The First Muni Bond & Domestic Vacay

Submitted by DeDora Capital on May 31st, 2018

by Will Becker, AWMA/AIF

Happy Friday!

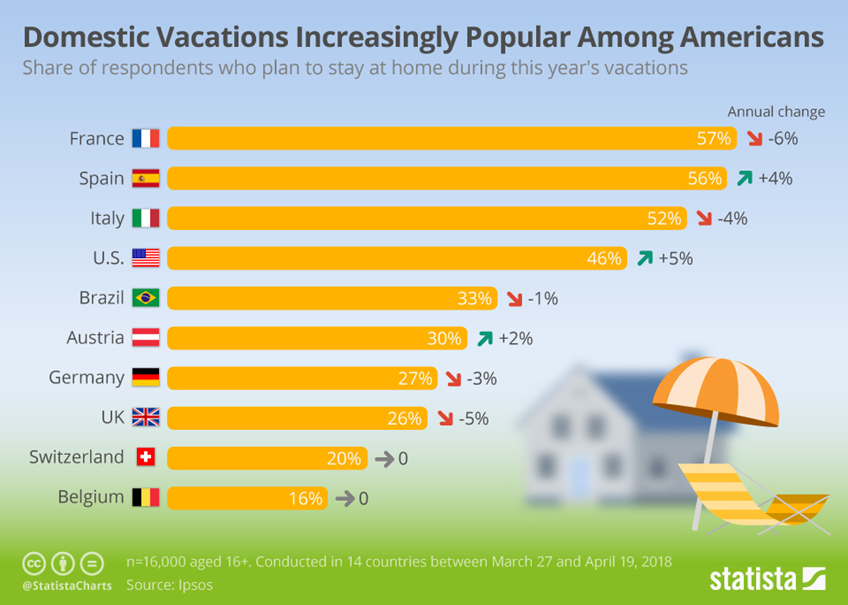

The days are warm, BottleRock & Memorial Day Weekend are over, and school is out next week. Summer is upon us! Are you taking any trips this summer? It is worth noting that domestic vacations - as opposed to vacations abroad - are on the rise in the U.S. as Nearly half of vacations are within the U.S.

Italeave/Quitaly/ItalExit

Speaking of abroad... Italy was in the news this week and not in a good way. Following their election, it wasn't clear if the country could reach a coalition government, or whether they would have to go through another election. As of Thursday 5/31, it appears that they do have a coalition government, but with the pace that things are changing who knows how solid that is. The reason this is relevant is that this election saw the growing impact of the "euroskeptics" and concern that Italy may be on the road to leaving the Euro. Some call it Italeave, Quitaly, or ItalExit, and the impact of that would be significant because Italy is the most indebted country in Europe. Before I get into that, a quick historical note about Italy and debt: turns out they kind of invented Municipal Bonds... but in an ignoble fashion.

Back in 1172, the Byzantine Empire in Constantinople held a bunch of merchants from Venice hostage. Displeased, but without enough cash to fund a mission to recapture their beloved merchants, Venice floated what many believe to be the first Municipal Bond. In short order, they raised enough money to send 120 ships to Constantinople. The plan was to take a gigantic number of ships to Constantinople and return with the merchants. What could go wrong? I'll let William Goetzmann, author of Money Changes Everything, explain:

"The Venetian fleet, waiting to attack, was suddenly ravaged by the plague. Byzantium did not need to put up a fight. Disease defeated the Venetian navy. [They] returned to Venice with the depleted fleet, bringing bad news and the plague... [The captain] was immediately murdered by an angry mob. The loan of 1172 was but one of many burdens to bear from this tragedy. Its principal would never be retired by the weakened republic."

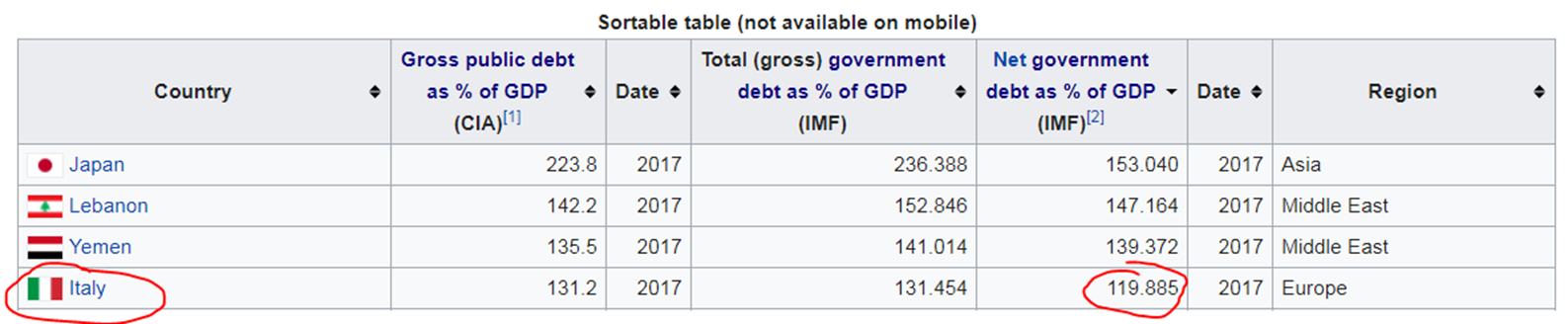

Fast forward to today, and Italy is the most indebted country in Europe. Currently, debt is 119% (see chart below) of Italy's GDP, the worst in Europe and fourth worst in the world behind Japan, Lebanon, and Yemen. Some folks are drawing parallels to Greece's issues with bond defaults in recent years. But to put this in perspective, Greece's economy is about the size of Kentucky, at $195 billion GDP. Italy, on the other hand, is the 8th largest economy in the world at $1.8 Trillion (see chart below). If Italy were a U.S. State, its GDP would be just ahead of Texas, the second largest State in the U.S. as far as GDP. In many ways Italy's troubles are not new news, though. For example, a 2016 article headlined Forget Brexit, Quitaly is Europe's next worry.

Nonetheless, this week's selloff in Italy was an “awakening to something that we all knew: the issues of the eurozone aren’t necessarily resolved," according to one Fund Manager. Their recent election drama also has to do with Italy's lackluster economic strength compared to its neighbors. The fear is that Italy leaving the Euro would lead to other countries following it out the door, along with a wholesale collapse of the european economies. More likely, in the short run at least, is that Italy's political turmoil stems from trailing its neighbors economically. One article in the Wall Street Journal lays it out:

"It is true that Europe's weak countries - bar Italy - aren't as weak as they were in the last crisis. Banks have been recapitalized or restructured, competitiveness improved, and current account deficits turned into surpluses. Ireland, Portugal, and Spain are all far stronger than they were. Italy, meanwhile, has bumbled along; as Capital Economics' Chairman Roger Bootle points out, every other country in the region except Italy has become more competitive against Germany since 2011."

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.