From Earnings Recession to Earnings Acceleration

Submitted by DeDora Capital on May 5th, 2017

by Will Becker, AWMA/AIF

Happy Friday!

Team Update

It's hot and dry in Napa, hello summer! The "Collected Works from Napa Valley Writers 2017" is hot off press and available on Amazon.com... who is that guy Will Becker on page 190?

Investment Perspective

Health care overhaul is back in the news on Thursday as the House of Representatives passed the "Health Care Reform Act of 2017." Health Care reform is now moving over to the Senate. "Winning approval for the bill could be even more difficult in the Senate than it has been in the House, where Republican leaders struggled for two months to wrangle enough votes in the caucus to secure its passage."

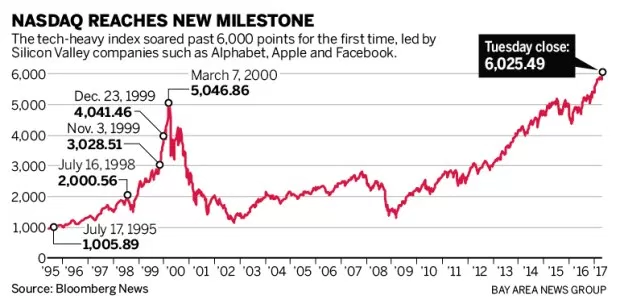

In the last update, I focused on state and regional economic factors. This time, two headlines caught me eye... "S&P 500 Reporting First Double-Digit Earnings Growth Since 2011" and "Nasdaq’s record high: Tech-heavy stock gauge tops 6,000." (chart below the Bear) Less than a year ago, we were looking at an Earnings recession... quarter after quarter of slowing earnings. But since then, we are seeing "upside surprises in multiple sectors." Earnings growth increased double digits, and on top of that 77% of companies beat their Earnings Estimates. In short, we have gone from earnings recession to earnings acceleration.PLENTY can still go wrong. In fact, is a near certainty that it will, at some point. I may be a sulking bear with this resurgence of good economic news, but we have to invest based on what is... not what should be.

Here is a chart of the Nasdaq's major milestones since 1995. Check out the fallout from the Dot Com crash... took 17 years to claw back to the previous high.

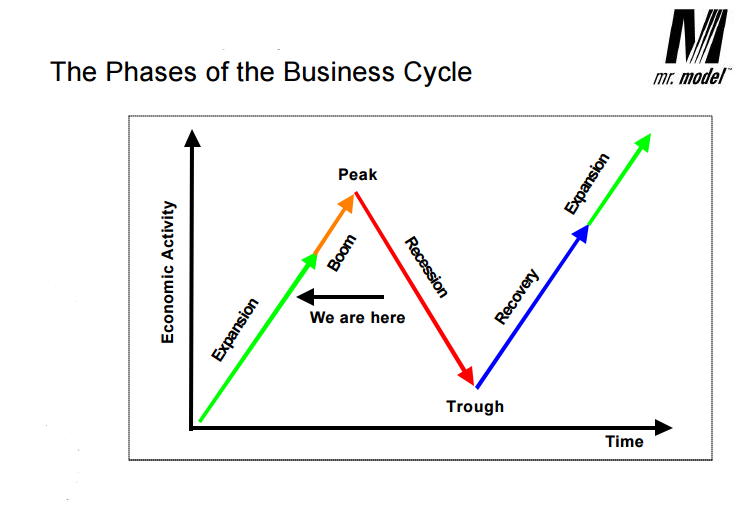

There are some leading indicators suggesting that we are in the late stages of Expansion and will soon enter the Peak period of the business cycle. Economist Dr. Robert Dieli says "My view is that the sky is not falling. It is, at best, clouding over as we proceed through the expansion phase and add items to our list that suggest we could be making the transition from the expansion into the boom." Below is a chart from Dr. Dieli showing where his data shows we are in the business cycle.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.