Global Financial Literacy 101

Submitted by DeDora Capital on December 4th, 2015

by Will Becker, AWMA/AIF

Pop quiz: “Suppose you have some money. Is it safer to put your money into one business or investment, or to put your money into multiple businesses or investments?” This question is from the S&P Global FinLit survey on financial literacy, and if you answered “Multiple businesses or investments”, then you are on the right track. Please click here to view the rest of the questions & take the short survey.

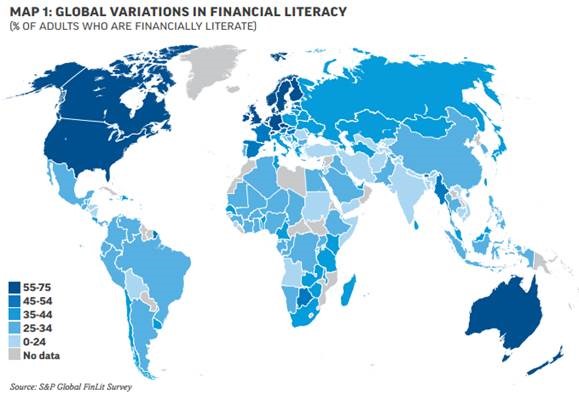

Here is a shocking statistic: 3.5 billion adults worldwide failed the survey… they lack an understanding of basic financial concepts such as risk diversification, inflation, interest, and compound interest. The U.S. tied Switzerland with 57% of respondents passing the quiz. That sounds great. Tied with the country known for trains that run like clockwork and amazing chocolate. But we are behind Denmark (71%), Norway (71%), Sweden (71%), Canada (68%), Israel (68%), Germany (66%), Netherlands (66%), United Kingdom (67%), Australia (65%), Finland (63%), New Zealand (61%), and Singapore (59%). I’m going to do something about that, and it starts today!

If you are going to take the survey, please do so now because there are spoilers below the chart.

We want our folks to lead the pack. So here’s a few quick tips to bring everyone to the head of the Financial Literacy class. Getting these four right puts you ahead of even Denmark.

- Risk Diversification: It is safer to put your money into multiple investments.

- Inflation: if the price of things you buy goes up as much as your income, you can only buy the same amount you could before.

- Interest: $100 + 3% interest is less than $105.

- Compound Interest: If you put $100 in a savings account that pays 10% [I know that’s a crazy interest rate, but please suspend disbelief for me], after five years you have more than $150. That’s the beauty of compound interest!

Congratulations, that is financial literacy according to the S&P Global FinLit Survey. If a financial question comes up, just remember that we’re in your corner. We have two Certified Financial Planners for a reason!

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.