Fidelity Says “36 percent of couples disagreed on the amount of the household's investible assets."

Submitted by DeDora Capital on December 11th, 2015by Will Becker, AWMA/AIF

It feels like Christmas. The Salvation Army bell ringers are out and about, Christmas Tree lots are packed, and it’s raining this week. There is even some snow in Tahoe! Whether you celebrate Christmas, Hanukkah, Kwanzaa, Yule, Festivus, or one of the many more holiday traditions, we hope that the holidays are finding you well.

The Holidays can be filled with joy, reunion, good food, and cheer. But it can also be a time of stress; family stress, financial stress, travel stress, cold/flu stress, pet-ate-the-Christmas-tree-ornaments-stress, etc. If you were recently in a disagreement with your spouse about money, then know you are not alone. According to Harris Interactive more than one-third of couples age 55 to 64 admitted to having "money fights.”

Some more sobering news from a Fidelity survey:

- “36 percent of couples disagreed on the amount of the household's investible assets.

- When asked how much they will need to save to maintain their current lifestyle in retirement, nearly half (48 percent) have "no idea." This level of disagreement is highest among those who are closest to retirement—Baby Boomers (born 1946-64).

- 60 percent of couples and almost half (49 percent) of Boomers don't have any idea how much their Social Security benefit might be, even though the information is readily available on the Social Security website

.

. - Couples aren't on the same page when it comes to describing their expected lifestyle in retirement—with one in three disagreeing about how comfortable that lifestyle will be.”

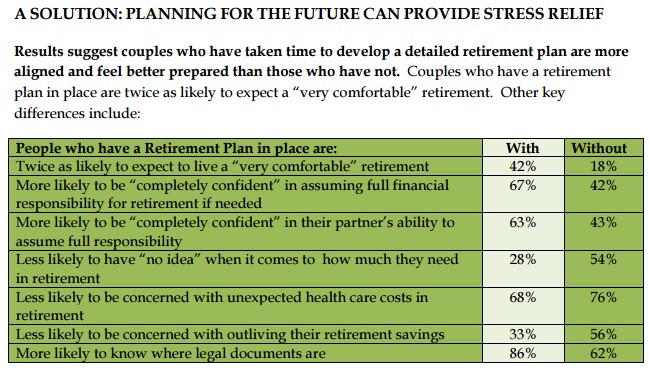

Now some good news from the study: couples that have a financial plan feel better prepared.

Now more good news: we specifically designed DeDora Capital to answer these kinds of financial questions!

Here are some quick answers, and we are available to go through much more detailed responses that are specific to each of your circumstances. Without further ado:

- How much are your investable assets?

- A good start is to review your Investment reports + retirement plan reports. If you don’t have a financial plan yet, and want to get started now, just hit reply and I’ll send the info to launch it.

- How much do you need to save to maintain your current lifestyle?

- The quick rule of thumb is that 4% is a sustainable portfolio withdrawal rate. The “4% Rule” has come under some criticism in our current low interest rate environment, but nonetheless it is a guideline that serves as a starting point.

- A full Financial Plan can answer this question much more completely. Let's get the plan started!

- How much will your Social Security be?

- You can find out more here: https://www.ssa.gov/. Social Security claiming strategies can be complicated, so let us know if you want to review the options.

- What is your expected lifestyle?

- We can help to define the financial costs and clarify the degree to which your assets are sufficient to fund the lifestyle that you have in mind. In each plan, our goals are to have a plan that reflects your core priorities, has a high likelihood of success, and brings clarity to upcoming financial decisions. Sometimes it is helpful to talk this through these financial topics with someone you are not related or married to…. and with someone that happens to have an advanced industry designation (such as Certified Financial Planner) specifically designed to answer these questions!

We want to do our part to reduce holiday & financial stress. If you believe that our team has helped you to find financial clarity, and you know someone that is struggling with these kinds of financial stresses, then let us help. We can review the situation and see if it is something we can solve. If we can, we will. If we can’t, we’ll say so.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.