Down 1,000! Up 600! Markets in Correction! Markets Not in Correction!

Submitted by DeDora Capital on August 27th, 2015

by Will Becker, AWMA/AIF

Happy Friday!

Investment Perspective

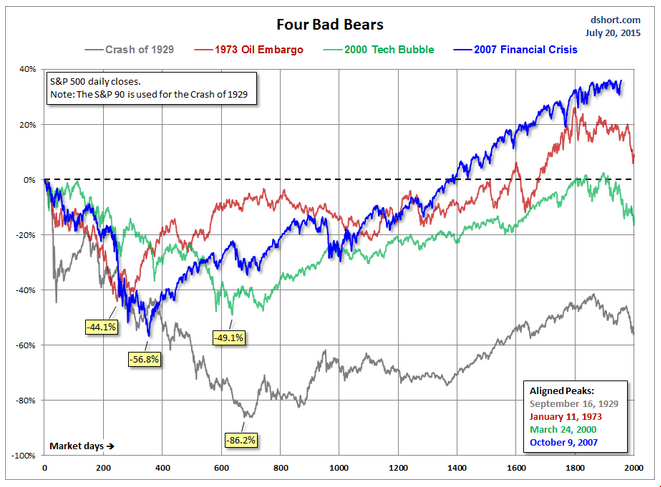

Down 1,000! Up 600! Markets in Correction! Markets Not in Correction! It’s been four years since a market correction, so the financial news channels dug into the recent drama with ferocity. Here are a couple things that were overshadowed by the noise: consumer confidence is up, and the recovery since the 2007 continues to be one of the strongest on record. The chart below illustrates the consistency and strength of the recovery. Granted, the recovery benefitted from a near-zero interest rate policy. But still, this is a historically strong expansion.

This brings me back to a 2014 Forbes article describing how the S&P 500 earned 7.4% annualized from 2004-2013, while the “average investor” earned only 2.6% annualized. Why such a big difference? The article describes how emotion-based decision making can lead investors to buy high and sell low. The article goes on to say,

“the average mutual fund investor has seriously underperformed against a variety of asset classes and has barely exceeded the rate of inflation. The average fixed-income investor has lost to inflation, losing valuable purchasing power. Why does the average investor underperform? Investors may only have themselves to blame. According to Dalbar’s QAIB, investors make poor investment choices that hurt their investment returns. These decisions, including when to buy and sell, are often driven by emotion.”

Paul and I have processes in place to be informed – not dominated – by the emotional side of investing. As part of that, we read voraciously and pay particularly close attention to the fundamentals of the economy. When we look at the healing that has taken place among a variety of indicators, it puts the correction that we experienced this week in perspective.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.