Let's Boost Well Being!

Submitted by DeDora Capital on April 21st, 2017

by Will Becker, AWMA/AIF

Happy Friday!

Another good rain last night - is this the last of the rain for the year?

Investment Perspective

Heads up that next week may be a bit turbulent in the political sphere as there are the potential for votes on both health care and keeping the government open. In other Government news, Treasury Secretary Mnuchin says that "we're 'pretty close' to bringing forward 'major tax reform'." Wall Street liked that news, along with more good earnings announcements, and the Dow zoomed +174 points on Thursday.

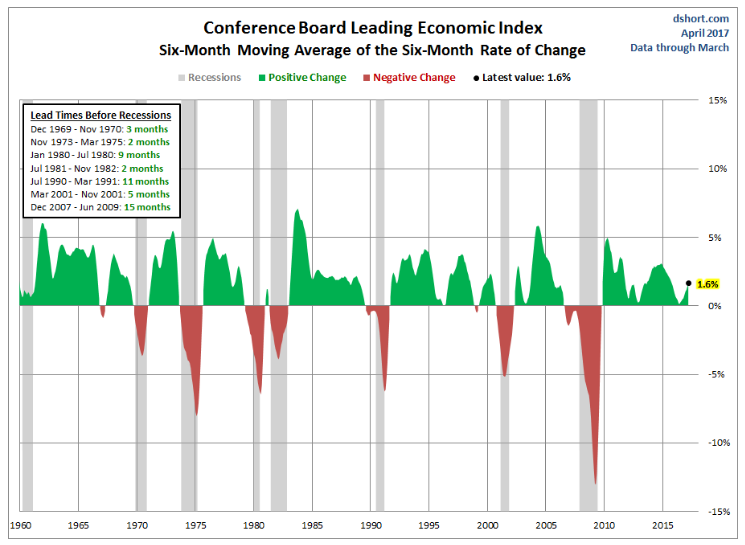

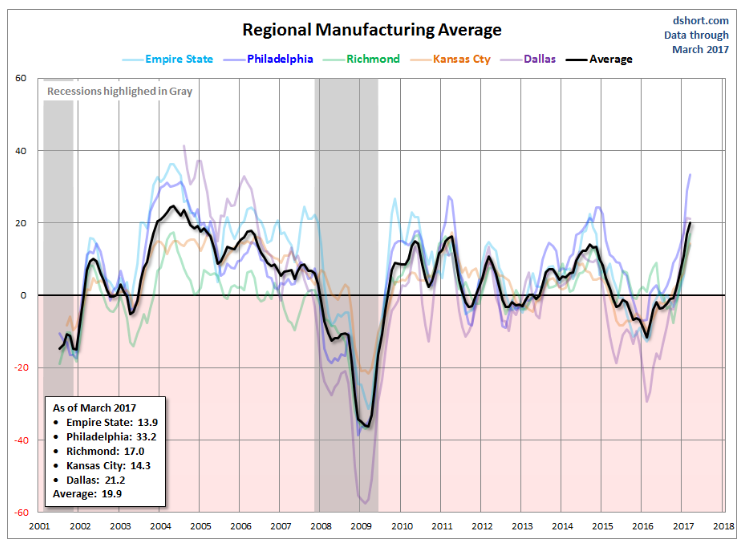

With clients in over a dozen states, we have to keep our fingers on the pulse of what's going on not only nationally but also within the various regions of this expansive country. With that in mind, I will review a few indicators and close out with a perspective on well being. The Conference Board Leading Economic Index expanded through February. There is a strong correlation between the direction of this indicator and the onset of a recession, so strength here is certainly very positive (see first chart below). Now let's take a look at the various regions of the US. Manufacturing data (see second chart below) looks pretty good across five major regions of the country, though as the chart below shows it is not always consistent; the Philadelphia region, for example, is strong while Dallas is still emerging from a rough 2016.

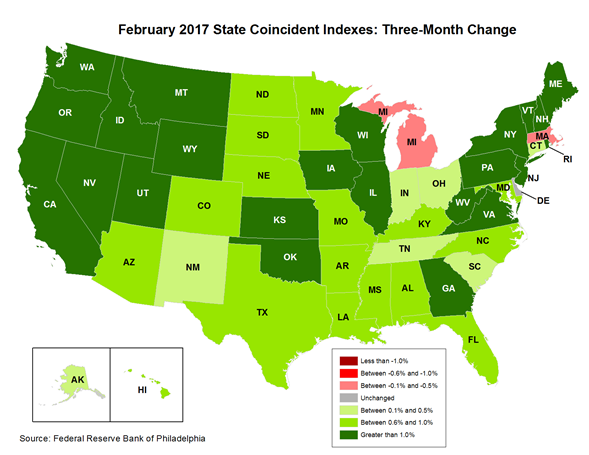

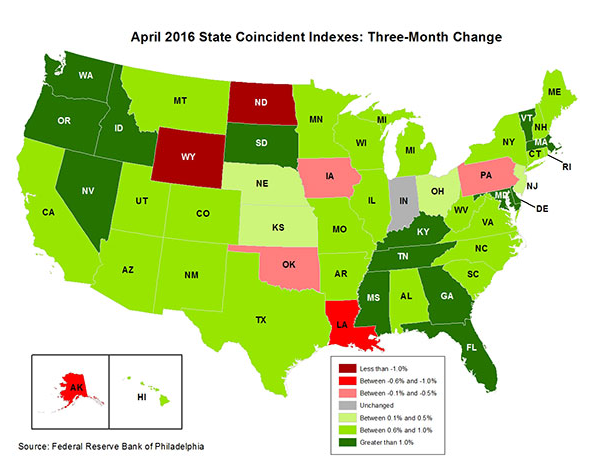

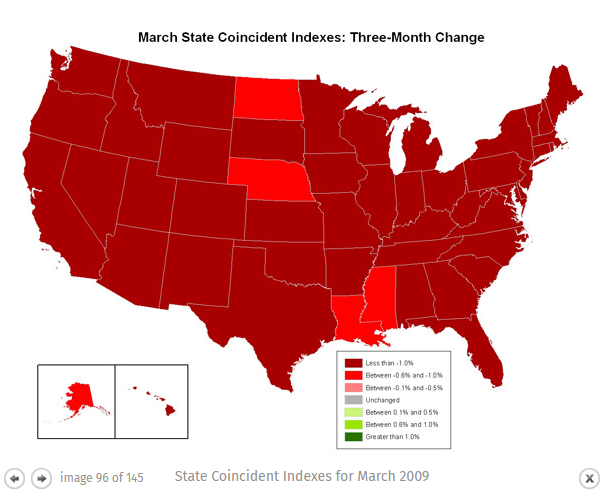

At the moment, only two states (Michigan, and Massachusetts) have worsening coincident indicators (see first chart), and those two were growing well a year ago (see second chart).

For a glimpse of what truly, horribly bad conditions look like... check out March of 2009. Yikes!

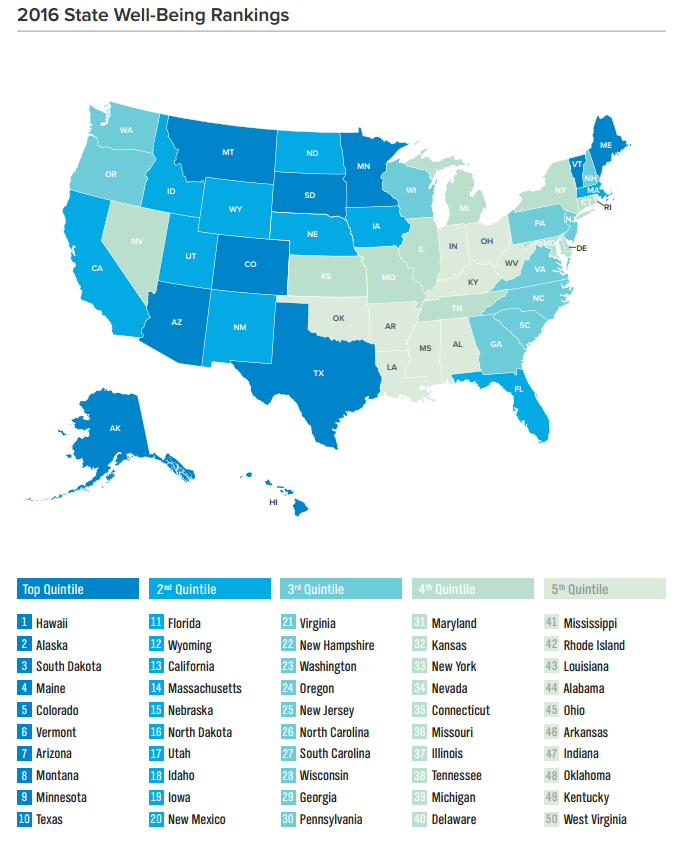

But what does all this economic data really mean when people are driven more by liking what they do each day, having supportive relationships, managing economic stress, liking where they live, feeling safe, and having good health? If only there was an Index to track this - kind of like a Dow Jones for well being. Oh wait, there is! Polling firm Gallup teamed up with Healthways to create the "State of American Well-being", an index to track financial as well as other contributors to well being. The five elements that they looked at were:

- "Purpose: liking what you do each day and being motivated to achieve your goals

- Social: having supportive relationships and love in your life

- Financial: managing your economic life to reduce stress and increase security

- Community: liking where you live, feeling safe and having pride in your community

- Physical: having good health and enough energy to get things done daily."

With that being said, what are the results? A map below shows the highest ranking in dark blue, lowest ranking in light. Other highlights include: "Millennials, the wealthy, and the West lead in exercise," "more Americans say they use their strengths on a daily basis, say their supervisor treats them like a partner, and creates a trusting and open environment," and "almost all of the highest obesity rates in the nation are in the south."

In closing, I want to go back to one of the five elements of this study: "managing your economic life to reduce stress and increase security." We are a mission driven Firm, and I can think of nothing as mission focused as helping our clients build well being! So as you read this update, please let me know if you would like to talk to any of us about a financial topic that could help manage your economic life, reduce stress, or increase security. Let's do what we can to boost well being!

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.