Looking at 2020

Submitted by DeDora Capital on January 24th, 2020

by Will Becker, AWMA/AIF

Happy Friday!

The last update looked at 2019. Today, we shift towards looking at how 2020 is starting out and some of the main things on our minds from an economic perspective. This update is longer than usual so that we can lay out many of the economic factors that we are looking at this year. In the interest of brevity, it is not comprehensive, though. More topics and depth to follow in future updates!

As always, the topics in these updates come out of our client conversations, articles that we are discussing with clients, and our own internal research. If there is something on your mind economically, let us know and let's go over it!

Is This the Turtle Expansion?

We open 2020 with the longest US economic expansion in history (if counted by months, more on that below), Trade Deals with Mexico, Canada, and China, and the US Stock markets at all time highs.

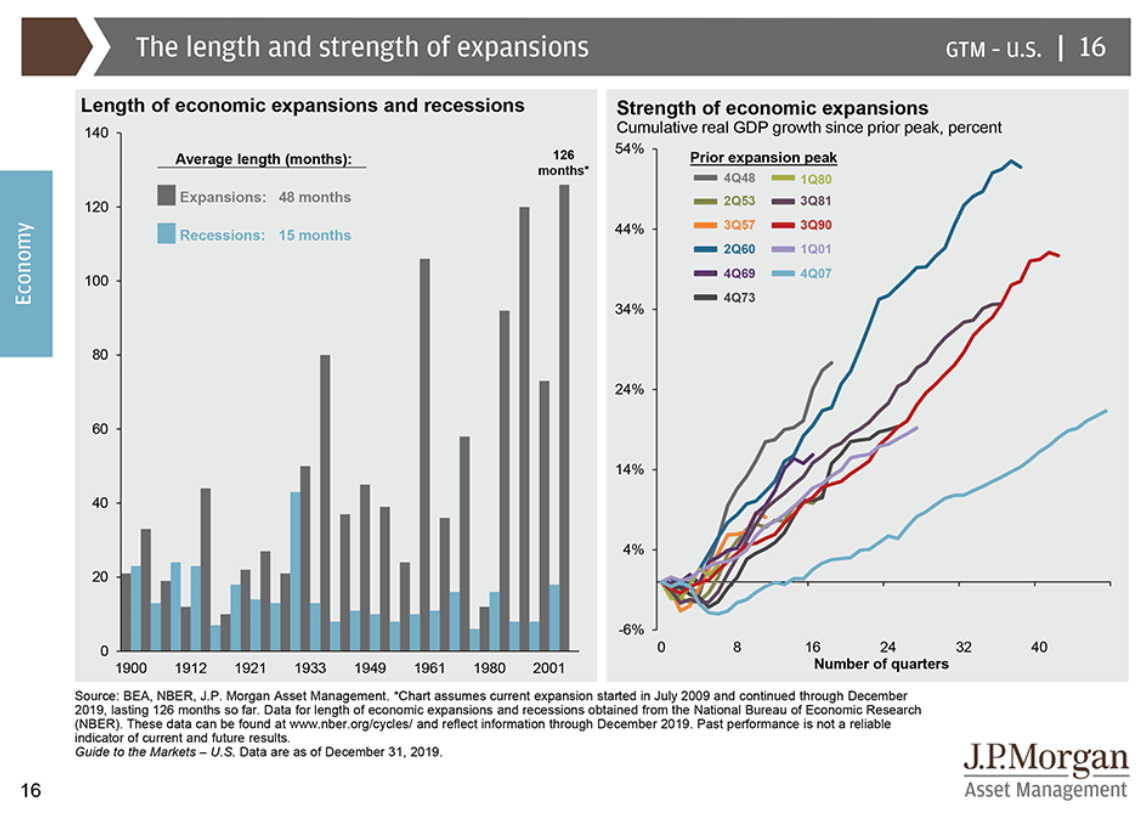

I mentioned above that this is the largest US economic expansion in history if counted by months. But when tracked by growth of Gross Domestic Product (GDP), we are still mid-expansion. It is possible that this slower rate of recovery could result in a more sustained expansion, or as I affectionately refer to it, the Turtle Expansion (vs the Hare, of course). Check out this chart below from JP Morgan comparing the expansion by months vs by GDP.

Boom/Expansion Phase Characteristics

The data shows that we begin 2020 in the “Boom” phase of the business cycle. This doesn’t mean that the end is necessarily imminent, but it does mean that there are characteristics of the later stages of a growing economy that we should be particularly mindful of.

Academically speaking, here are a few things that should happen during the later stages of an economic expansion. We will be expanding on these and more in updates to come, but for the time being, here are a few to keep in mind.

- Inflation should grow, and there is some evidence that a year over year increase in gas prices may contribute to that.

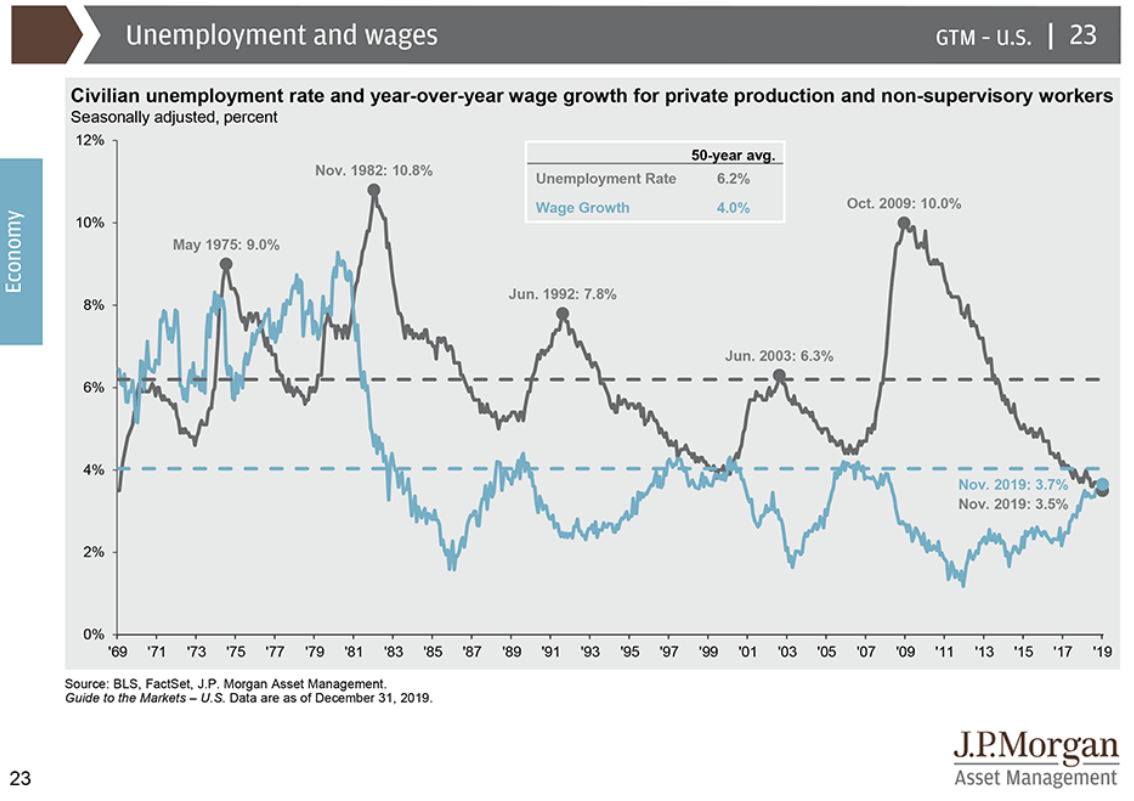

- Wages should rise as employers increase compensation to recruit and retain skilled employees. While unemployment is at historically low rates, wage growth has continued to expand since 2017, and continued wage growth should result in lower corporate profits. See the Unemployment and Wages Chart below.

- Profits should lessen with rising costs, but stock prices may still go higher due to consumer spending, low debt service payments, less regulatory cost, or increased governmental spending such as on infrastructure.

- Debt levels may grow as businesses invest in expansion, though an increase in past-due debt would indicate weakness in this area. This indicator is positive at the moment, but we continue to monitor it for weakness.

- Economic indicators should increasingly be “mixed,” as issue areas pop up or individual indicators flip into a negative direction.

- Fewer employees should quit their jobs (in favor of another job, taking time off, or retiring), and layoffs start to increase. This is undiplomatically referred to as the “Losers to Leavers” ratio. Currently, the data is strong, but it is something to continue watching in 2020.

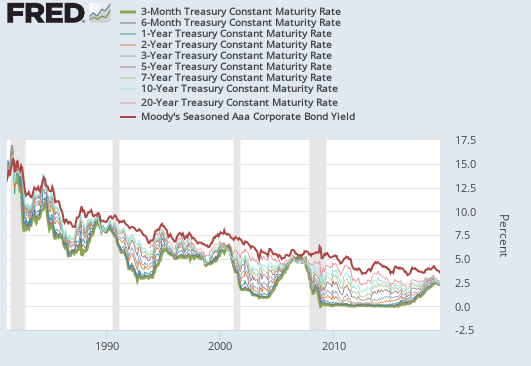

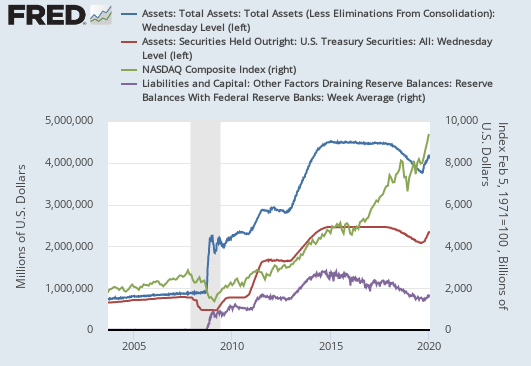

- Federal Reserve returning to a “hostile” approach again. They tried dialing back the stimulus last year, and it backfired. As a result, the Fed changed course by cutting interest rates and dramatically re-expanding their Balance Sheet. The net result is that money is cheap to borrow, cash pays so little that investors are willing to take on more risk to get a return, and there is a ton of cash pumped into the economy. Interest rates are so low that, as Mark Cuban says, “Where else are you going to put your money?” [besides the stock market]. See second and third charts below showing the Interest Rates and the Federal Reserve Balance Sheet.

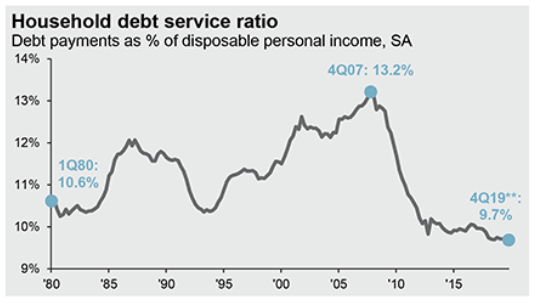

- If wages, employment, or interest rates go far enough the wrong way, households will most likely spend a higher percentage of their income on debt payments... reducing free cash flow to buy 'disrectionary' things. This is the “Household Debt Service Ratio.” At the moment, this ratio is as strong as it has been in 40 years. See fourth chart below labeled Household debt service ratio"

Manufacturing and Valuations

2020 also opens with two specific concerns that we want to flag.

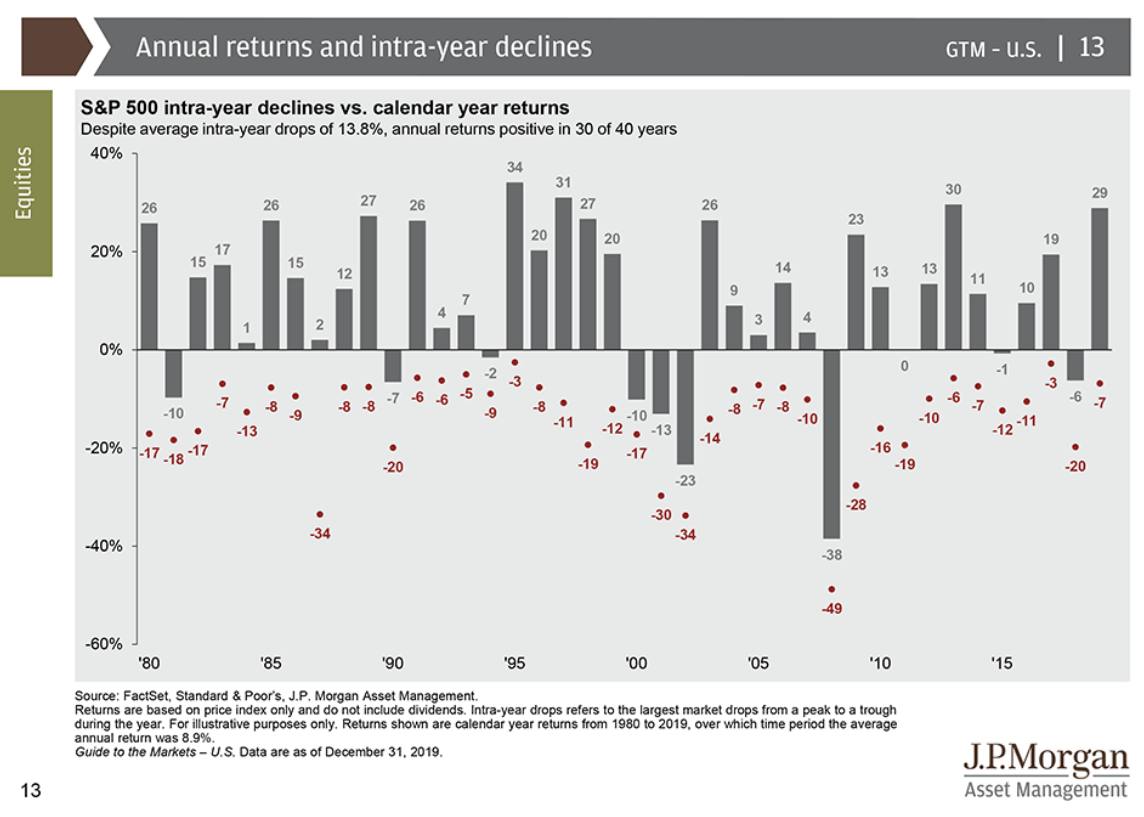

- Stock prices pulled ahead of earnings and profit growth (see first chart below). We do not get lulled into a false sense of complacency! On average, there is a 13% drop in the markets during the year (see second chart below).

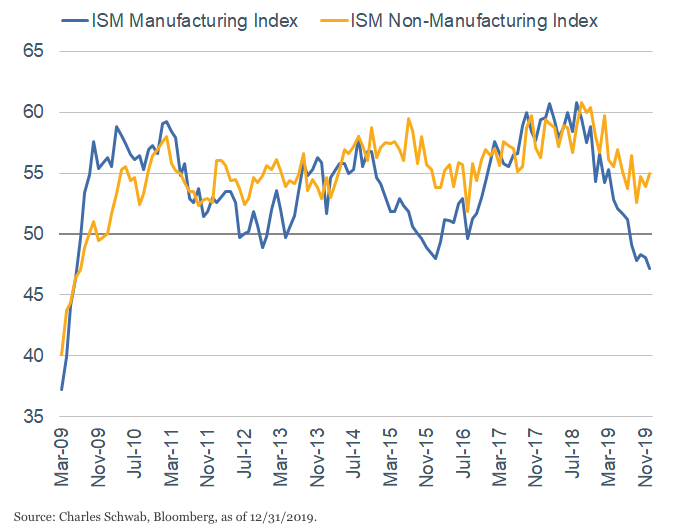

- Manufacturing is slipping. Employment, Retail Sales, and Household Incomes have been enough to make up for it, but the weakness in Manufacturing is worth noting. See third chart below.

Wildcards

For lack of a better term, there are additional variables that could individually affect economics in a jolting kind of way and are forefront enough in our minds that we should mention them.

- The US Presidential Election & Congress. As we have said many times, we are Investors and Planners - not political commentators. As a result, we view politics through the lens of economics and family financial health. Congress is increasingly politically polarized, most notably with a hollowing out of the moderate middle. As a consequence, it is steadily more difficult to get legislation passed through both sides of Congress. Absent an external influence that dims the partisan lines, we should anticipate gridlock among policymakers. This is not the update to get too far into the weeds on the upcoming Presidential Election, other than to be mindful that when you get down to a two-horse race… anything can happen.

- Infrastructure spending. If Congress and the President agree on a significant Infrastructure spending bill, that could significantly boost the materials and manufactoring industries.

- War/Terrorist/Cyber attack. By definition this is something that is far out of our wheelhouse to weigh in on, other than to say that unexpected international incidents could occur. Is the recent hostility between the US and Iran really over? Will there be an increase in cyber hacks that hamper businesses?

- Pandemic risk. At the moment, there are three cities in China under some degree of quarantine or restriction due to the new strain of coronavirus flu. Past pandemics (looking at you, Ebola and SARS) have had varying degrees of impact, mostly local.

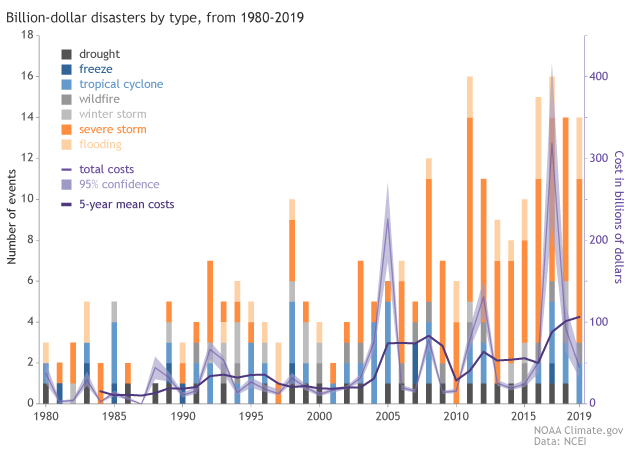

- Large scale Natural Disasters that cause more than $1 Billion in damages are on the rise (see chart below). From Wildfires in California to Hurricanes along the eastern seaboard, the economic price is significantly higher in recent years. These are relevant both in terms of national economics, and especially family finances, as the loss of a home or business from weather events can be its own kind of catastrophe.

Video

- Here is a dog that stops traffic to let kids cross the street. Speaking of animals helping animals... here's a second video for you.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.