Election Next Week & More Than Average Doing Better Than Expected.

Submitted by DeDora Capital on November 4th, 2016

by Will Becker, AWMA/AIF

It took 10 innings in a Baseball game so long it ended the next morning, in the 7th Game of the World Series after a 108 year slump, but the Chicago Cubs are World Series Champions! Congratulations to the Cubs for winning for the first time since Teddy Roosevelt was President.

Speaking of President… the 2016 Election is next week. Please mark your calendars and vote on November 8th. Even if you are fed up with the Presidential race, there a number of local races to weigh in on. And in my beloved California we have 17 state ballot initiatives to vote on!

We have a plethora of economic perspectives and scenarios, but there’s not much sense going into detail until the election is over. That’s not just due to the Presidential race… the Senate & House races will have a significant impact as well – especially when it comes to economic behemoths such as the Farm Bill and Highway Bill. We continue to invest towards our primary economic thesis, with Plan B’s at the ready.

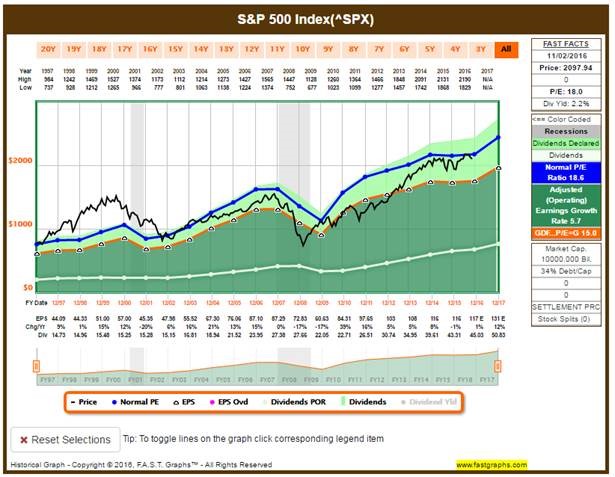

Having said that, here’s the most relevant market metric at the moment: Earnings are ok. FactSet is reporting +1.6% Earnings Growth for the 3rd Quarter of 2016, projecting a very slight Earnings Growth (+.2%) for the full year 2016, then projecting double digit earnings Growth for 2017. While earnings are basically flat so far this year, more companies are beating Earnings Per Share and Sales Estimates than average. In short, more than average are doing better than expected.

To illustrate the Earnings situation, here is a chart. When the green area goes up (chart below), Earnings are growing and the market is ok.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.