Inflation

Submitted by DeDora Capital on April 19th, 2018

by Will Becker, AWMA/AIF

Happy Friday!

This week's topic is Inflation, and before you shake your head in dismay, let me say that Inflation is one of the least appreciated factors in economics, family finances, financial planning, and, well, just about everything we do on the team. So, get that cup of coffee, and let's do it!

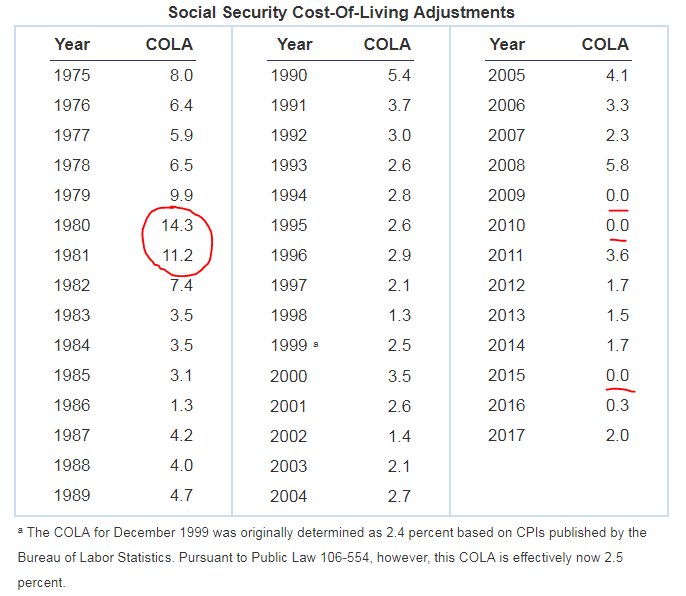

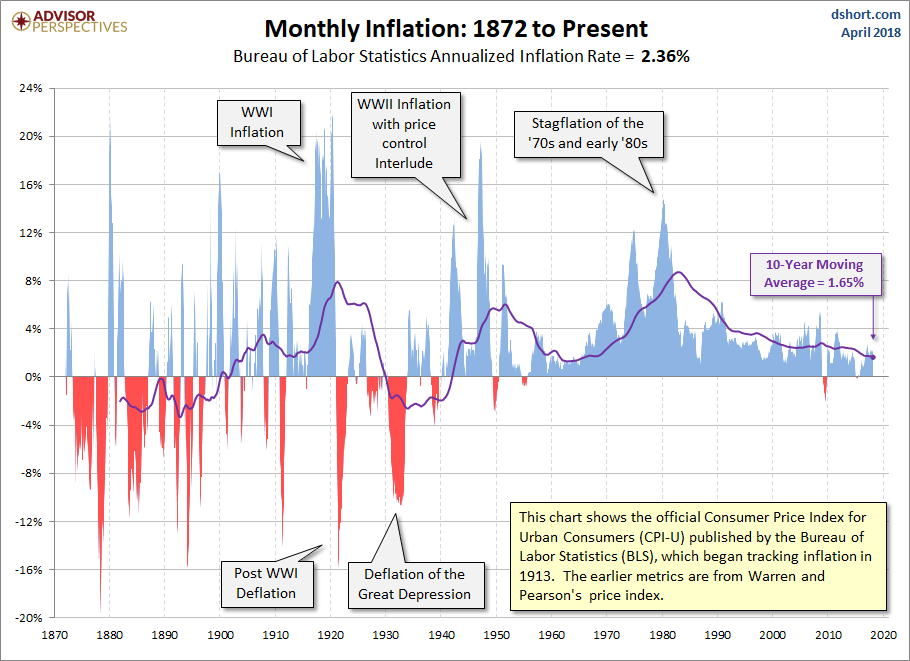

It has been easy to gloss over inflation this decade because there hasn't hardly been any. The annual Social Security Cost-Of-Living-Adjustments (COLA) are based on the Consumer Price Index. i.e. Inflation. In three out of the last seven years there has literally been no inflation to report. But compare that to 1980 -1981, when Social Security Cost Of Living Adjustments were double digits!

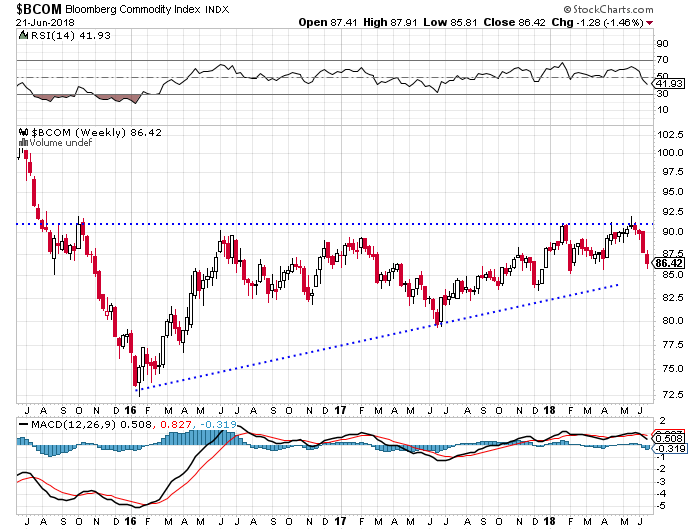

The economic news this week included commodities appearing to wake from their slumber. Since 2016, Commodity prices have been what we call "sideways." That is code for "not doing anything interesting... just sitting there." The Bloomberg Commodity Index (see below) has been hovering between about 80 and 89 since 2016. Three times since 2016 the index has tried to break upward, but each time couldn't muster the strength and fell back into its sideways pattern again. This week the index perked up to 89.95 and may very well break through 90. Commodity prices are correlated to both interest rates and inflation, so we watch this index as an indication of where there may be pressure on markets. For example, if Aluminum costs more, and you run a company that makes things out of Aluminum (bike frames, ladders, soda cans, etc), then you will pass this higher commodity price on to consumers. Current commodity prices suggest that Inflation is likely to increase.

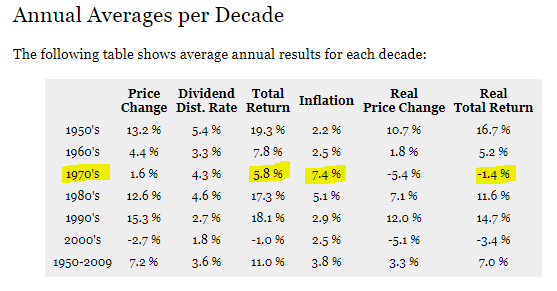

One reason I mention Inflation is because this decade it has been largely absent. But inflation can make otherwise positive stock market returns negative. For example, in the 1970's the S&P 500 was positive. That's great, right? Except that Inflation gobbled up all those gains and then some more... resulting in a negative "Total Return" for the decade (see below). For this reason, we have colleagues that base their entire investment benchmarking on beating inflation. There is a sound logic to that - if a client's account increases more than inflation, it is objectively a win. When Inflation is 0-3% that doesn't sound very fancy. But in 1981 when Inflation was 14% it was a tricky job. When we talk about a 'time horizon' or income needs for an account, we are weighing the potential for long term gains in Equities not just meet but well exceed inflation vs. the certainty of shorter term income of Fixed Income. Owning Stock in companies that do well may be the best tool to address inflation, but at the same time we don't want to take more risk than is needed for a client!

Relatively stable, modest inflation (roughly 2-4%) is good. Note that I started that sentence with 'relatively stable.' From the 1800's through 1950, Inflation jumped all over the place. Then from 1950-1982 annual inflation went up steeply, and from 1982 - 2018 the rate of inflation has been more modest. For the past 10 years, Inflation is averaging 1.65%. It's a bit lower than average, but ok.

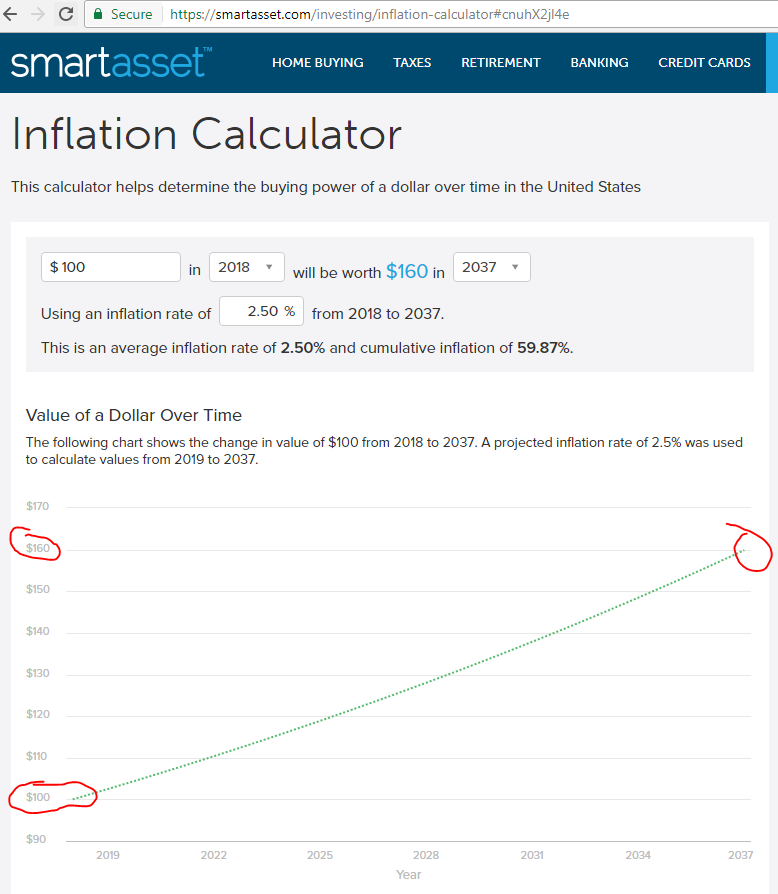

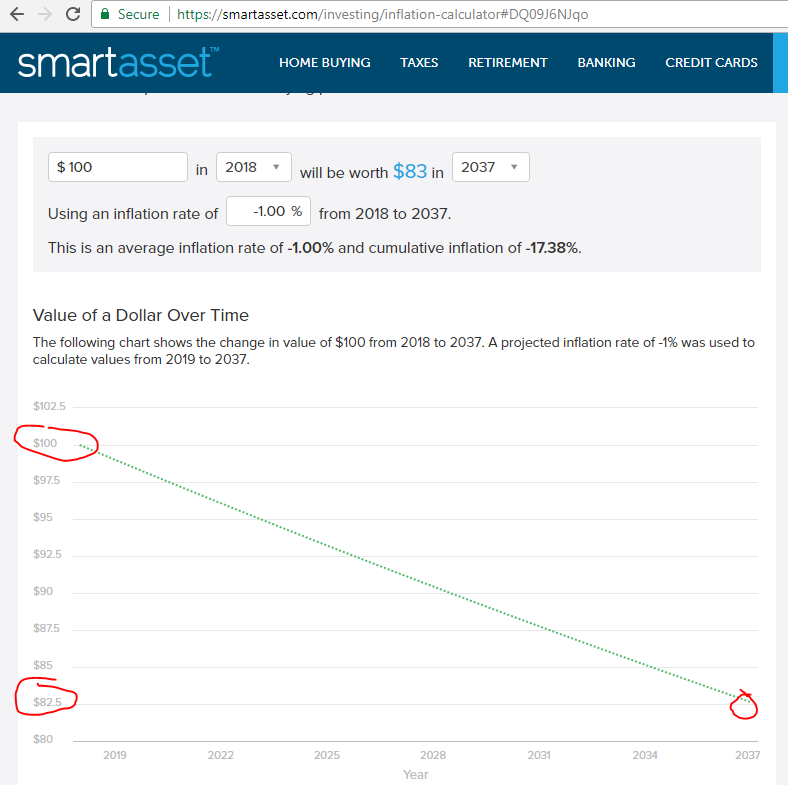

If modest inflation is good, then what is bad? Deflation. I know that paying less for electronics is great. Electronics is a wonderful example of a depreciating commodity. But outside of that, Deflation does really bad things... especially with long term debt. Let's say you buy a new house with a 30 year fixed mortgage at 4%. Now let's say that for the next 29 years Inflation is a reasonable 2.5% average per year. All else being equal, if your income was $100,000 in 2018, it would inflate to $160,000 in 2037. So, when we fast forward to the end of that mortgage, you are paying it off with 60% higher income due to inflation. Win! Now let's look at the bad version... let's say that there was Deflation of just -1% for that same period of time. 29 years later, you are paying that mortgage on a $82.5k income. In real life, of course there are options; you can raise your wages through more skills or qualifications, take a second job, reduce some expenses, etc. But, ahem, there is a gargantuan National Debt that is in a similar predicament.

Let me close by saying that - from a pure economic and investment perspective - stable, modest Inflation is good. Late in a business cycle we expect to see Inflation begin to increase as commodity prices and interest rates align for a higher cost of living and a higher cost for debt. Higher wages usually happen about that same time. Some folks may hear that as evidence that the next recession is closer. But normal inflation between now and then is a good thing.

When the economy puts up a fence, we'll try our best to be the smart donkey.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.