graduating from college with worse job prospects and massive debt. This is unfolding in Millennials having lower home ownership rates, for example.

In closing, when we look at the macroeconomic indicators, as wells as specific ones such as Interest rates, inflation, unemployment, and earnings (snapshot below)... things look ok, and consistent with the latter end of the expansion phase of the business cycle. That's not really my opinion, it's just what the facts and data say. For the record, my opinion is that the Fed should have let interest rates rise years ago, resulting in a bumpier but more reasonably priced equity market and decent income for retirees. But I don't get to make the rules! This week we are experiencing political risk mixed with the lack of a pullback in an awkwardly long time.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.