Indicator Tour

Submitted by DeDora Capital on December 2nd, 2016

by Will Becker, AWMA/AIF

Happy Friday!

This update is going to dive into economic data, so as a reward at the bottom there is a cute video of three little bears playing in a hammock. Enjoy!

In the past two weeks, President-elect Trump has nominated a variety of positions, and those folks are starting to articulate the policies that his administration will attempt to roll out. While the policies are important for a variety of reasons, I want to take a step back and tour a few economic indicators that we monitor. While these are not exhaustive, they give a glimpse into the work that our Investment Committee does on an ongoing basis. Paul DeDora, Forrest Hill, and I each have seats on the Investment Committee, and we pull out information from a variety of sources. Here’s some of them. As always, feel free to contact any one of us if you would like to review in more detail how the current economic situation should best be approached within your individual accounts. That’s what we are here for!

Indicators and what they say.

Prior to the election, most analysts were “issuing dire warnings about what could befall markets across the globe should Donald Trump pull off a surprise upset in the U.S. presidential election.” That quote is from a recent Bloomberg article that went on to say, “Fast forward to three weeks after the election, and the U.S. stock market is continuing to hit record highs. And even while analysts are scrambling to decode the impact the President-elect's campaign promises will have on their respective sectors, they're assuming a vastly different tone.” In fact, the Dow, Nasdaq, and S&P are hitting highs!

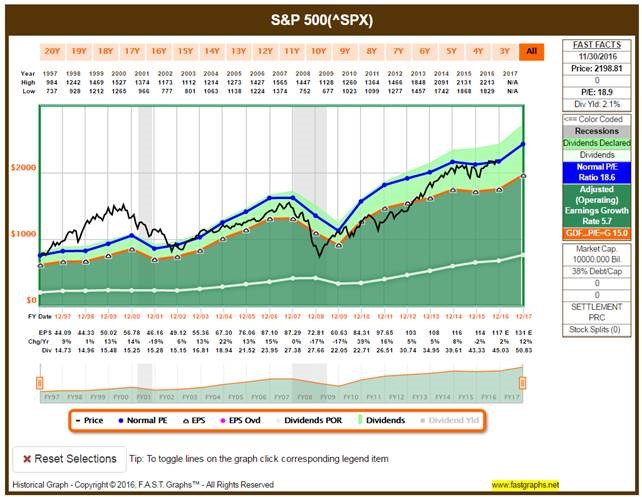

So a natural question is “since the market is high, should we sell?” Digging into the data on this, it turns out that “on 43% of all days, since the S&P 500’s inception, US large cap stocks were at or close to making new records.” So selling near a high would be sitting out two full days per week – and the gains & dividends of those days. That just won’t work. Instead, we look at the underlying economics. To begin with, Earnings (Dark Green) are in a slight upward trend. This is good! In fact,72% of companies in the S&P have beat their earnings estimates recently.

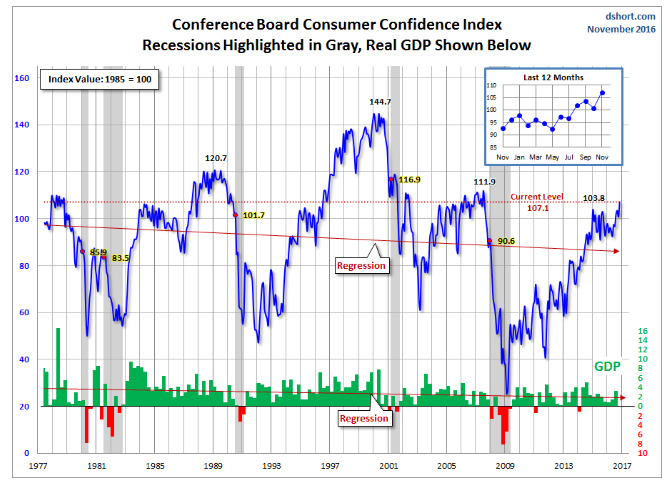

Ok, so what do some other indicators say? Consumer Confidence is back up to pre-recession levels.

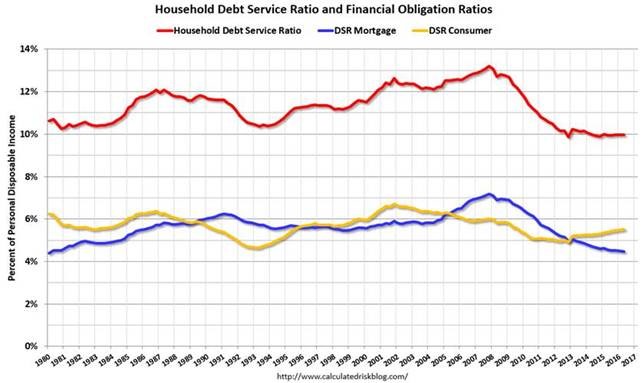

Among the Five Economic Reasons to be Thankful in one article - low unemployment, near record job openings, low gas prices, increasing wages – I want to particularly point out decreasing household Debt. Because our investment and planning perspective view is very family-finance based, the amount of income that goes to pay debt is something we take very seriously. Back in 2007, the average household spent 13% paying debt. Today that number is under 10%. Much of that decrease is due to falling interest rates and less mortgage debt. All in all, this metric suggests that household cash flow has improved.

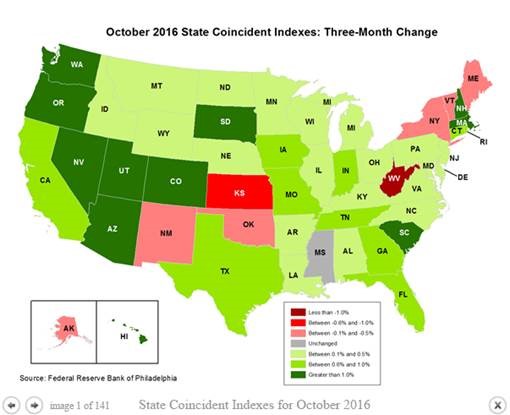

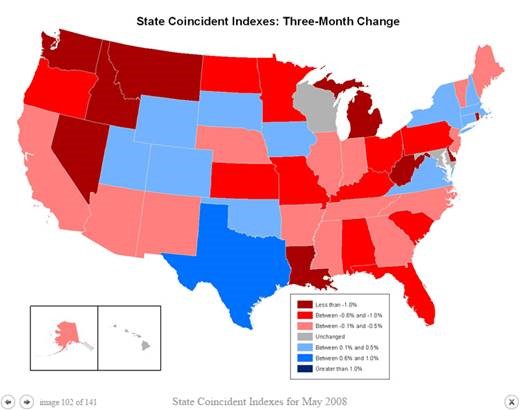

If we learned anything in the recent election, it’s that some states are experiencing very different economic conditions. But how many are getting worse? The most recent State Coincident Indicator data is showing that west of the Mississippi and the Eastern Seaboard are looking stronger, while West Virginia, Kansas, New Mexico, Oklahoma, New York Vermont, and Maine struggle.

Just to put that in perspective, though, here is a chart showing how bad May of 2008 looked…

This is not to say that this year has been smooth sailing by any means, or that there are no headwinds. Earlier this year there was a recession call that almost happened. Outside of the US economy, there are also global weak spots. Southern Europe is one of them, in addition to Latin American economies. Italy, for example, has a referendum next week that could inject additional drama in to the European economy.

Also, here in the US, Rising Interest Rates have finally started… mortgage rates are increasing and the 10 year YS Treasury yield rose to 2015 levels. I know that people who had a mortgage in the 1980’s when there was double-digit interest rates may scoff at a quote such as “the 30-year fixed-rate average climbed to 4.08 percent.” But it’s true - mortgage rates are finally inching up. While they are still amazingly low, the most important part is that the direction of rates is going up.

Thanks for sticking with this update… here’s your video of three little bears playing on a hammock!

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.