How Are World Markets Doing?

Submitted by DeDora Capital on July 30th, 2015

by Will Becker, AWMA/AIF

Happy Friday!

The Markets

The U.S. markets snapped a 5 day slump this week, with the S&P 500, Dow Jones Industrial Average, and Nasdaq up for the month (as of market close on Thursday when I am writing this). Major economies abroad - such as China (ASHR), Japan, (EWJ), and Europe (IEV) are actually ahead of the S&P 500 thus far in 2015. Below is a chart from Morningstar, showing the Year to Date performance of each of these Exchange Traded Funds. For all of the drama surrounding China's steep decline in June & July, they are still +10% this year. Investors in our Tactical Growth Strategy may recall that we had a modest investment in the ASHR China Exchange Traded fund this year, exiting in June when the Fund was +28% for the year.

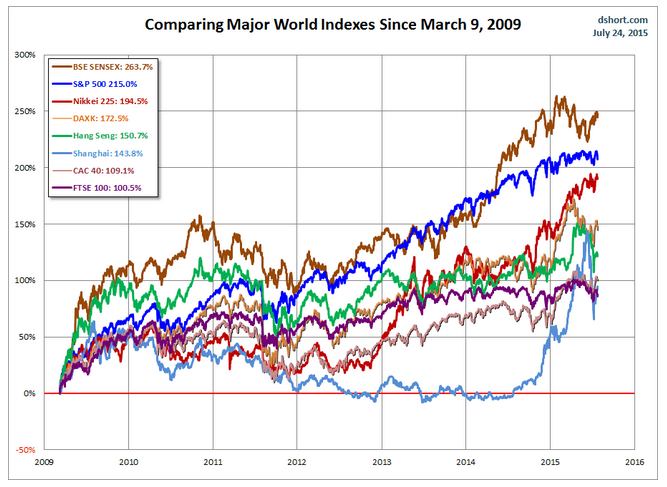

But before getting market envy, take a look at Doug Short's chart showing how a variety of markets have performed since 2009. We are in Blue, and note how relatively smooth our growth has been. Market pullbacks in 2011 and late 2014 look modest compared to the experience in India (BSE Sensex), Japan (Nikkei), Germany (DAXK), France (CAC), Hong Kong (Hang Seng),The UK (FTSE) and China (Shanghai) have been through. By comparison, we're looking pretty darn good since 2009.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.