“If the world were perfect, it wouldn’t be.”

Submitted by DeDora Capital on September 24th, 2015

by Will Becker, AWMA/AIF

Happy Friday!

Team Update

Last week’s update started out with info on the Valley Fire in Lake/Napa/Sonoma Counties. Last Saturday I spent some time volunteering at the Calistoga Fairgrounds Evacuation center. The outpouring of donations & volunteering were overwhelming. Not only folks from the Napa area, but I met several families that drove over from Marin & San Francisco in order to help out. As of Thursday, the Valley Fire is the 3rd most destructive in California History with 1,910 structures destroyed. But some good news - as of Thursday of this week, the fire is 85% contained. Mid-week, families began moving back to Lake County.

Paul and I are lifelong baseball fans, and I know many of you are also. So let me take a moment to mention that Yogi Berra passed away this week at 90 years old. How many baseball players are regularly quoted? One of my favorite Yogi quotes is “Baseball is 90% mental and the other half is physical.” But a good runner-up is “If the world were perfect, it wouldn’t be.” Rest in peace, Yogi.

Investment Perspective

You may have noticed we have spilled significant ink in recent updates to contrast economic conditions in the U.S. with those in the rest of the world. The basic theme: the U.S. economy is 70% larger than China, the runner up (according to ITR Economics). Plus, the U.S. economy “is driven largely by domestic consumption, services and innovation. China, on the other hand is heavily reliant on low-cost manufacturing and exports” according to the September report from ITR Economics. They go on to say that 5% of China’s exports come to the U.S., while 1% of our exports go to China. “Therefore, China’s economic performance is much more dependent on the US than the other way around.”

That being said, relationship between the U.S. economy and the rest of the world can also be described as “it’s complicated”. For example, when things get crazy elsewhere, foreigners tend to buy U.S. Bonds. The Corporate Bond market has seen significant outflows … domestically… in the past three months. However, foreigners have more than doubled purchases of U.S. corporate bonds. In fixed income allocations, we took the opportunity to consolidate the Corporate Bonds, Preferred Stock, High Yield, and Emerging Market Debt positions into Lord Abbett’s Bond Debenture fund (LBNYX). While we were are at it, we also added to other under-weight positions. In equity portfolios, we are consolidating the Champlain Small Company Fund (CIPSX) into Vanguard Small Cap (VB) & Victory Small Cap (VSOIX). Champlain was in the Due Diligence penalty box already. The position is still held in some accounts where there is significant capital gains. So if you received a big packet of trade confirmations, this explains why.

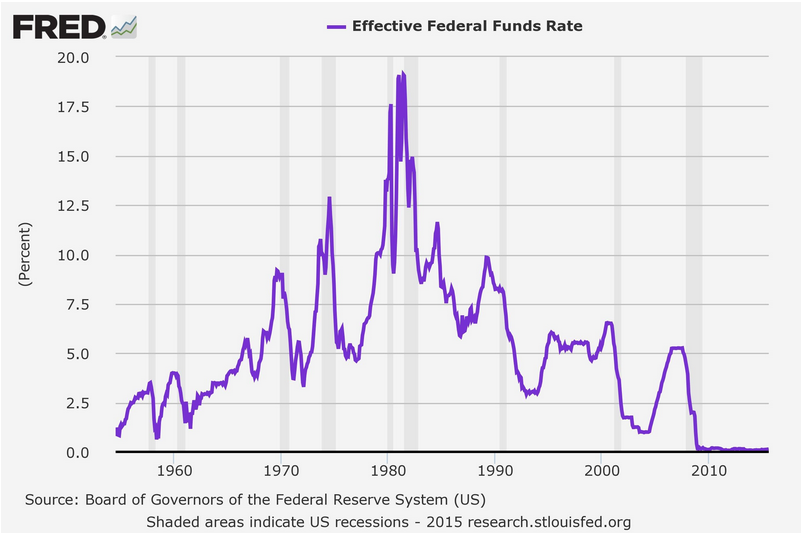

I should mention Interest rates… this week, the Federal Reserve elected to keep Interest Rates steady. However, on Thursday, Federal Reserve Chair Janet Yellen indicated that a rate hike “sometime later this year” would likely be appropriate. It’s like Déjà vu all over again, said someone wise.

Federal Reserve has actually very quietly doubled the Federal Funds rate since Janet Yellen took over. But that’s only a little bit over zero, after being at flatline for five years. We’ve seen rising interest rates before, we’ve seen what happens. It’s not uniformly dire, as I mentioned last week. We hope that the Federal Reserve has the sense to raise rates before the next recession, because negative interest rates sounds like a really bad idea. For reference, here is a chart of the Federal Funds rate since the 1950’s.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.