Is Dow 1 Million The Low Number?

Submitted by DeDora Capital on September 22nd, 2017

by Will Becker, AWMA/AIF

Happy Friday!

Planning Perspective

I feel like a broken record on cybersecurity risk but hacks went to a whole new level in September, with 143 million consumers compromised by a cybersecurity breach at a major Credit Rating company and non-public information taken from a Federal Agency charged with protecting investors. Talking about Equifax and the Securities & Exchange Commission in these cases. Equifax then made it worse by directing customers to a fake phishing site.

Just to be clear, this means that a company in charge of our credit histories had 143 million consumers' credit information breached, and an agency charged with investor protection was hacked and used for illegal stock trades. If this sounds so 21st century, that's because massive data breaches are really a thing of the past 12 years or so. The Washington Post has an interractive article about the history of Data Breaches here. This sounds like a dystopian futuristic sci-fi movie, but unfortunately it is real life in 2017.

As consumers, here are some things we can do to attempt to address at least some cybersecurity risks:

- Change passwords - and use multiple passwords.

- Back up important documents - in case there is a ransomware attack.

- Run a credit check - especially look for any unfamiliar accounts, lines of credit, or addresses.

- Put a "Credit Freeze" on accounts - this makes it harder to have a fraudulent acct opened without you knowing about it.

- File your taxes early - making it less likely that a criminal files a false tax return in an effort to swipe your refund.

- Run antivirus/antimalware on your internet connected devices - www.malwarebytes.com and www.bitdefender.com/ have been consistently recommended to us by Security experts.

- Check out the "4 Things You Should Do About the Equifax Hack" article from the New York Times.

Investment Perspective

Warren Buffet turned heads by saying that the Dow Jones Industrial Average will reach 1 million in 100 years. The Dow Jones is currently at 22,397, up +13% so far this year. If going from 22,397 to 1 million in 100 years sounds crazy, then sit down for this one: that's the low number. Mario Gabelli ran the numbers, and found that Mr Buffet's 100 year target was based on only a 3.9% compound interest rate... as opposed to 5.5% Average Dow Jones return for the past 100 years or so. If the Dow keeps growing at the historical average of 5.5% compound interest rate for 100 years... that would be another 3 million higher than Mr. Buffet's prediction. Not that the markets will go up in a straight line, though. Perhaps that is why perennial optimist Mr. Buffet is sitting on $100 Billion in cash.

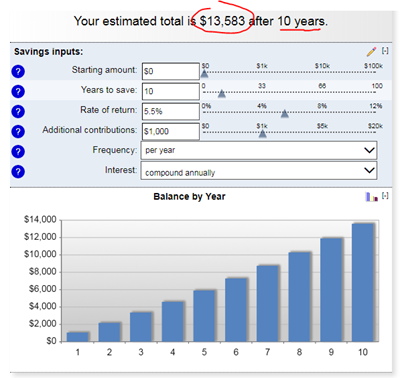

Nonetheless, this illustrates the power of compounding interest. I was recently talking to a group of young employees in their early 20's, and realized that saying things like "the power of compounding interest" doesn't mean much without an example. So here is another hypothetical example. Let's say you invest $1,000 per year for 10 years. You now have $10,000, right? Wrong! You now have about $13,583 if the deposits were invested and grew at the a very modest historical Dow Jones average of 5.5% per year. Calculator here.

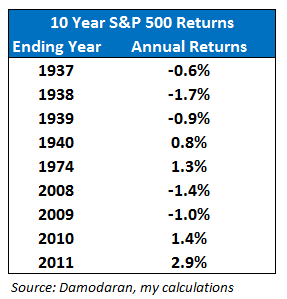

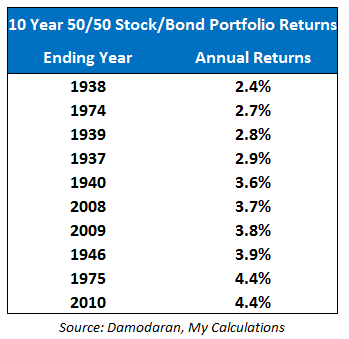

But how likely is that? Going back to the beginning of the S&P 500, there are 5 rolling 10 year periods that were negative - 1937, 1938, 1939, 2008, and 2009 (first chart below). Let's say that you were invested more cautiously and had a modest 50% stock 50% bond portfolio? That brings the returns into the 2-4% range, again that is for the worst periods (second chart below).

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.