Coronavirus

Submitted by DeDora Capital on February 21st, 2020

by Will Becker, AWMA/AIF

Happy Friday!

Coronavirus

This week brought news of the first known coronavirus patient in Napa County. In this case, it was a passenger that had been on a quarantined cruise ship, who was transferred to Travis Air Force Base, and then to Queen of the Valley Hospital in Napa. The US evacuated this and other American passengers on the cruise ship after finding that there continued to be infections on the ship.

Before going further, let me preface this by saying that none of us on the team are medical doctors, nurses, or in a position to give health or medical advice! Call your doctor! The comments and links below are our observations from the perspective of investors and planners.

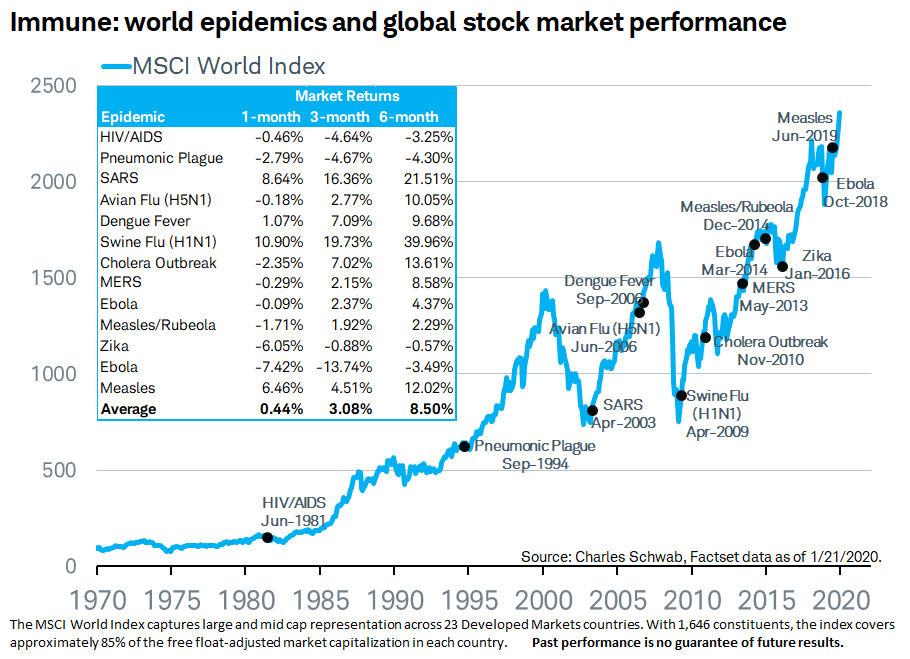

Diseases have a notoriously hit and miss impact on economics. I will get into that in some more detail in the next section. On one hand, there was the 1918 Spanish Flu that killed up to 50 million people and had a similarly drastic effect on commerce. On the other hand, the MERS, SARS, Ebola, and other outbreaks were tragic in terms of the lives affected, but they did not necessarily translate into broad scale economic declines. Also, let’s bear in mind that the Centers for Disease Control reports that the common flu kills up to 61,000 people per year.

With all of that in mind, here is some recent info on how the coronavirus is shaping up. The New York Times reports that:

“As of Tuesday, the case fatality rate of COVID-19 appeared to be about 2.5 percent. That’s in keeping with what it was, for example, from the beginning of the outbreak up to Jan. 28. By comparison, the case fatality rate for the seasonal flu in the United States ranges between 0.10 percent and 0.18 percent. For SARS, it’s about 10 percent and for MERS, about 35 percent. For Ebola, it has varied between 25 percent and 90 percent, depending on outbreaks, averaging approximately 50 percent.” As one journalist wryly summed it up, “While lower than the SARS 10% fatality rate, that number is not at all reassuring.”

How does the coronavirus compare to the Spanish flu? Here is one comparison:

“One hallmark of the Spanish flu pandemic of 1918 was that it didn’t just prey on the very young and old; it killed seemingly healthy people in the prime of their lives. And even though the case fatality rate — or number of deaths per person infected — was just 2.5 percent, because the world’s population was naive to the virus, and the virus could spread easily and kill broad swaths of the population, that 2.5 percent meant 20 million to 50 million people died by the time the pandemic was over.

With the new coronavirus, “the deaths still appear to be in people who are at risk of dying of other respiratory diseases — elderly and people with underlying health conditions,” said Jennifer Nuzzo, an infectious disease expert and senior scholar at the Johns Hopkins Center for Health Security. So unlike Spanish flu, the novel virus doesn’t yet appear to be killing otherwise healthy, young people.

But 2019-nCoV’s case fatality rate is also hovering around 2 percent at the moment, Nuzzo added in the same breath. (It may be slightly higher in Hubei, China’s hardest-hit province and home to Wuhan.)”

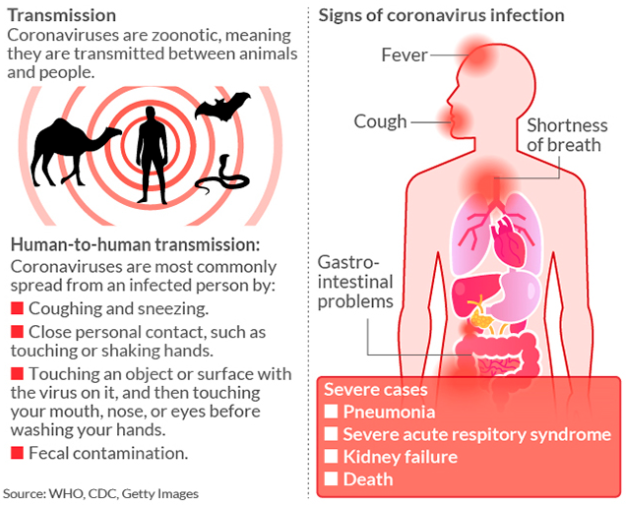

The chart below shows ways that the virus is transmitted and signs of infection.

Travel Update

Out of an abundance of caution related to the coronavirus, heads up that we are changing upcoming airline related travel plans to lower the risk of contagion. We still want to have some sort of face-to-face time with folks, no matter the travel situation. If you have an Apple device, heads up that we can use FaceTime. If you use another kind of video conference application (i.e. Skype, etc), just let us know when the meeting is being scheduled and we are happy to install what's needed.

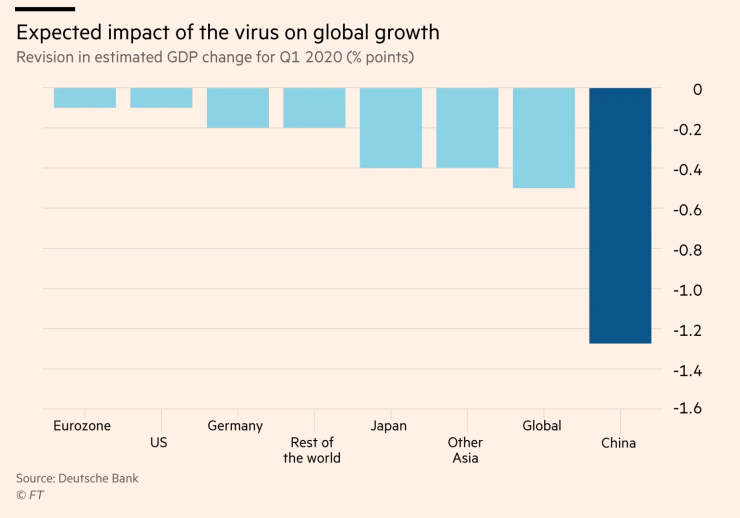

Coronavirus and Economics

Is the coronavirus having an impact on commerce? Yes, but it varies widely. While the massive quarantines are of course having an effect in China, at this point the projected economic impact is less severe elsewhere. Outside of China, at the moment a hefty portion of economic impact is based on pro-actively canceling upcoming events to reduce the likelihood of getting infected. With that in mind, Conferences are canceled in Barcelona, Singapore, Melbourne, and San Francisco. Note that we have canceled travel plans for the same reasons.

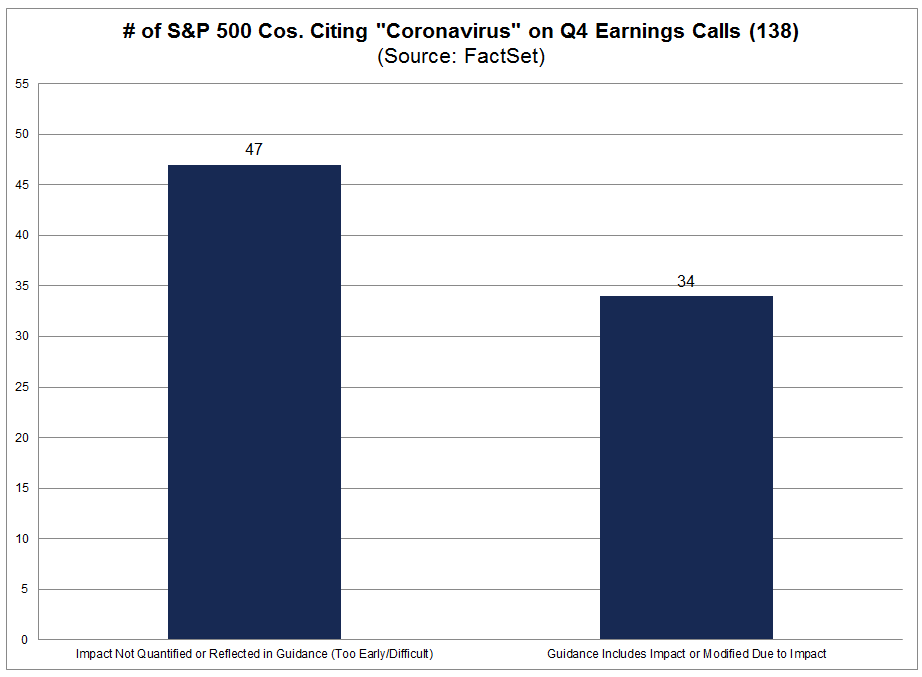

Companies with higher than average revenue exposure to China are discussing the coronavirus more on their earnings calls (see chart below). Amazon is working with suppliers and sellers to sort out the logistics for Prime Day.

Apple is reporting lower earnings guidance as a result of the virus:

“In its letter Apple said that its prior guidance was based on its “best estimates about the pace of return to work following the end of the extended Chinese New Year holiday on February 10.” As China’s return to work has proved halting, and the coronavirus itself more intractable than some anticipated, the company’s change in guidance is almost unsurprising.

The Cupertino-based firm cited two key reasons for the change in guidance: First, that “worldwide iPhone supply will be temporarily constrained.” This is not surprising given what we’ve learned about Foxconn’s less-than-quick return to capacity at various factories. Apple also said that “demand for our products within China has been” impacted by the virus.”

Viral outbreaks have historically had a surprisingly and notoriously modest impact on markets (see chart below). The key is to not be lulled into a false sense of security, by assuming that all pandemics will fall into this same pattern.

Economic Update

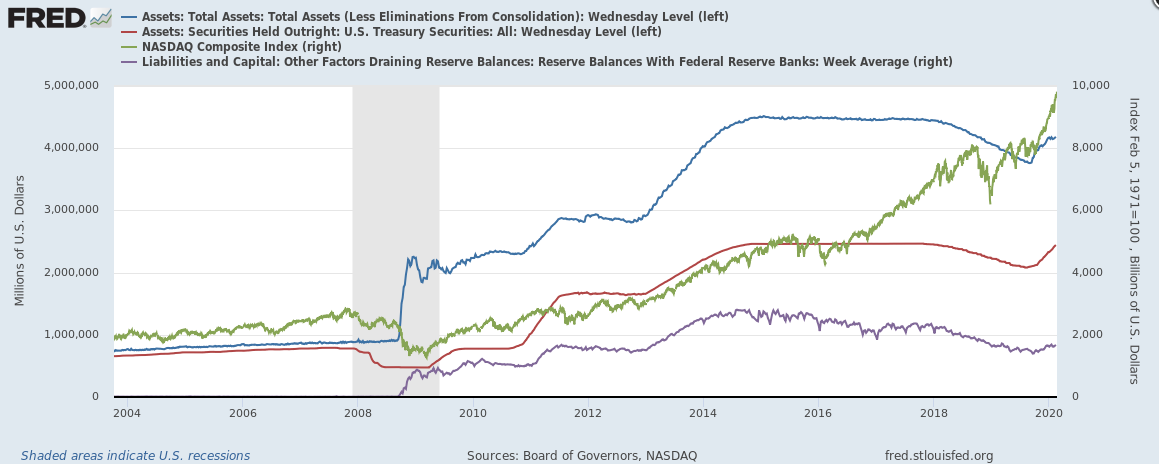

The Conference Board's Leading Economic Index improved in January, the Manufacturing Index improved in February, the Federal Reserve continues to stimulate through growing its balance sheet (see chart below), and the Federal Reserve is now talking about low interest rates as “not really a choice anymore … [but] a fact of reality.” These are all, at least in the short run, good news.

What does all the mixed up news mean for investors today? We continue to focus on the needs of each individual client. For example: are there significant changes to your income or cash needs since the last time we spoke? Do you have upcoming expenses that are not yet reserved for? Is your view on risk higher or lower than it used to be? If anything has changed, please give us a quick heads up, and let’s talk it through!

We are in the longest economic expansion in US history. Let's remember the sage wisdom of former Oakland A’s third baseman Carney Lansford. Back in the late 1980’s and early 1990’s, he was a leader on the team that won multiple World Series titles. After winning the world series, he showed up at spring training with T shirts for the team. What did they say? “CONTENTMENT STINKS. STAY FOCUSED.” Amen, Carney.

Video

- This was a long update, so here are two animal videos: this guy and his head-butting goat, and the Cat that loves Pigs.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.