Debt, Revenue, and Recession Indicators

Submitted by DeDora Capital on May 17th, 2018

by Will Becker, AWMA/AIF

Happy Friday!

Investment Perspective

On the docket for today's update: debt (again!), where revenue comes from, and some recession indicators.

Debt

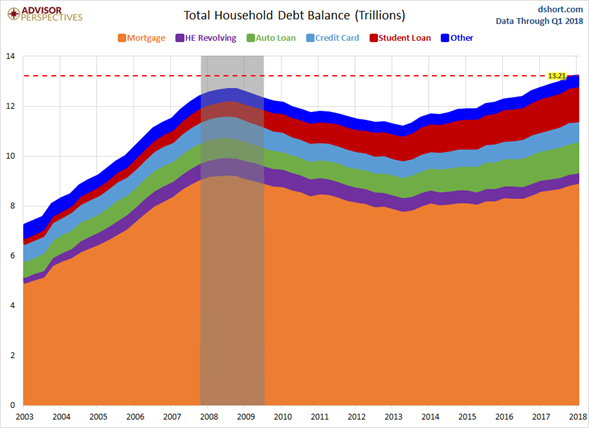

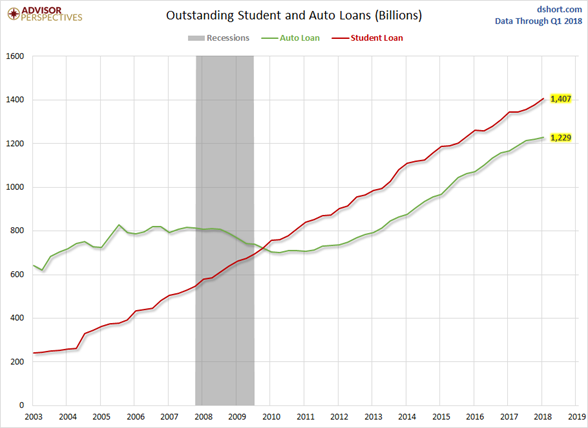

I covered debt - and especially the issue of variable debt in a rising interest rate environment - in the 3/23/2018 and 4/6/2018 updates. But then Household Debt went and hit another record in the 1st Quarter of 2018, +.5% from the previous Quarter and well ahead of the pre-recession peak. The two largest drivers of this debt are Student Loans (in Red) and Auto Loans (in Green). Though not specifically called out in the chart below, Medical debt is also a driver of debt growth. So let me take a moment to reiterate: If you have variable debt and there isn't a plan in place to get rid of it, please let us know!

Revenue

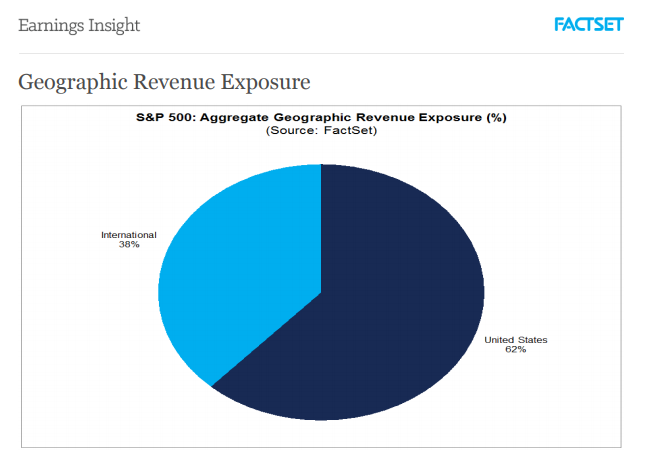

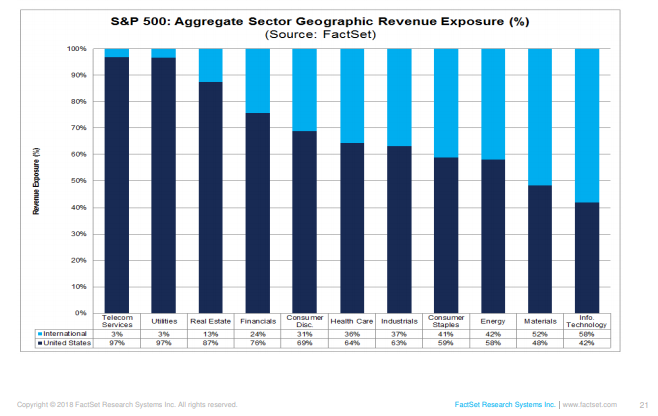

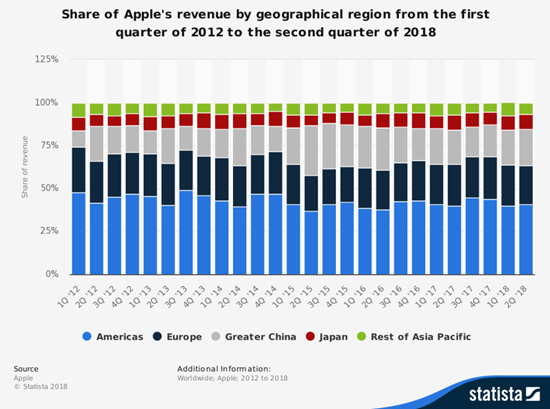

Did you know that 38% of the S&P 500 revenue comes from outside the US? In fact, Materials and Information Technology companies derive over half of their revenue from other countries. For example, Apple Inc is the largest company in the S&P 500 and 60% of their revenue comes from outside of the Americas. Also, China is Facebook's 2nd largest Country for ad revenue, after the US. S&P 500 Telecommunications and Utilities companies tend to derive almost all their revenue from the US... because it is kind of hard to power the electric grid or fix a phone line from abroad.

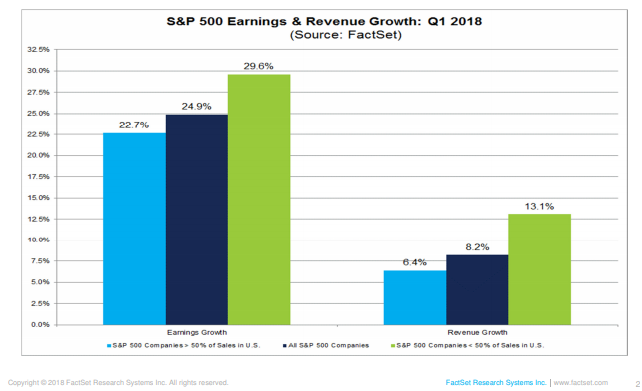

This information gets more interesting when we can slice and dice the data to see which regions are contributing to revenue growth. At the moment, S&P 500 companies with more than half of their Sales outside of the US are growing faster than those that focus their revenue on the US. What does that really mean? Tech companies have outperformed the markets this year, and they tend to get their revenue from abroad... so that is part of the explanation. This reminds us that Europe, China, and India are large markets for our Technology companies! Sometimes this gets lost in the "Trade Deficit" conversation that often focuses more on things like airplanes and corn than iPhones and Facebook ads.

In any case, Earnings continue to come in strong. FactSet reports 78% of companies are beating their Earnings estimates in the 1st Quarter of 2018, and that earnings growth is expected through 2018.

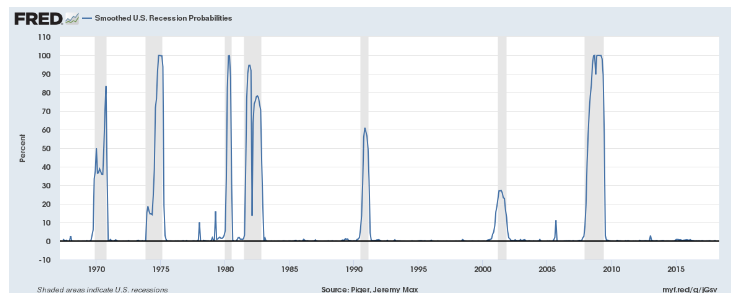

Recession Indicators

The relationship between Inflation, Employment, and Interest rates are signaling a possible business cycle peak in 2019. That is consistent with Guggenheim's recession call for late 2019 or 2020, though with rising stock prices until then. The St. Louis Federal Reserve's U.S. Recession Probabilities indicator is ok at the moment, though it has a habit of spiking rapidly. Until then, we are doing our best to make hay while the sun shines.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.